What Is the Difference Between an Invoice and a Bill?

What Is an Invoice?

An invoice - alternatively referred to as a check, a statement, or a bill of sale - is an itemized record of the products or services you provided to your client. Invoices

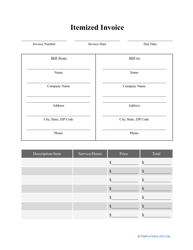

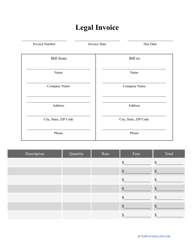

A simple invoice will include a unique identifying number, the date of issue, basic information about the buyer and the seller, the shipping address (if necessary), a list of goods sold or services rendered, the amount due, and the buyer’s payment terms. The invoice is an official legal document and can be used in court in the event of any disputes.

Invoices are one of the key elements in business accounting. Here’s what you can do by being consistent and diligent in your invoicing strategy:

- Keep a clear record of all transactions and inventory. Invoices, bills of sale, and quotes are all incredibly helpful for recording all the transactions you make with your clients.

- Get paid on time and in full. Invoices specify you payment terms and provide your clients with several methods of payment to choose form. Making this information clear, concise, and correct will allow you to expect timely payment from customers.

- Analyze your revenue and predict future sales. If using automated software, the information aggregated from the invoices you issue can produce valuable marketing insights and help you compile historical data about sales to build your marketing strategy.

- Pay taxes correctly. Recording the revenue of your company is crucial when it comes to reporting the amount you owe in taxes.

What Is a Bill?

Virtually identical to an invoice, a bill in business refers to a document that specifies the monetary amount the client owes for items they buy. Bills are issued before any payment is sent and must be paid in full for the transaction to be considered complete.

When invoicing your clients, the bill should be compiled and sent out as soon as the order has been placed or - if delivering services - as soon as the project is completed. This serves a dual purpose: it makes sure that the details of the sale are fresh in your mind and, ideally, allows you to receive payment as quickly as possible.

Make sure that your bill features the amount due, your payment information, and at least one additional method of payment. If your client is unable to pay via bank transfer, they should be able to compensate you using an online money transfer service, a cheque, or other methods.

What Is the Difference Between an Invoice and a Bill?

An invoice and a bill are two terms that are often used interchangeably. Both documents convey the same details about the transaction, the amount due, and the participating individuals or businesses. The main difference between an invoice and a bill is that the terms are used by the different parties to the same sales transaction.

If you’re the one supplying the goods or services, you would create an invoice and then use it to bill your customer. The client would then record the invoice as part of their recordkeeping as a bill to be paid. In short, invoices are used by businesses looking to collect money from its clients, while bills are used by the clients to refer to the money they owe.

What Is “Invoice Number” on a Bill?

An invoice number - also called an “Invoice ID" - is a unique code assigned to any individual invoice (or bill!) and used for tracking payments and managing unpaid bills as well as for bookkeeping and accounting.

Related Topics: