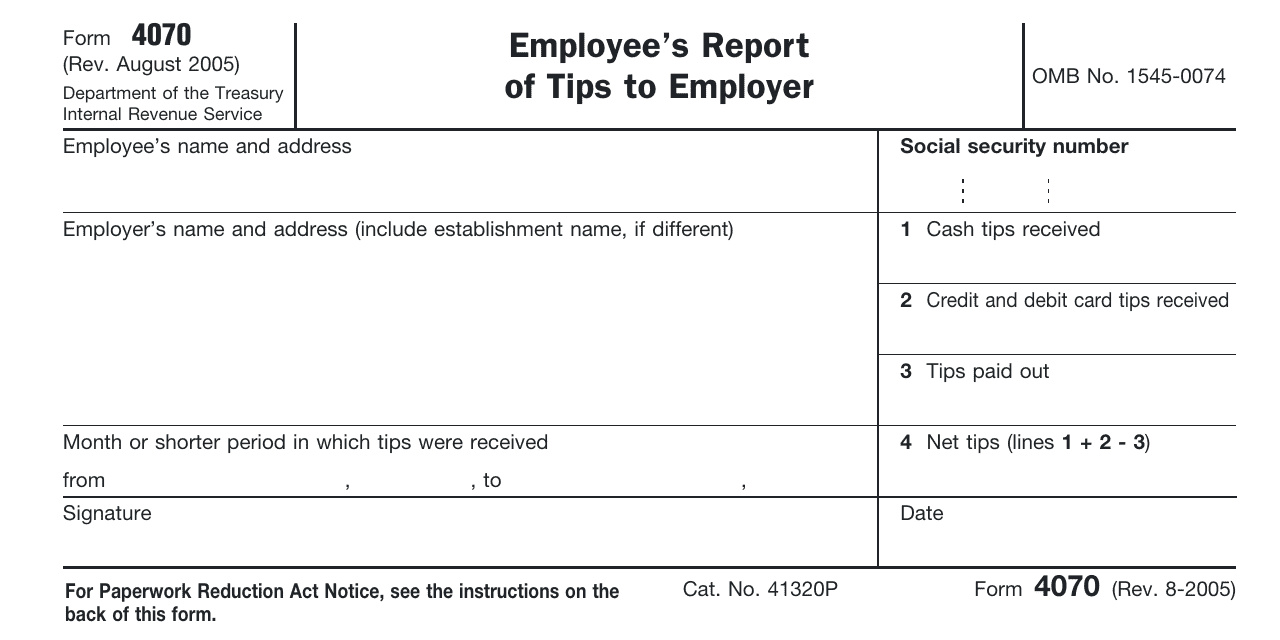

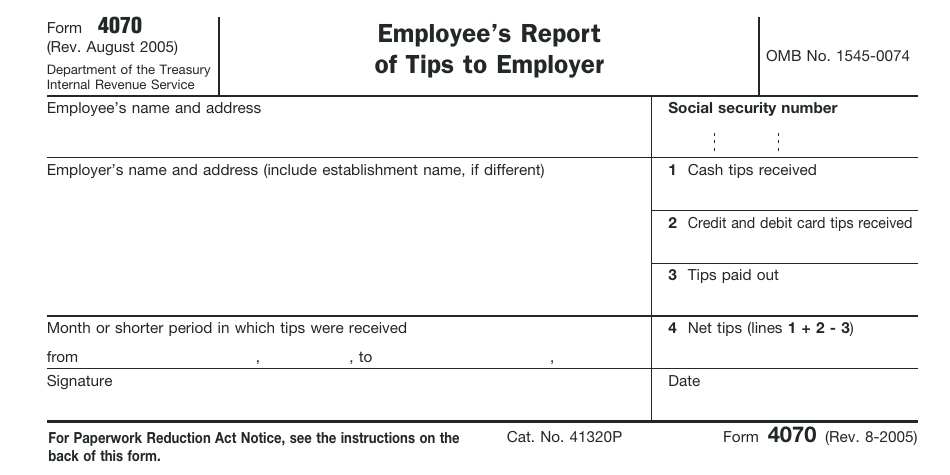

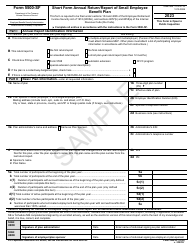

IRS Form 4070 Employee's Report of Tips to Employer

What Is IRS Form 4070?

IRS Form 4070, Employee’s Report of Tips to Employer , is a formal instrument used by employees to elaborate on the amount of tips they get every month.

Alternate Names:

- Tax Form 4070;

- IRS Tip Reporting Form;

- IRS Tip Reporting Form 4070;

- IRS Employee Tip Reporting Form.

Service industry workers that receive additional income from tips are expected to keep track of these tips and let their employers know about them on time. Whether you got tips in cash from your clients, shared tips with other employees in line with the regulations set up in your organization, received non-monetary tips such as coupons or tickets, or increased your income with tips from credit and debit card transactions, all these tips must be described in writing in the document in question.

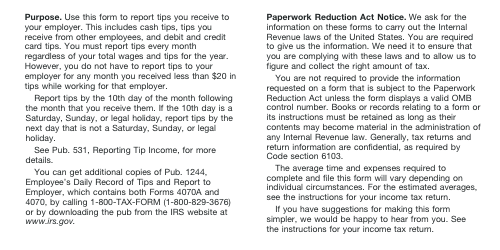

This report was issued by the Internal Revenue Service (IRS) on August 1, 2005 - older editions of the document are now outdated. You may download an IRS Form 4070 fillable version through the link below.

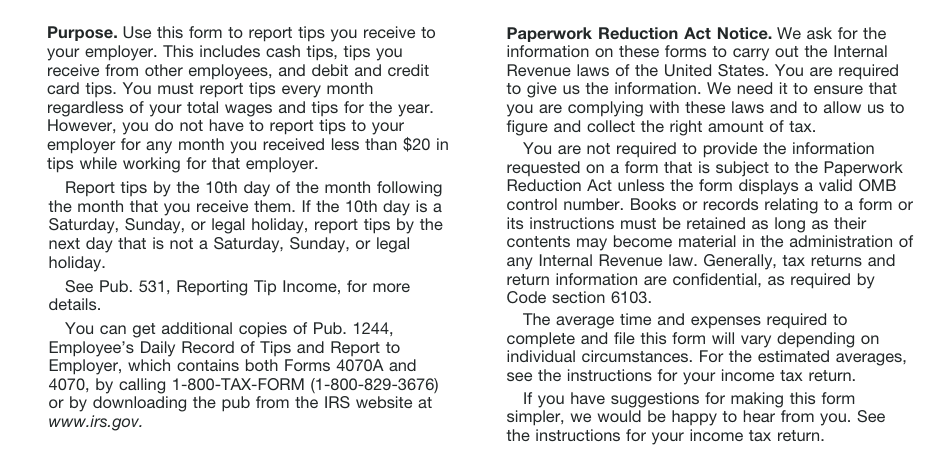

IRS Form 4070 should be used in conjunction with IRS Form 4070A, Employee's Daily Record of Tips. This form is used to keep track of tips received every day. Using IRS Form 4070A is voluntary. The employee can keep their own daily tip record, as long as it contains the number of cash tips, tips from credit and debit cards, the value of noncash tips, and the number of tips paid to other employees through tip pools or splitting.

The IRS Tip Reporting Form does not require recording tips received in a form of an item of value, but these must be reported on IRS Form 1040, U.S. Individual Income Tax Return.

Check out the 4070 Series of forms to see more IRS documents in this series.

Form 4070 Instructions

Follow these instructions for Form 4070 to inform your employer about the tips you received over the previous month:

-

Write down your full name, mailing address, and social security number . Identify the employer by their name and legal address. Note that the form should contain the name of the establishment if it differs from the legal name of the employer.

-

Specify the time period covered in this report - you are obliged to clarify how many tips you received by the tenth day of the month that follows the month when the transactions took place . There is, however, an exception - if the tenth day happens to be a holiday, Saturday, or Sunday, you can postpone the reporting until the next business day. The employer may ask you to file a report more often than once a month in accordance with the internal policies of the business.

-

Provide information about the tips you received - all the categories must be listed separately . Calculate the total number of tips and write down the result in the form. Currently, workers are not expected to inform their employers about tips below $20 but if the amount is bigger, make sure you complete this instrument. No matter how big the amount you state in writing, the employer will be responsible for deducting taxes on this portion of income you report whether this is done through your salary or via an alternative method.

-

Certify the 4070 Tax Form by signing and dating it . You need to use IRS Form 4070A, Employee's Daily Record of Tips, to keep up with the tips on a daily basis - it is recommended to maintain full records so that when the time comes to prepare a monthly report, you do not miss any details. Self-employed individuals must not forget about their duty to include the tips as a part of their income on IRS Form 1040 Schedule C, Profit or Loss From Business, attached to their annual income statement.