How to Buy Land and Build a House in the United States

Many potential first home buyers are looking to buy land to build a home or to buy into a new housing development. We would recommend considering all the potential pros and cons before making a final decision, examining the different ways you can buy land, and learning more about land and construction loans.

What Are the Advantages of Buying Land?

- It is affordable. An easier way into the real estate market is buying vacant land which is cheaper compared to the land that already has buildings and other structures on it;

- Your insurance rates and property taxes will be significantly lower if you buy vacant land to build;

- If you can pay out the full amount of the vacant land in cash, it means you can immediately own your investment;

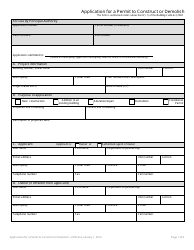

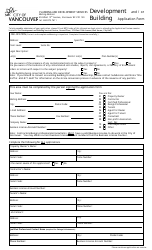

- When you buy land, you do not have to worry about repair works, tenants, and other issues that come with owning buildings, and it is easier to obtain a building permit.

What Can Be Developed on Land?

Before you decide where to buy land to build a house, you need to have a clear understanding of the land potential. Certainly, buying raw land is a good investment, and if you invest in house construction, it can increase in value in a short time, so that you can sell your house for a profit. You will need to take zoning and land regulations into account.

Whether the land is residential or commercial, you have to find out the restrictions regarding the types of buildings and activities allowed. If the land is agricultural, learn what livestock is allowed and what crops can be grown. You can manage a community garden or wildlife preservation, build a tiny house, use the property as a solar and wind energy farm. There are some other steps to take when buying and developing land:

- Before you sign a standard purchase contract, you need to diligently examine the property. After that, conduct an appraisal to learn its market value. You need to figure out how much it really costs with all the expenses. If it is raw land, you will have to pay for improvements, so determine which utilities you want to install;

- It is recommended to hire a land planner. This individual will help you to manage the development of the land, assess the land and water potential, and select and adopt the best alternatives for land use;

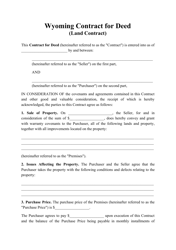

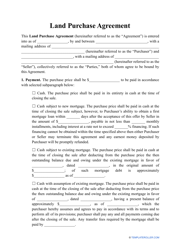

- Find a real estate lawyer. A skilled professional is often needed to draft a land purchase agreement. If you are interested in making loan payments directly to the seller of the property, consider entering into a land contract;

- One of the options is leasing land for commercial use. If you are reluctant to make a long-term commitment, it might be the right choice for you. Negotiate the release of previous leases.

There are several documents you might need to get when purchasing land:

- A warranty deed is used to transfer an interest in a real estate to a new owner in exchange for part of the purchase price. This legal instrument will give you protection from any prior claims or demands against the real estate;

- You need to be ready to demonstrate your financial records, which include a net-worth statement and an income statement. A net-worth statement is a financial report showing your long-term and short-term liabilities and assets. An income statement is a personal financial spreadsheet or document that outlines your current financial position;

- Obviously, you need to prove your payment capacity providing an IRS Form 1040, one of the IRS (Internal Revenue Service) tax forms providing information about your annual income tax return.

How to Get a Loan to Buy Land?

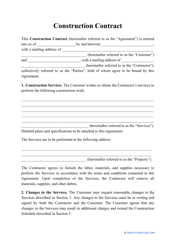

If you think about buying land to build a house, but you do not have enough funds, a construction loan – a short-term loan to buy real property – can be a good option for you. You can also use this loan to build your own house on the property you own or renovate already existing structures.

Can you get a mortgage to buy land and build a house?

It is uncommon – you will have a hard time convincing a lender to finance your purchase, even if you are ready to sign a lien note – a written promise to repay a sum of money plus interest - for a land mortgage. So instead it is recommended to apply for a land loan. There is also an option to use the Department of Agriculture Section 502 direct loans – they help low-income applicants obtain housing in rural areas providing payment assistance – a subsidy temporarily reducing the mortgage payment. If you think about buying a lot to build a house via getting a mortgage, you need to make sure your FICO score – a credit score used by lenders to predict your ability to pay debts – proves you are creditworthy. Additionally, you might consider signing a deed of trust, which serves as an agreement between you and the seller to temporarily give the property to a neutral third party to serve as a trustee.

Can you buy land and build a house with an FHA loan?

A Federal Housing Administration (FHA) loan is a mortgage loan backed by the FHA to help low and moderate-income potential buyers to purchase land and build a house. This is a one-time offer that is intended to assist in purchasing primary residences, therefore, these loans cannot be used to acquire land alone. To get an FHA loan, you need to complete a Uniform Residential Loan Application (Freddie Mac Form 65/Fannie Mae Form 1003).

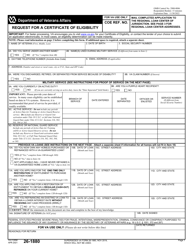

Can you buy land and build a house with a VA loan?

The same rules apply to the Department of Veterans Affairs (VA) loans. They can help you to bear the buying land and building a house costs, but you have to commit to building on the site. Generally, you need to have a contractual obligation to build a home, so a VA loan simply helps you to purchase the land. The first step in getting a VA loan is to apply for a Certificate of Eligibility (VA Form 26-1880).