Types of Invoices

To give your customers clarity when it comes to paying for products and services they order and stay on top of the accounting process figuring out the discrepancies you find in financial documentation of your business, it is necessary to prepare and record various invoices - formal statements that describe the goods in question and explain how and when the client is supposed to pay for them.

PO and Non-PO Invoices

Most companies have an established filing system that allows them to retrieve any document quickly and track payments they are owed. Traditionally, all invoices are separated by the customer and date, but it is also important to categorize them into PO and Non-PO Invoices - the former is associated with a purchase order the client shares with the vendor while the latter is used for discretionary spending and emergency purchases that do not require planning.

Vendor Invoice

A Vendor Invoice is a document generated and sent to a customer (an individual or organization) after an unpaid order for products and services was placed. Usually, businesses prefer to link every document of this kind to a corresponding purchase order - the details from the latter can be easily reproduced in the Vendor Invoice. Once you agree upon the terms of sale with the client and set a payment due date, you can send this statement to them requesting payment for the items listed in the form.

Wholesale Invoice

If you represent a wholesale business that generates revenue by purchasing large quantities of goods and then selling them in bulk to smaller merchants, you need to fill out a Wholesale Invoice to record the information about the transaction and send it to the client. Unlike other types of Invoices, it can contain a wholesale discount off the usual retail price and a different price you are charging the other party compared to regular customers.

Interim Invoice

An Interim Invoice is used when it is hard to anticipate all the costs of the long-term project and the client can be charged for products and services that could not be predicted at the time of the initial arrangement with the supplier. Often prepared by contractors, an Interim Invoice should include the schedule that shows when the customer pays - it is a common practice to follow the project timeline to find out how and when to charge for every invoice, so the client has to pay on a regular basis.

Proforma Invoice

Complete a Proforma Invoice if you still need to clarify certain terms of the sale with the customer - before you ship goods or deliver services, you need to make sure all the details listed in the form adhere to the expectations of the purchaser. This document is often drafted to formalize international transactions and it serves as a legally binding agreement between the parties. In case it is difficult to predict the accurate sale price that may include fees or shipping costs, this type of invoice would be the best choice.

Recurring Invoice

If your business regularly sells the same goods or renders the same services to the loyal client, you can guarantee weekly or monthly income for your company by customizing a Recurring Invoice. Note that not every document of this kind has to be similar - it is possible to change certain details like the quantity of goods or the shipping details; as long as you keep routinely working with the customer, a scheduled invoice will let you monitor all the transactions.

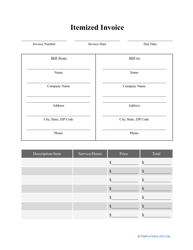

Itemized Invoice (Itemized Bill)

If the customer asks you to provide a breakdown of all the services or items you offer, describe them and indicate the price for each, or this is just an established practice of your business, you can compose an Itemized Invoice to show what products the other party is getting and how much money they have to pay for every one of them. This invoice type lets the client know how they spend their funds and helps you build a transparent relationship with them by showing you are not hiding any suspicious charges.

Related Topics: