The 5 Types of Property Ownership: Individual Ownership, Joint Ownership, and Title by Contract

What Is Property Ownership?

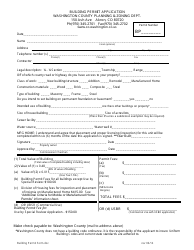

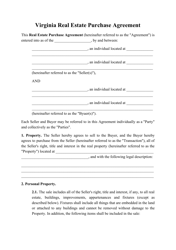

Property ownership is a state of possessing exclusive rights to the property as well as all legal responsibilities connected with it (e.g., paying rates and taxes). Acquiring ownership rights for the property is a complicated process. On top of signing a title deed or grant deed to the property, it requires examination, completing and registering a great deal of real estate paperwork, as well as getting familiar with related legal information.

What Are the Main Types of Property Ownership?

If you want to buy a house in the United States, decide on the mode of ownership first. There are many different types of property ownership. The following five are the most widespread:

1. Individual Ownership. This is the simplest way of owning property. You are the sole holder of all rights of your building or land and can sell, give, or donate it to anyone you like without obtaining any legal consent from your family members. The property will be transferred to your heirs according to your will (Will Form Templates) or, if you leave no will, according to the state law;

2. Joint Tenancy. In this case, two or more people own an equal share of real estate. The relationship between the owners does not matter. After one of the owners is deceased, the share is automatically passed to the surviving owners. This type of property ownership is also called a joint tenancy with the right of survivorship and is most common between spouses or parents and children;

3. Tenancy in Common. This is a type of joint ownership. However, unlike a joint tenancy, the owners may have different shares of the property. Each tenant has an interest in the property and can pass it to any individual with the sales agreement, will, or other legal documents;

4. Community Property. This type of joint ownership exists only between spouses. At present, it is recognized by ten states: Alaska, Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington, and Wisconsin. Both spouses own an equal share of all assets or income obtained during the marriage. Each spouse can choose to will the owned share to any person without restrictions. However, if one of the spouses wants to sell a house or any other jointly owned property, the consent of the other spouse is required;

5. Title by Contract. According to this contract, you have full control of your property during your lifetime. After your death, the property passes to the beneficiaries you have designated without probate. In most cases, beneficiaries need to provide only a death certificate to claim property ownership.

How to Check Property Ownership?

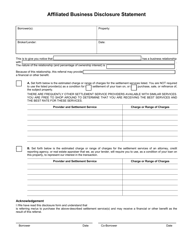

Before starting to search for real estate purchase agreements, you have to do one more thing: to check if the seller is the real owner, and that the real estate title is free of defects (e.g., another person's rights). The common way is to ask the seller about the affidavit of ownership that clarifies how the owner has obtained the property. To substantiate the ownership claim, the seller can show you copies of purchase documents or copies of mortgage payment records. Even if you are going to buy a mobile home, which in most states is considered personal property rather than a real estate, it is better to check if the seller has a valid certificate of title for a mobile home.

To verify the property records by yourself, you can visit the local office where the deeds are filed. In addition, you can check property tax receipts. In most states, they are public and available online. Finally, you can always hire a professional to check the records if you have any doubts.

What Is Tax on Transfer of Real Property Ownership?

Transferring real property ownership usually requires paying taxes. Taxes can be imposed at the federal, state, and local levels. They are usually based on the type of the transferred property, its market value, and intended use. The transfer taxes are typically paid by the seller. In some cases, the seller and buyer make an agreement, according to which the tax issues must be settled by the buyer.

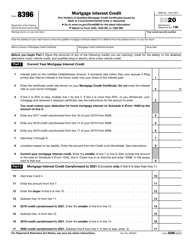

Remember that owning a property means that you’ll have to pay all the applicable taxes. The tax amount is determined by local officials and can be disputed by the owner. Property taxes can be reduced by different types of deductions.

File Form 1040 with the Internal Revenue Service (IRS) to deduct the expenses of owning real estate and itemize the deductions on Schedule A, Itemized Deductions. File Form 8396 to claim mortgage interest credit for part of the annually-paid mortgage interest and read through this year’s tax deductions for homeowners in order to find more ways to shrink your tax bill.