How to Pay an International Invoice?

Over the last couple of years, global trade has seen significant growth. The United Nations Conference on Trade and Development (UNCTAD) reports that international retail commerce has been steadily increasing by around 5% annually.

Thanks to most businesses migrating online - either fully or in part - consumers can now purchase products or order services from any country across the globe. For the provider, however, things aren’t as easy. Currency rates, taxes, and customs laws all need to be researched in order to get your products delivered to your international client.

If your small business is about to take advantage of the globalized economy, here’s what you need to know about billing internationally.

How to Pay an International Invoice?

Doing business outside of your country can be extremely lucrative. This can serve to diversify your clientele, work with talents all over the globe, and access previously unattainable markets. But how do you pay an international bill if invoiced by an out-of-country partner?

- Transfer money into a designated bank account. Most banks allow their clients to receive international transfers via the SWIFT system. Banks usually charge a set rate for every payment, thus making this type transfer most suitable for larger payments. In addition to this, international bank transfers can take several days to go through. Consider this if quick payment is necessary.

- Pay your providers through PayPal. PayPal is one the biggest and well-trusted internet payment services. PayPal’s invoices are auditable, non-anonymous, and accepted in most countries of the world. The only downfall of this method is the platform’s fees: PayPal charges a percentage of the full transaction amount as a fee for their services, making this method suitable for smaller amounts of money.

- Send money with Western Union. Using a classic in-person financial transfer company is great when working with countries where other methods may not be available. The final fees of the service will depend on the amount you are trying to transfer and the destination where it will be received.

How to Invoice International Clients?

International invoicing can be challenging for a small business or individual entrepreneur. Sending and receiving payments from all over the globe is tricky and difficult to correct if done wrong. Here’s what you need to take into account when invoicing internationally for the first time:

- Currency. Your international invoice should reflect the required amount in a commonly-used international currency (like euros or U.S. dollars) in order to avoid confusion and complications. If billing in a foreign currency, request a Forward Exchange Contract (or “Forward Cover”) with your bank to secure the current exchange rate at the moment of issuing the invoice.

- Payment Method. After determining the currency of your invoice, the next most important thing is figuring out a method of payment that makes sense for your business. Use direct debit or bank transfers for larger sums or online wallets or payment systems for smaller amounts.

- International Taxes and Fees. These will depend on the countries you and client are located in.

How to Create a Commercial Invoice for International Shipping?

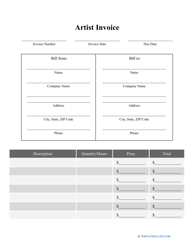

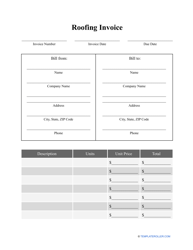

If you sell your goods to out-of-country clients, you will need to create a specific type of invoice that can be used for international shipping and customs purposes. The easiest way to figure this out is to use an international commercial invoice template downloaded from a trusted website. Alternatively, you can create your own multi-use invoicing template from scratch.

Here’s our checklist that you can follow when creating your own international shipping invoice:

- Make sure that every invoice includes the date of issue and a unique invoice number for ease of tracking, shipping, and returns.

- Provide the full name and address of your business or your own name and legal address (if invoicing as an individual contractor).

- Include your client’s full name, billing address, and shipping address.

- List all of the products or services sold along with their quantity and a detailed description for each line.

- Specify the total payable amount in the agreed-upon currency.

If invoicing a customer in a country in the European Union, make sure to include the following information:

- The Value Added Tax (VAT) number of both you and your customer.

- The VAT rate being charged and the taxable amount per rate.

- If applicable, the article under which your goods or services may be exempt from VAT rates.

Related Topics: