Generic Bill of Sale Form - California

What Is a California Generic Bill of Sale?

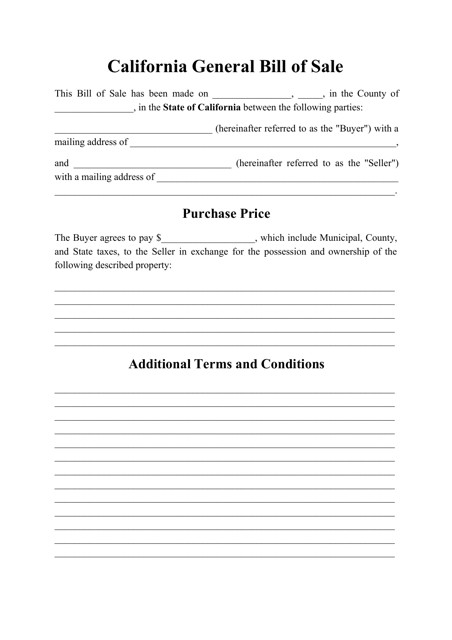

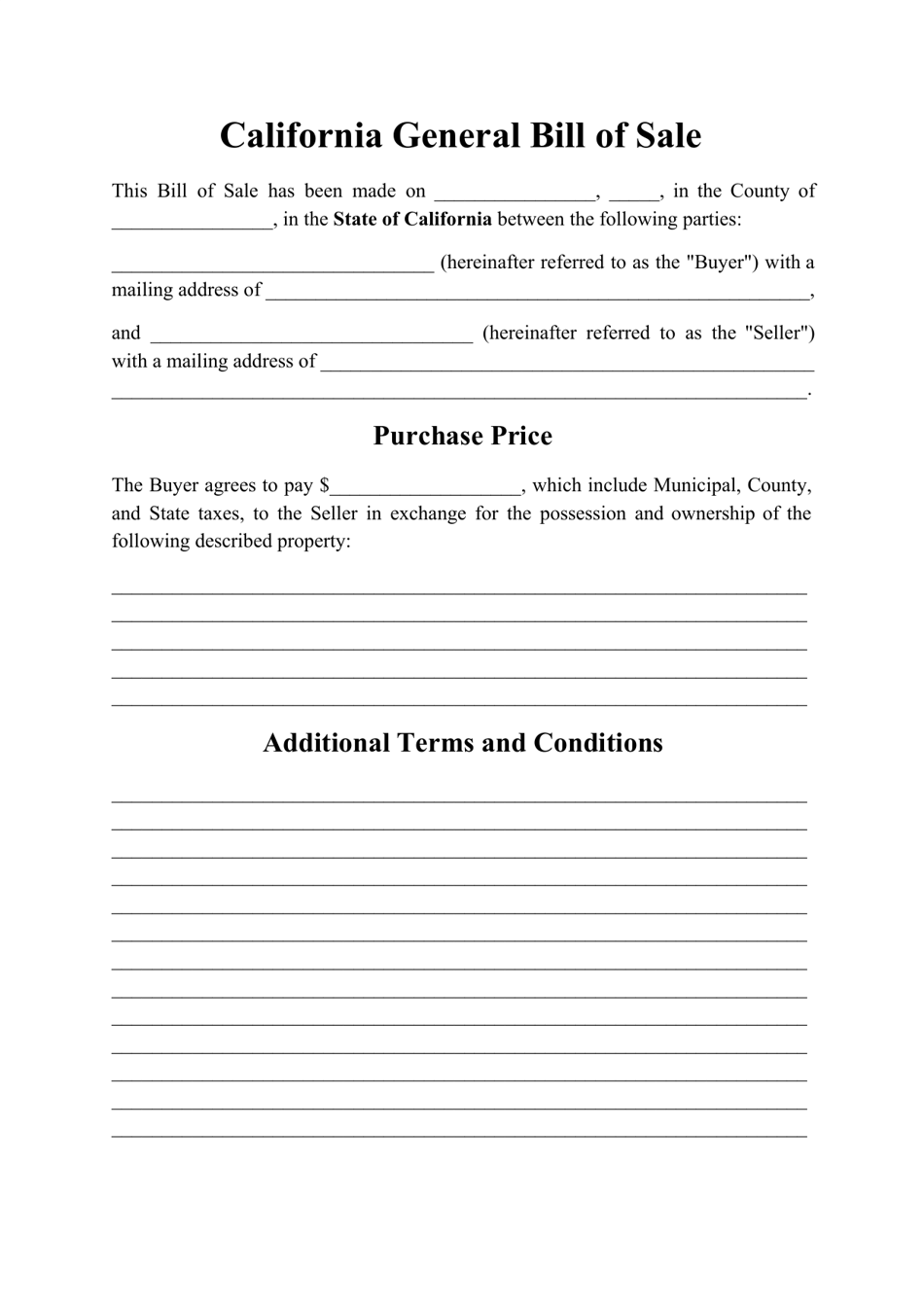

A California Generic Bill of Sale is the legal agreement between two parties, the seller and the buyer, regarding the transfer of property. This legally binding document should be filled out and kept by both, the seller and the buyer. The seller will have a written record containing all the transaction details. The buyer will receive a solid proof of purchase.

Does California Require a Bill of Sale?

According to California laws, you are not obliged to fill out a Bill of Sale when transferring a minor property. However, it is a good idea to complete one. It will help you to keep the relevant information and provide you with proof of purchase. This evidence may be useful if any legal issues arise.

California does not provide a state-issued Generic Bill of Sale. You can either download and complete the template provided below or use our customizable online template to build your own California Bill of Sale. The custom form you create will be considered a valid proof of purchase as long as it follows the state requirements.

California Bill of Sale Requirements

- Seller Information. At a minimum, you are required to indicate the full name, address, and driver's license number. You can also specify the daytime phone number in this section;

- Buyer Information. Specify the same information about the buyer;

- Property Details. This block must contain the relevant description that will help to identify the property: make, size, color, year, serial number (if any);

- Sales Details. At a minimum provide the date of the sale and the price of the item. If the property is given as a gift, this information must be recorded on the Bill of Sale. If the sale includes any specific conditions, it is recommended to list them on the document as well. This will help to clear the situations if any questions arise. Be as detailed as needed; attach a separate sheet if necessary;

- Disclosure. If the property has any defects or issues, specify them. To protect themselves, the sellers also indicate in this block that the buyer agrees to buy the described item "as-is";

- Signatures. The seller's signature is required, but the buyer should sign the form as well.

As to the form and size of the document, the state does not have any specific requirements. Prepare the form in two original copies for each party to keep one.

Does a Bill of Sale Have to Be Notarized in California?

Notarizing a Bill of Sale in California is optional. The state does not require a notary public to testify your deal; signatures of both parties are enough for the document to be a legal agreement. At the same time, if you want something more secure, you can add a block for notarization when creating your Generic Bill of Sale.

Related Templates and Forms:

- Generic Bills of Sale by state;

- Other Bills of Sale for the state of California.