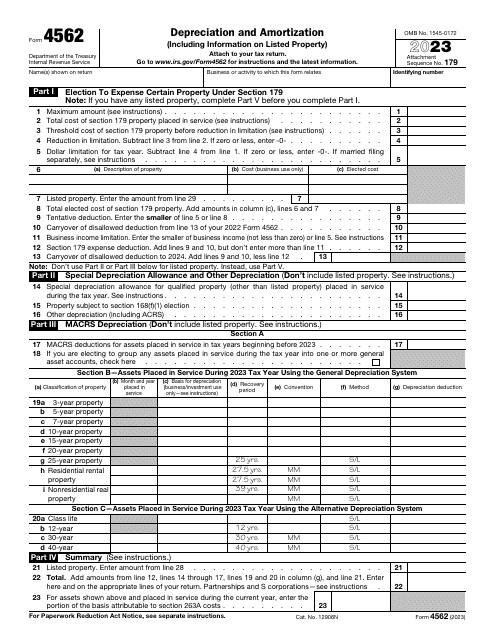

IRS Form 4562 Depreciation and Amortization (Including Information on Listed Property)

What Is IRS Form 4562?

IRS Form 4562, Depreciation and Amortization (Including Information on Listed Property) , is a formal document prepared by business owners whose intention is to ask for tax deductions due to depreciation of assets they used to carry out business operations and amortization of this property.

Alternate Names:

- Tax Form 4562;

- Federal Form 4562.

You need to explain what assets slightly lost in value during the previous year so that you are able to offset the acquisition costs at some point in the future. Fiscal organs allow taxpayers to deduct certain amounts on the basis of the estimated usefulness of the items.

This statement was released by the Internal Revenue Service (IRS) in 2023 - older editions of the form are now outdated. You can find an IRS Form 4562 fillable version via the link below.

What Is Form 4562 Used For?

If your business purchases and uses certain assets to generate profit, you will not be allowed to identify their total value as a business deduction when filing tax documentation after the first year. Nevertheless, you are entitled to deduct some costs every upcoming year by preparing and submitting Form 4562 to describe the depreciation of those assets since they are losing their value over time.

This option is available for both individuals and entities and applies to tangible assets like the facility you use as your office space and intangible assets like copyrights. Note that you cannot list land among your assets no matter how much it means for your business since land is considered to have an infinite value.

When Is Form 4562 Required?

It is mandatory to file Form 4562 if your goal is to claim depreciation under certain conditions - the assets featured in the document were used for the needs of your business over the course of the tax period identified in writing, you want to exercise your right for a deduction that applies to depreciable assets instead of waiting to capitalize on the property, the vehicles and other assets are not mentioned on Schedule C, Profit or Loss from Business (Sole Proprietorship), attached to IRS Form 1040, U.S. Individual Income Tax Return, the depreciation refers to an income statement filed by the corporation with the exception of IRS Form 1120-S, U.S. Income Tax Return for an S Corporation, or the amortization you account for starts during the tax period you are describing.

Form 4562 Instructions

Follow these Form 4562 Instructions to inform tax authorities about the depreciation of your property:

-

Write down the name (make sure it matches the one you list on your annual income statement), specify what kind of activity or business the document in question relates to, and add your taxpayer identification number . Be ready to enclose extra sheets of paper to the instrument if you run out of space - mark them accordingly to avoid confusion.

-

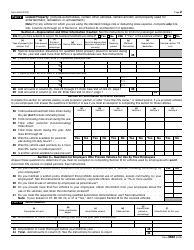

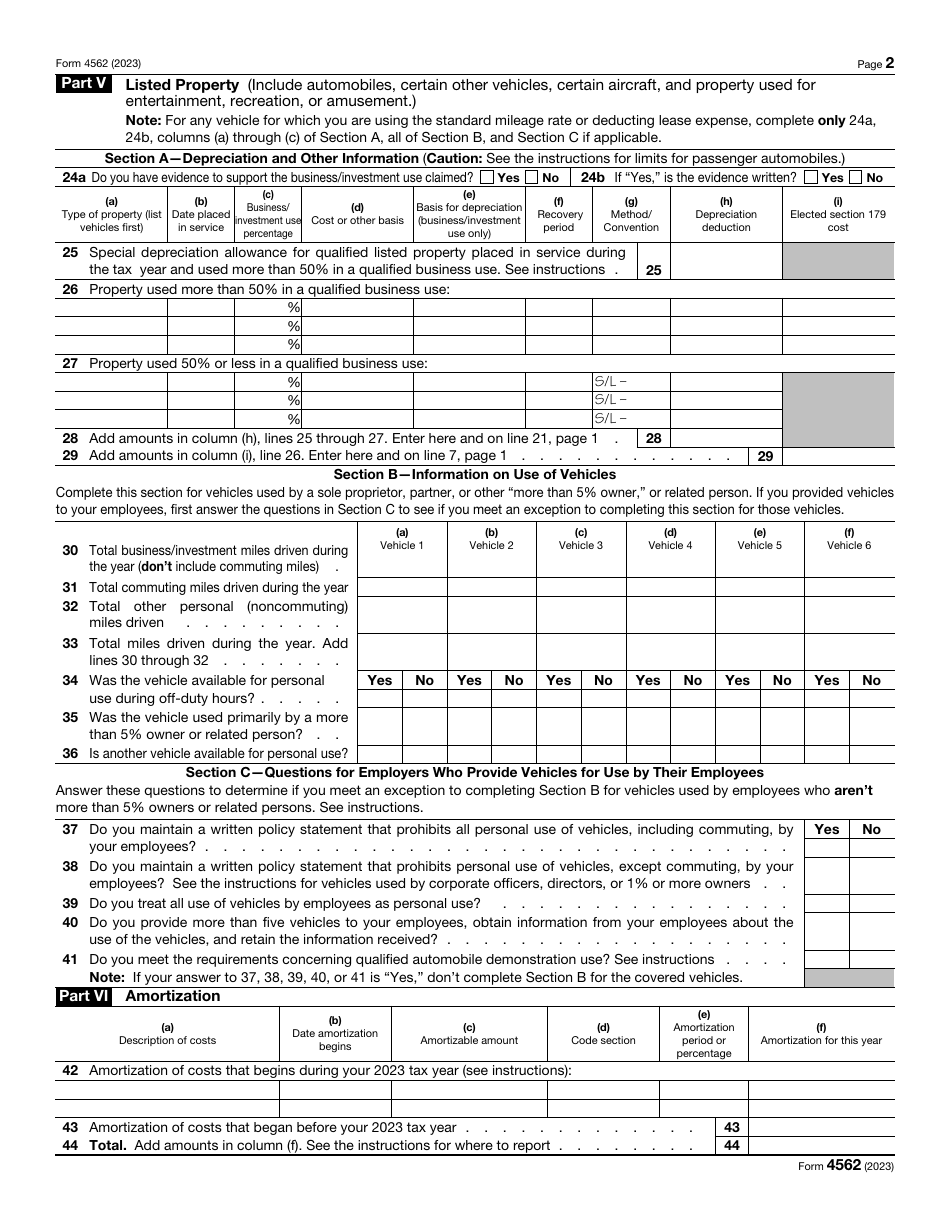

In case you own property whose primary use is to serve as a productive asset such as vehicles that do not exceed 6,000 pounds and whose purpose is to transport passengers, vehicles that naturally end up being used for personal needs, and equipment that helps you with creating entertainment content or providing recreation activities, you need to start with the second page of the form . Specify the property type, indicate the date you started using it, state how often you use it for your business or as an investment, and enter the value of the item.

-

Tell the IRS more about the vehicles you are using - these are supposed to include cars and motorcycles you give to your employees . You can list up to six vehicles and elaborate on the miles driven due to business or personal reasons and certify if those cars were utilized for personal purposes while the driver was off-duty. It is also your responsibility to provide more information about the company policy that outlines how the vehicles are going to be used by the workers.

-

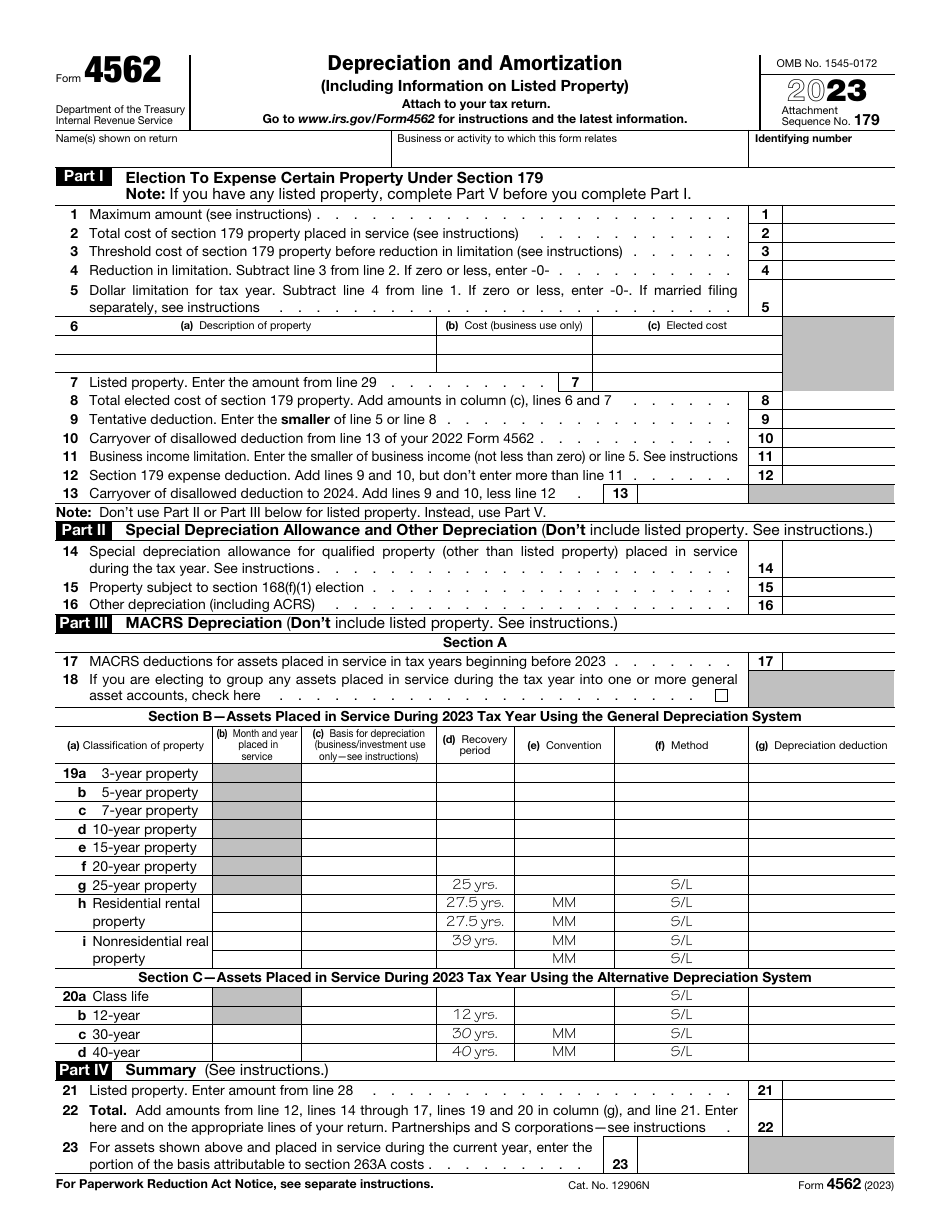

Confirm you are electing to expense specific assets in accordance with the fiscal regulations . Use the worksheet from the official instructions for Form 4562 to learn the maximum amount, describe the property, and use the formulas from the document to figure out the amount of deduction you are allowed to claim.

-

Explain whether you are entitled to receive an additional allowance that applies to the property over its first year in service . You may also have to enclose a separate document that further clarifies what kind of property you are talking about and the method of depreciation you opt for.

-

Provide the details of the depreciation that will apply to tangible assets apart from the property you identified on the second page of the instrument . These assets are divided into different categories - it is required to calculate the deduction relevant for all categories separately. Summarize the information by adding all the results you got from all the parts of the form.

-

Disclose the amortization details - briefly summarize the costs, write down the date amortization began, state the amount of amortization and the section of the Tax Code that lets you amortize the expenses, specify the percentage or period of amortization, and indicate the amortization for the year in question. Include the amount of amortization during the previous years and combine the numbers.