How to Get a Client to Pay an Invoice?

If you are dealing with a difficult customer who refuses to make timely payments or simply does not reply to your messages anymore, you should find a way to request the payment politely, motivate the client to pay on time, and prevent similar issues in the future. No matter what industry you represent and the amount of debt you are owed, there is always a chance to collect the payment and ensure other clients follow their contractual obligations after signing an agreement with you.

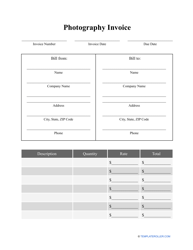

How to Invoice for Freelance Work?

Here are some tips for you if your goal is to draft an Invoice for Freelance Work - you will gain the trust of your customers and motivate them to reach out to you in the future:

- Adopt a personalized approach to every client - show the customer you care about them and are closely involved in their project; this will help you to stand out among the competitors who would seem distant and indifferent to the client's needs.

- Talk to the client especially if this is the first transaction you are formalizing together - they may offer you a template they typically use for these operations or ask you to send a Freelance Invoice by email.

- Avoid waiting for the payment - while large corporations can afford to issue invoices that will not be paid for a month, an independent professional may have to ask their clients to pay the bill within one or two weeks to stay afloat.

How to Invoice as a Contractor?

If you offer independent services on a contractual basis, usually for specific projects or jobs, you may need to prepare a Contractor Invoice. While this document is not significantly different from invoices regular vendors send out, you should follow these steps when you Invoice as a Contractor - this will improve the rapport with the client and guarantee they will call you back in case they require your services again:

- Adopt a billing policy to let the client base know about your rates, payment methods, and late payment fees and charges in advance - this way, both parties will be able to manage their expectations and plan the budget better.

- During negotiations offer customers a progress invoice - using this document, you will be able to charge them in installments after every stage of the project is completed.

- Indicate several payment options and discounts, be flexible with the invoice payment terms - if the customer is choosing between several contractors, the more ready you are to tweak the conditions of your agreement, the bigger the chances you will be selected for the project.

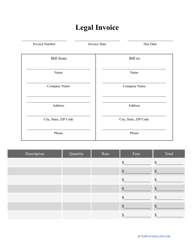

How to Sue for Non Payment of Invoice?

If you have sent multiple reminders to the customer including the Invoice Non Payment Letter with an unambiguous request to send you the money, yet they have ignored your correspondence or failed to fulfill their duties, the only choice you may have is to file a legal action against the debtor. Follow these steps to sue the customer:

- Make sure legal proceedings are worth it - if you lose more money paying legal fees than obtaining an Invoice Payment, it may be wiser not to pursue this option.

- Find a lawyer that specializes in cases of this kind - even if you do not hire them to help you along the way, a brief consultation will help you to get insight into the current state of affairs when it comes to similar lawsuits.

- Consider filing an action in a small claims court - it will be the least time-consuming and the cheapest way to collect the debt.

How to Cancel an Invoice?

Whether you have included incorrect information in the invoice or forgot to offer your long-term customer a discount, you can cancel the invoice. There are two main ways to do it:

- If you are using accounting software or handle your finances on online sales platforms, there are tools and options you may use to exclude the invoice from your records and notify the customer they do not need to pay you anymore . In case the invoice is still unpaid, it is possible to open your account or the program, pick an unpaid invoice, and choose the option to cancel it.

- Prepare a credit memo - a document that lists the details of the invoice and confirms the transaction was called off before its completion. You can use accounting software to send a message to the client - they will receive it the way they got your invoice and these documents will be linked to each other - or compose a separate letter informing the customer about the reasons behind the cancellation.

Related Topics: