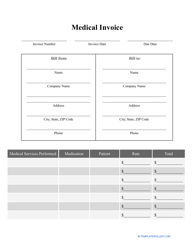

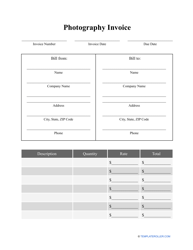

Parts of an Invoice

What Does an Invoice Look Like?

An invoice is a commercial statement that records the details of a transaction between a seller and a buyer. Freelancers and business owners alike use invoices to charge a payment for their products and services, but what does a professional invoice look like? Traditionally, this document identifies both parties, indicates the person or entity responsible for payment if the shipment will be delivered to someone else, lists the goods or services ordered by the customer, describes the method of payment and sets the payment deadline, and states the late fee the client will have to pay in case they fail to compensate the vendor on time.

What Is “Invoice Number”?

An Invoice Number - a reference number generated by the company - allows the business to identify clients and shipments. No matter how many sales you make, a proper system of assigning numbers to every document you draft will let you keep track of all the transactions. Moreover, a customer can reach out to you in case of an issue and tell you the number written on the invoice they have received so that you know what products or services are being discussed. Traditionally, an Invoice Number contains numbers or a combination of numbers and letters that facilitates identification of the customer and transaction.

What Does “NET 15” Mean on an Invoice?

Vendors write "NET 15" on every invoice that must be paid in full within fifteen days after it is received by the customer. Since it is an established practice to send an invoice asking for payment within a reasonable amount of time, the parties can negotiate the number of days the client has to pay for the goods or services; alternatively, the vendor can have a set payment deadline for all customers regardless of the price of items or the time the parties have worked together.

What Does “NET 30” Mean on an Invoice?

If you see "NET 30" on the invoice you have been sent by the vendor, it means the other party wants you to pay for the products in full during the thirty calendar days from the moment the services were rendered or the goods were delivered. It is customary to request a payment giving the client more than four weeks to fulfill their obligation - for instance, the buyer may need to wait for the upcoming payday to obtain funds for paying their invoice debt.

What is the Standard Late Fee on an Invoice?

Whether you have had issues with customers who failed to pay on time or you are just making your first steps on the market, it is highly recommended to warn customers about an additional charge that will enter into force if they delay payment. While it is possible to negotiate a late fee with every client separately, most companies prefer to charge 1,5-2% monthly interest for every unpaid invoice. Make sure you are charging as much as other entities in your industry and increase this amount if necessary.

What Does “Bill To” Mean on an Invoice?

It is quite common for a purchaser to buy the goods or services from a business but ask the vendor to send the invoice to a different individual or organization. This is why most invoices include two separate fields - "Ship To" and "Bill To": the former receives the products while the latter is the one responsible for payment. For instance, an individual may order office supplies in their own name but ask the vendor to include the name of the company they work for in the "Bill To" box since these expenses are typically covered by the business.

What Is the Difference Between “MSRP” and “Invoice Price”?

"MSRP" stands for Manufacturer's Suggested Retail Price. Some businesses choose to include this term in their invoices to show the recommended price the manufacturer would ask the dealership to request from a customer. Yet, this is not a final price, simply a starting point in the negotiations, and the dealer usually prefers to begin negotiations with the MSRP. The "Invoice Price", on the other hand, indicates the actual amount of money the dealer has paid the manufacturer for the item in question. If you are in the retail business, your invoice may show both figures, depending on your agreement with the other party. See our MSRP Vs Invoice Price post to learn more.

What Is “FOB” on an Invoice?

"FOB" means Free On Board - this abbreviation refers to the party liable for the items that are somehow damaged or completely destroyed during the shipment process. If the invoice says "FOB origin", the purchaser assumes the risk: they will pay for the delivery and the seller cannot be held responsible for any damage. However, if the invoice contains the words "FOB destination", the buyer can be compensated for any loss by the vendor who retains the risk until the goods safely reach the party that purchased them.

What Is a “PO Number” on an Invoice?

A "PO Number," or a Purchase Order Number, is сreated when an invoice is drafted on the basis of a purchase order filled out by the customer. Ensure every invoice based on the purchase order has a PO Number that corresponds to the request completed by the client - you will be able to manage the inventory and quickly refer to the right document during any dispute or audit. Note that not every invoice is a PO invoice: some of the invoices you will be asked to compose are not triggered by the customer recording their preferences in a purchase order - they are called Non-PO invoices.

Related Topics: