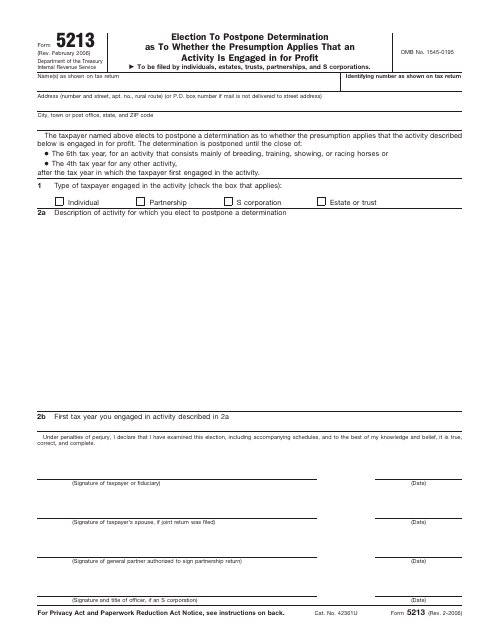

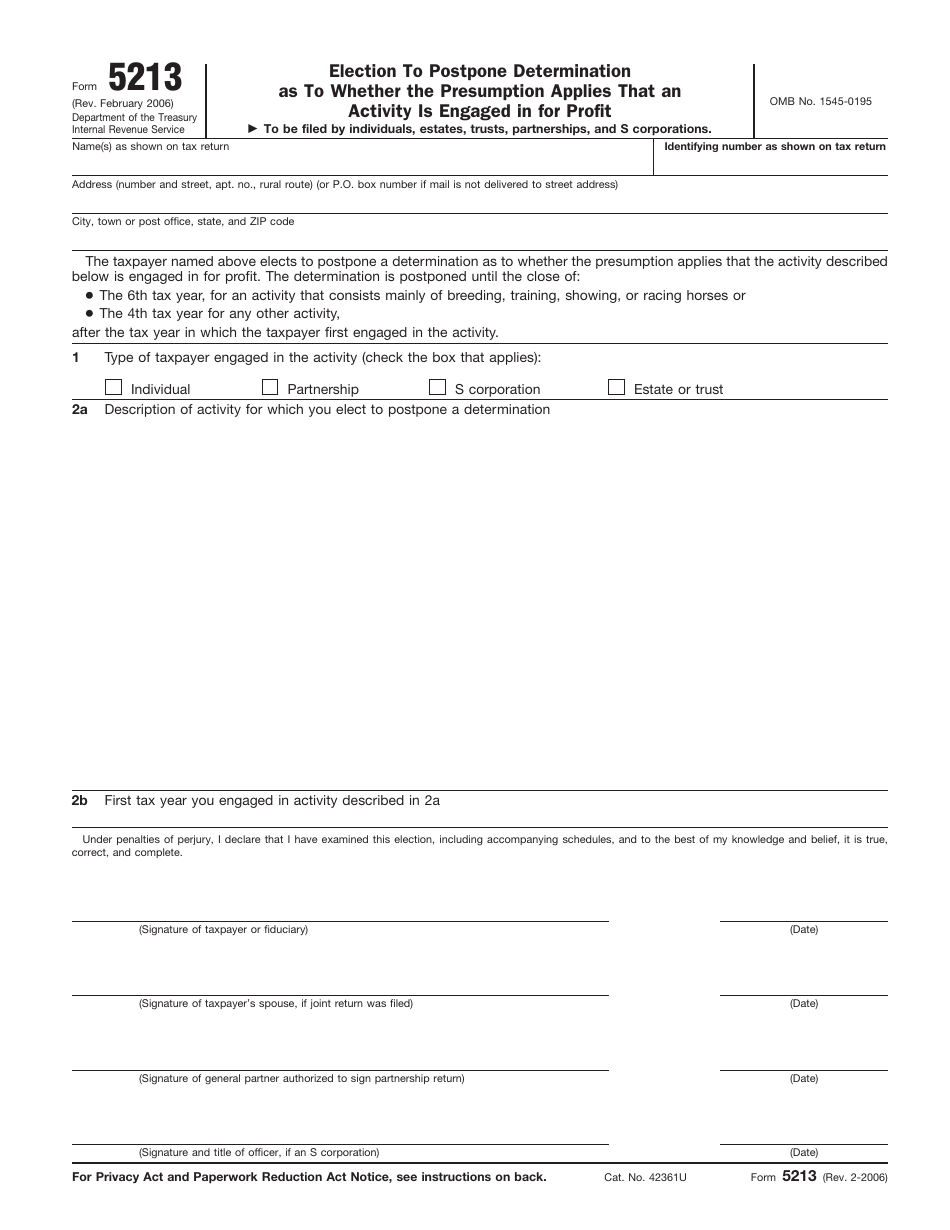

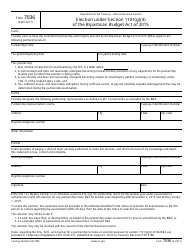

IRS Form 5213 Election to Postpone Determination as to Whether the Presumption Applies That an Activity Is Engaged in for Profit

What Is IRS Form 5213?

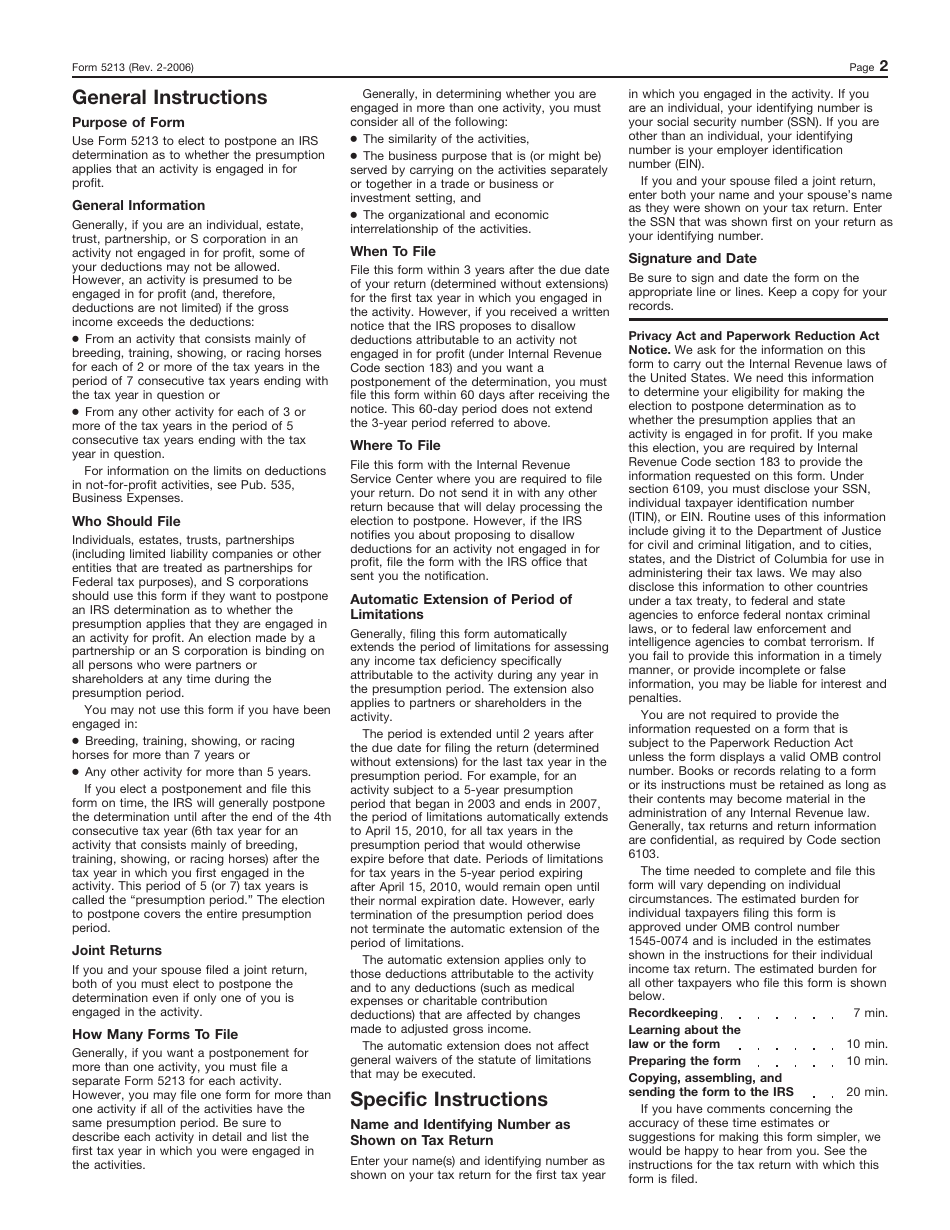

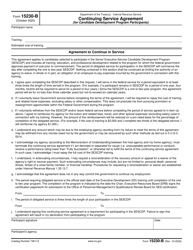

IRS Form 5213, Election to Postpone Determination as to Whether the Presumption Applies that an Activity Is Engaged in for Profit is the document you complete to ask to postpone the determination of profitability of your business. The form can be completed by individuals, estates, trusts, and S corporations. The election made on this form allows you five years to show a profit from your activity. You have seven years to show a profit if you are engaged in breeding, showing, training, or racing horses.

The form is issued by the Internal Revenue Service (IRS) with the most recent revision of the form released on February 1, 2006 . Download the latest version of the fillable IRS Form 5213 through the link provided below.

IRS Form 5213 Instructions

The IRS 5213 instructions are as follows:

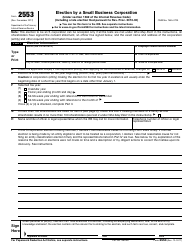

- If a partnership or an S corporation makes an election on this form, it is legally binding on all partners and shareholders during the presumption period;

- If you file the form on time, the IRS usually postpones the determination to the end of the fourth tax year since the year you first started your business. If the business is connected with training, showing, breeding, or racing horses, the determination is postponed until the end of the sixth year. This time is called the "presumption period";

- If you file the tax return jointly with your spouse, the postponement election must be made by both of you, even if only one of the spouses is engaged in the business;

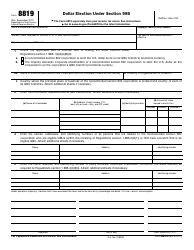

- If you want to request a postponement for several activities, you usually file a separate form for each of them;

- If all activities you claim the postponement for share the same presumption period, you can claim a postponement on the same form;

- Submit this election within three years since the due date of your return. However, if the IRS sends you a proposition to disallow deductions for an activity not engaged in for profit, and you wish to postpone the determination, submit this election within 60 days after you have received the IRS notice;

- File this form with the same IRS office you file all of your tax deductions and returns. Find the list of the offices by the state on the IRS website;

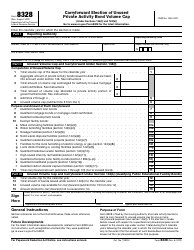

- When completing the form, specify your name as it appears on the tax return for the first year you engaged in the business;

- If you file the tax return jointly with your spouse, provide both your and your spouse's name on this form;

- The identification number requested by this form is either your Social Security number (if you are an individual) or the employer identification number (if you fill out the form for the partnership, estate, trust, or S corporation);

- If you file the joint tax return, enter only the Social Security number shown first on your return for the requested identifying number;

- Describe the activity you request determination postponement for in details and make sure you specified the tax year you started the activity;

- For the form to be valid, sign and date it on the line that applies to your situation.

After completing the form, copy it and keep for your records.