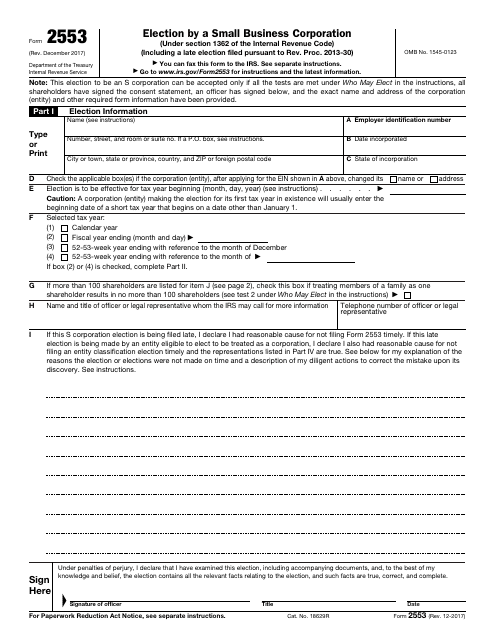

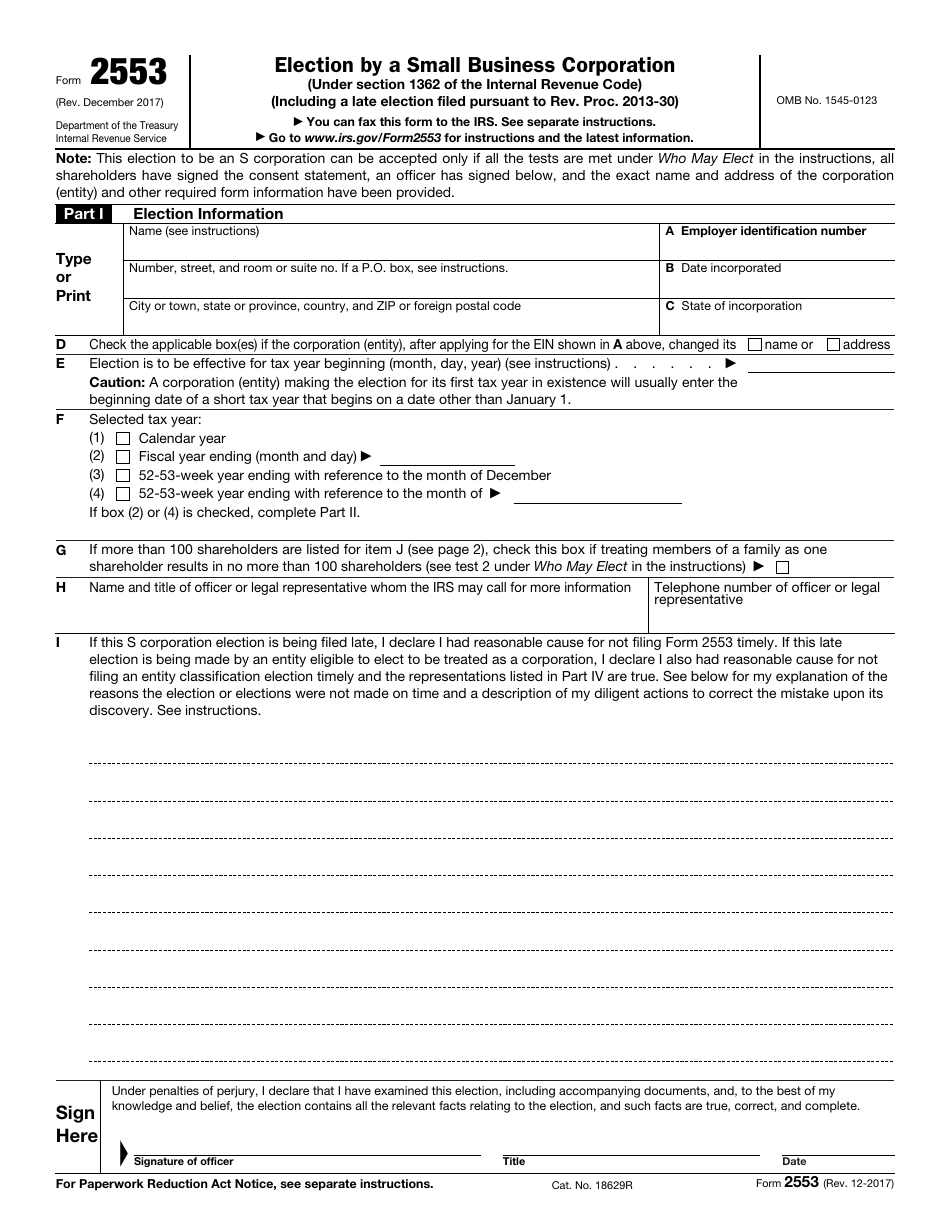

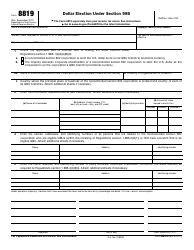

IRS Form 2553 Election by a Small Business Corporation

What Is IRS Form 2553?

IRS Form 2553, Election by a Small Business Corporation , is a fiscal statement filed by companies that want to be recognized as S corporations.

Alternate Name:

- Tax Form 2553.

Many taxpayers are registered as C corporations by default - if you want to change the business structure of your entity for any reason, including extra tax benefits, you need to show tax organs you are eligible for this change. This decision must be supported by all shareholders that confirm their commitment by signing the paperwork together.

This form was issued by the Internal Revenue Service (IRS) on December 1, 2017 , rendering previous editions obsolete. An IRS Form 2553 fillable version is available for download below.

What Is Form 2553 Used For?

Prepare and file Form 2553 to express your intention to change from a C corporation to an S corporation. As long as you are able to demonstrate your compliance with qualifying criteria set by the IRS, your election will be made official.

The corporation you manage is supposed to be a domestic entity that operates strictly on the territory of the United States, all people that own shares have to be US citizens or residents of the country, the maximum number of shareholders is one hundred, and you may only issue a single class of shares. You will not be permitted to transform into an S corporation if you conduct international sales or you run a financial institution that applies the reserve method to account for bad debts.

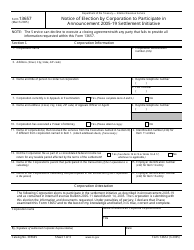

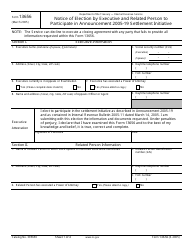

Form 2553 Instructions

The IRS Form 2553 Instructions are as follows:

-

Identify the organization - its name, employer identification number, and correspondence address . You have to point out when the corporation was formed and enter the state where it happened. Check the appropriate box if you have changed the corporation's name or address since you applied for an employer identification number.

-

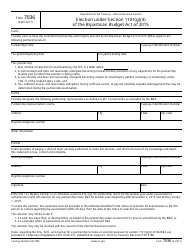

Confirm the date the election becomes effective . Check the box to choose the tax year you will outline in your tax paperwork - you may opt for a traditional calendar year or go with a different tax period if necessary. Certify you want fiscal authorities to treat family members as a single shareholder so that the total number of shareholders does not exceed one hundred.

-

Identify the corporation officer that will be able to communicate with the IRS and discuss the election . You may also list the details of the tax professional you hired to help you out with the matter. In case you are filing the paperwork late, explain the reasons behind it using the comments section. Certify the form by adding your title, dating, and signing the document.

-

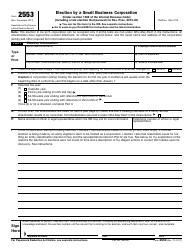

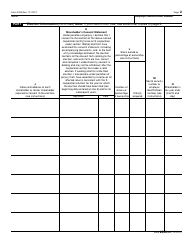

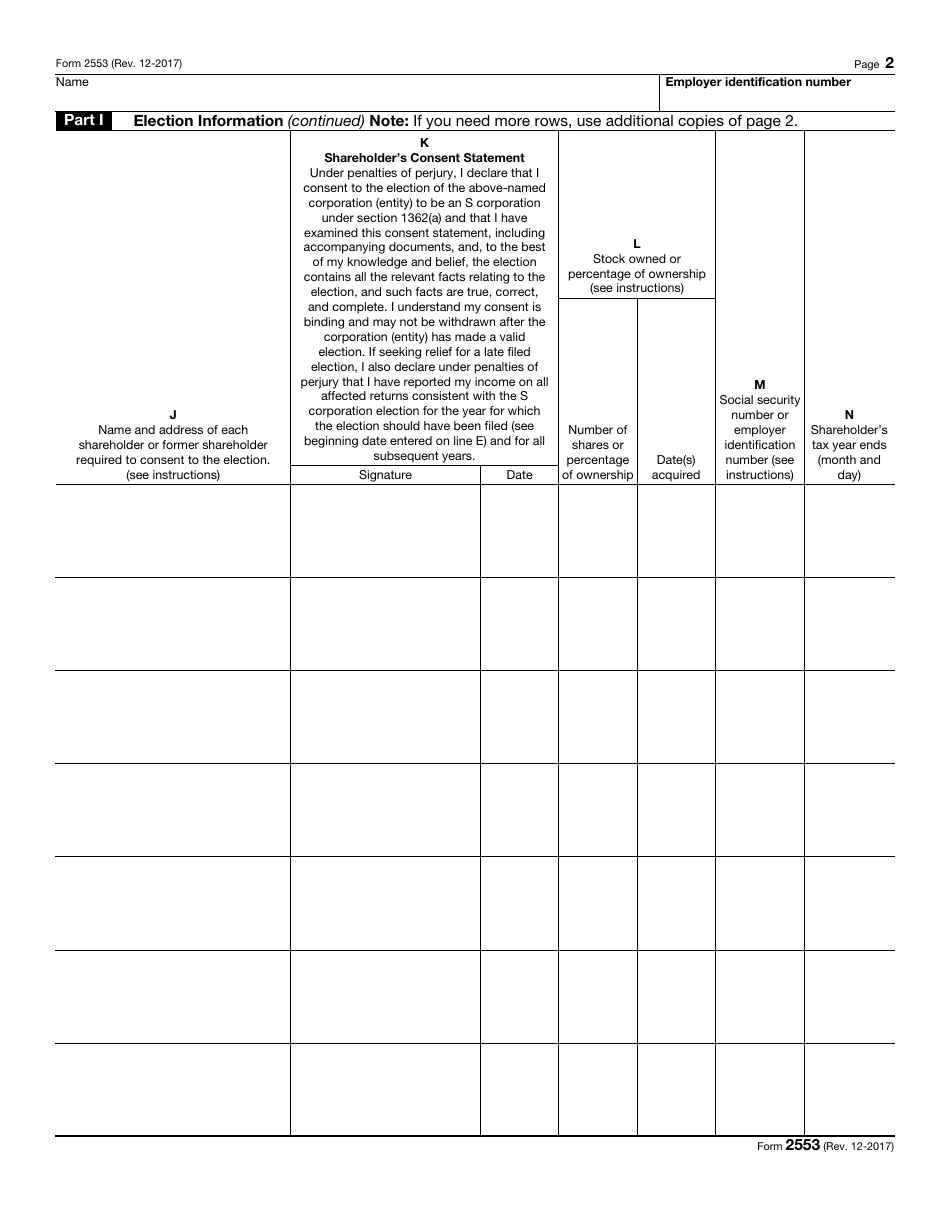

List the names and addresses of all shareholders that must provide their consent to the election in question . Every individual is expected to sign and date the form, indicate their percentage of ownership or number of shares they currently own, record their taxpayer identification number, and the date when their tax year is over. It is possible you will not have enough space for all the shareholders - in this case, you are allowed to print out as many copies of the second page of the form as needed and attach them to the document.

-

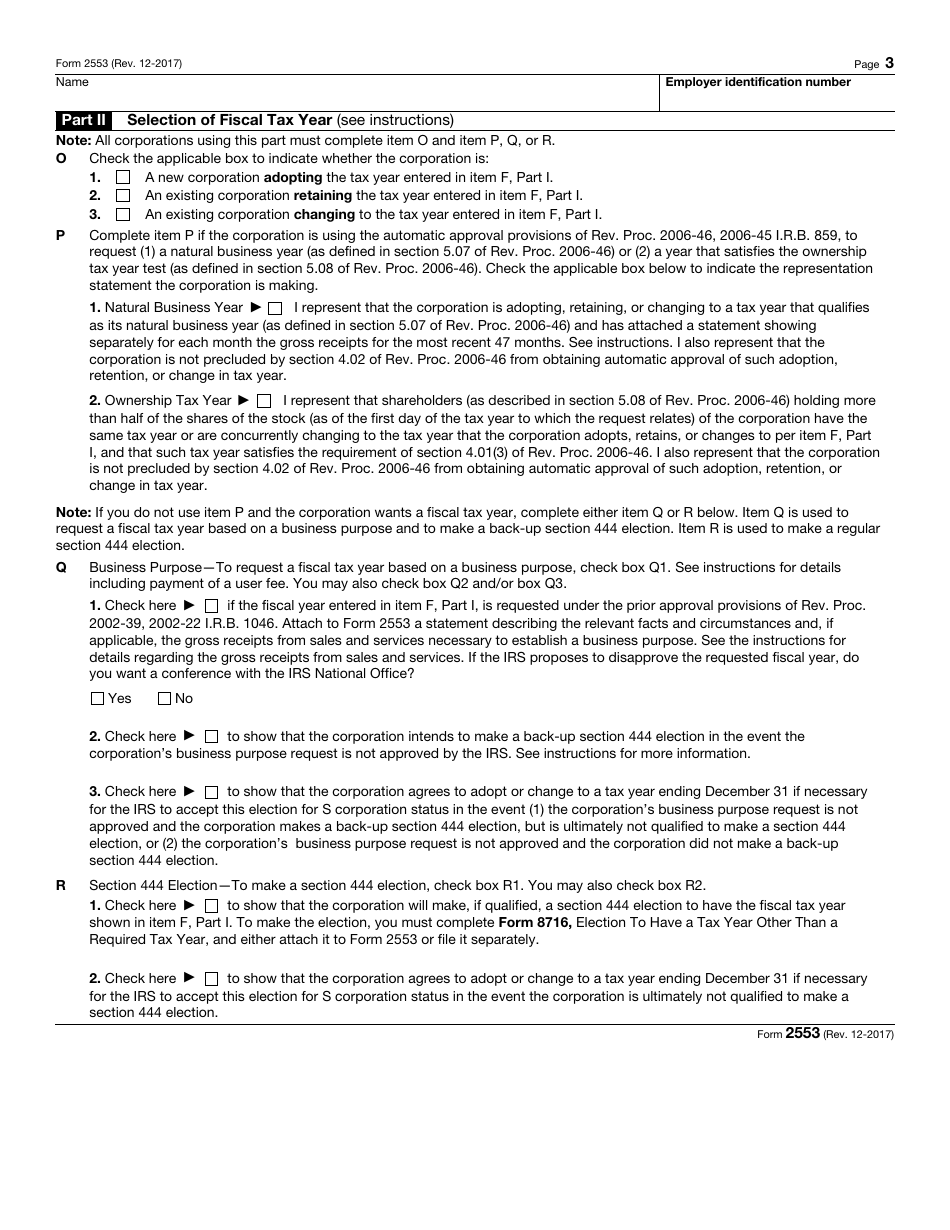

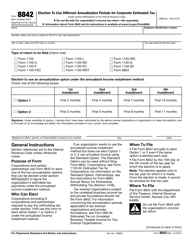

Confirm your intention to adopt a new tax period or stick to the conditions you have adhered to in the past . You have an opportunity to report your taxes based on a natural business year or conform to the year the majority of shareholders prefer to follow. It is also permitted to request a tax period on the basis of your business purpose or choose a taxable year that differs from the required one.

-

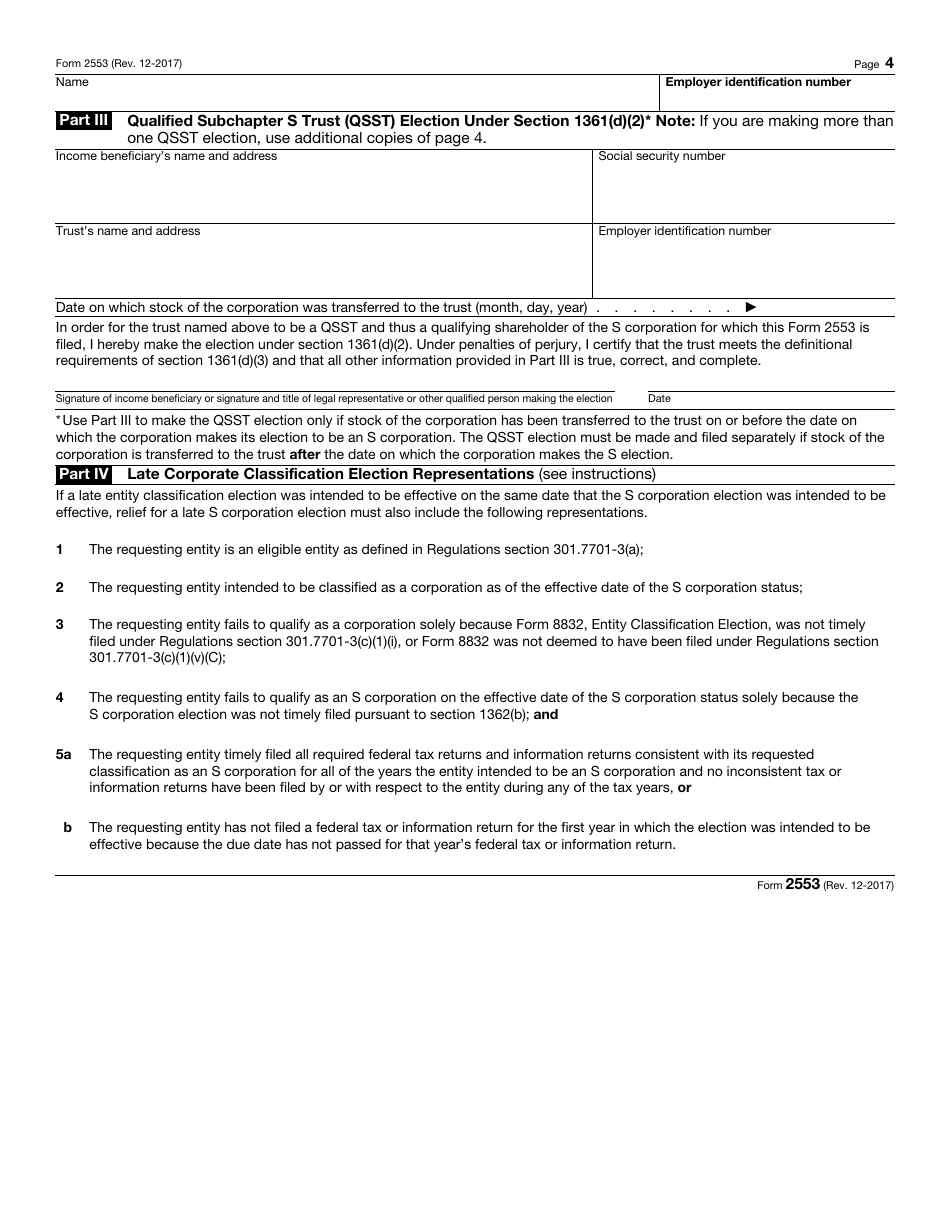

Establish a qualified subchapter S trust, list its details, and identify the beneficiary of the income by their full name, social security number, and address . Specify when the corporation's stock was transferred to the trust and obtain the signature of the beneficiary or their authorized representative to certify the election.

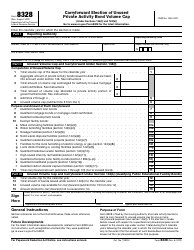

When Is Form 2553 Due?

There is no Form 2553 deadline in the conventional sense of this word - corporations are free to make the election whenever they assess the need to transform into S corporations. However, businesses need to know that the date of filing will determine when the change will go into effect. If you file the papers during any month of the year, the election will come into force the next year. Nevertheless, you may still be considered an S corporation if you submit the instrument within two months and fifteen days after the tax year begins so make sure you do not delay the filing.

There is no need to file the form again next year or at any point in the future - once the approval from the IRS is received, the structure of the business changes permanently; wait for a formal letter from fiscal organs within two months of filing the statement.

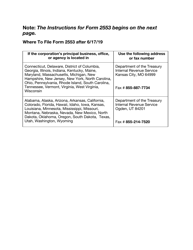

Where to Mail Form 2553?

Currently, you are unable to file Tax Form 2553 electronically. The mailing address depends on the location of your business or its main office:

-

If you operate in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming, send the paperwork to the Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201. Form 2553 fax number for these states is 855-214-7520 .

-

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, and Wisconsin corporations need to submit the form to the Department of the Treasury, Internal Revenue Service Center, Kansas City, MO 64999. Alternatively, file the instrument via fax - the number is 855-887-7734 .