Bill of Sale Vs Invoice

Is an Invoice the Same as a Bill of Sale?

Although many people would use these two terms interchangeably, there is actually a subtle difference between an Invoice and a Bill of Sale. It is true that in some cases, people can often use these terms to refer to the exact same document and in this case, the different terms depend on the parties involved in a transaction. As a business that provides a certain product or service, when you want to charge your client for carried out work you produce an Invoice. It is this invoice that a client must pay. The client that receives this Invoice will often treat it as a Bill of Sale.

However, in other instances, these two terms can refer to two completely separate documents. In order to understand the differences, it is first important to know what each of these terms mean.

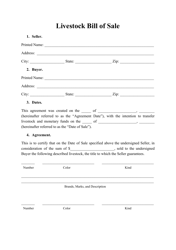

What Is a Bill of Sale?

A Bill of Sale is a much less official document and is usually handed over immediately after placing an order. More importantly, the client would normally be expected to pay for this prior to receiving the product or service. A Bill of Sale will also not provide much detail in the bill. They usually include simple information along with the overall cost including and excluding tax. You can use a Bill of Sale template to get a better idea of what should be included and what it should look like to help draft your own.

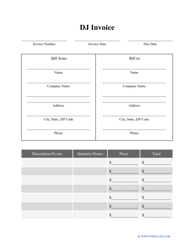

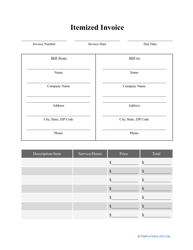

What Is an Invoice?

On the other hand, an Invoice is a legal business document that follows a strict structure in order for it to be legally binding. They usually contain a high level of detail in regards to the products or services that they have produced. In most cases, this document is issued towards the end of a completed project or once goods have been received. After receiving this document, the customer must pay the sum stated in the invoice. In general, a well-formed invoice will contain the following information:

-

A large ‘INVOICE’ title. This makes it obvious to the customer what the document is and will make them more likely to pay the invoice more promptly. If it isn’t clear what the document is and that it needs to be paid, a customer could put it to one side and forget about it;

-

Details regarding the customer including contact details;

-

Details about the company producing the invoice, including their contact details;

-

An individual invoice number. This makes it easier to keep track of and track down any payments or missed payments;

-

The date that the invoice was issued;

-

The deadline date for the invoice payment. This is usually x amount of days after the issue date;

-

A detailed list of all the products and services carried out, their quantities, and individual prices;

-

The overall subtotal that the client must pay (including and excluding tax), taking into account any potential discounts or deposits.

What Is the Difference Between an Invoice and a Bill of Sale?

Now that it is clear what each document is, we can summarize their main differences:

- A Bill of Sale must usually be paid immediately, often before receiving the service or products required;

- An Invoice is usually paid after the successful completion of a job or delivery. Payment is not usually immediate and there is a deadline date for which the customer must submit the payment;

- An Invoice is also a legally binding document whereas a Bill of Sale is a lot less official;

- A Bill of Sale doesn’t delve down into specifics and high levels of detail. An Invoice however tries to provide as much detail as possible so that the customer can see an itemized breakdown of the products or services they have received which also very often helps to prevent disputes.

Related Topics: