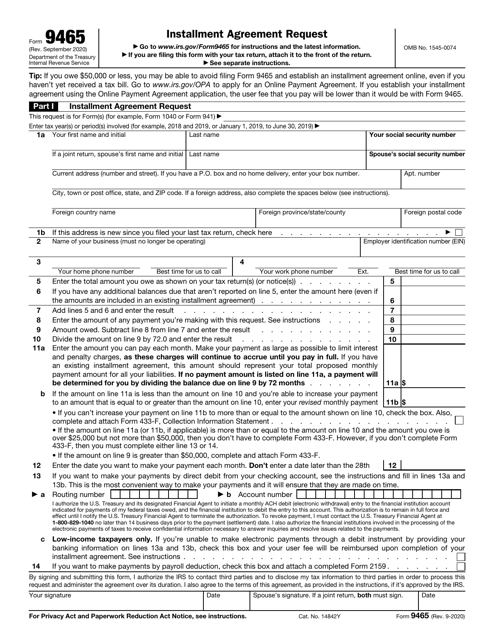

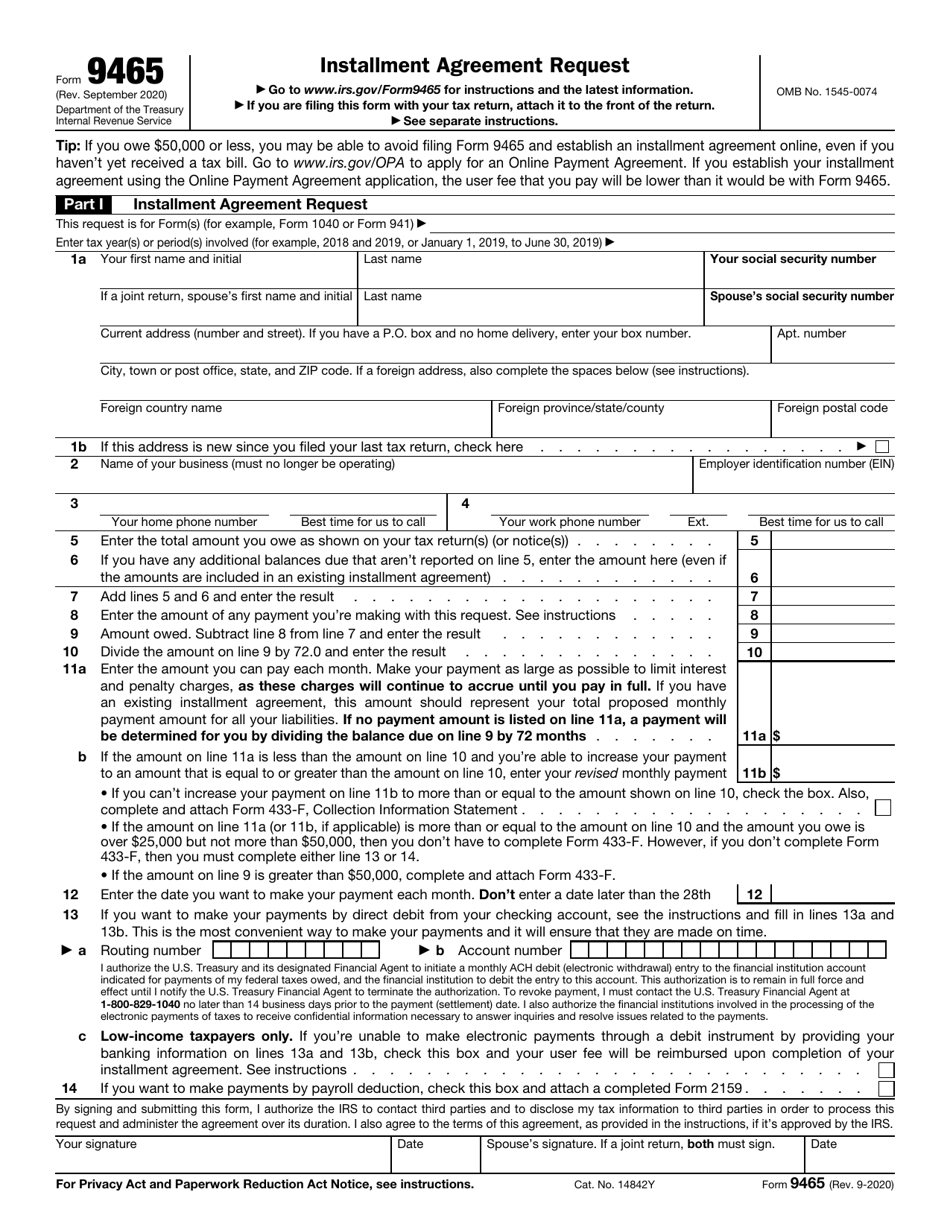

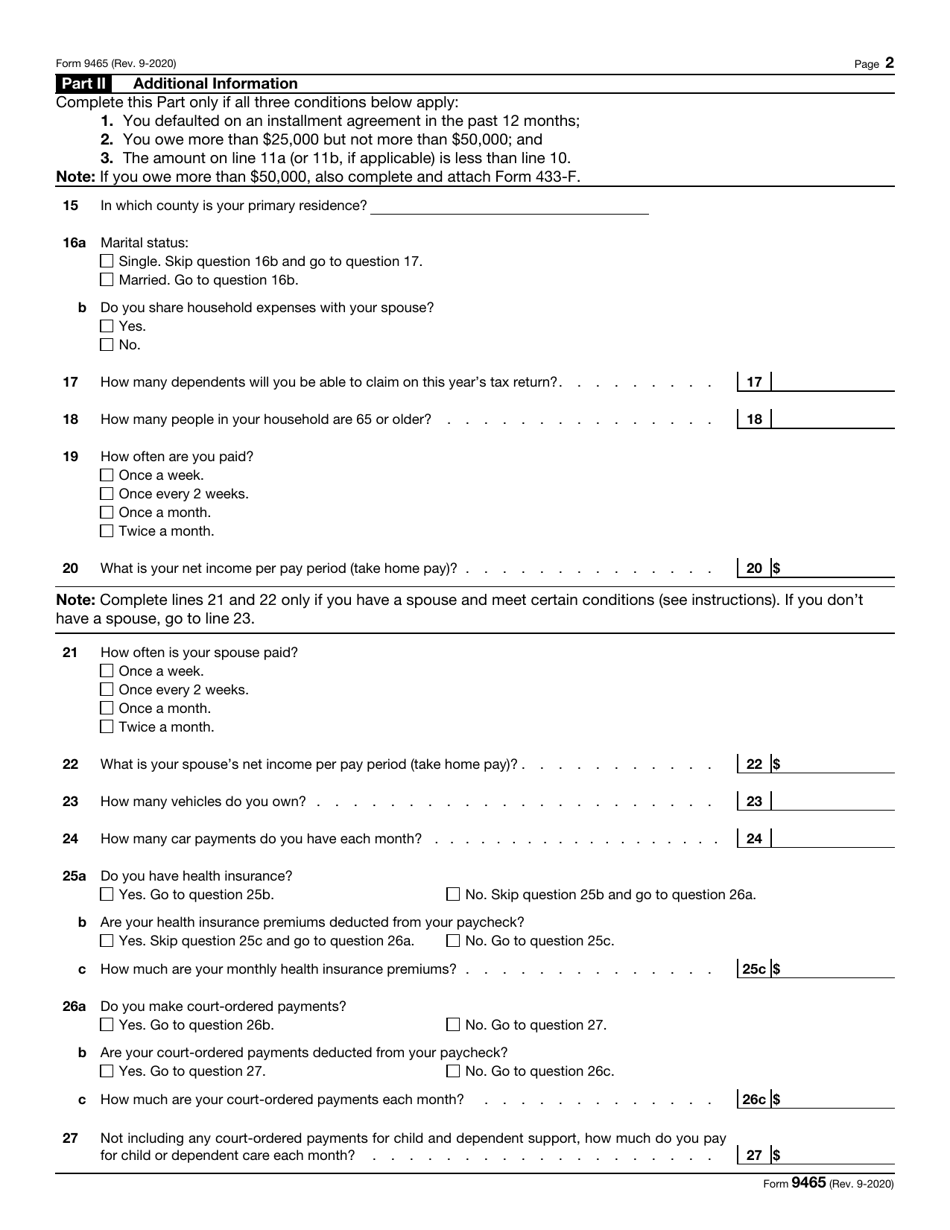

IRS Form 9465 Installment Agreement Request

What Is IRS Form 9465?

IRS Form 9465, Installment Agreement Request , is a formal document used by taxpayers to ask tax organizations to set up an elaborate payment plan to handle tax debt.

Alternate Name:

- Tax Form 9465.

If you owe money on your income statement and you cannot pay it within the next six months, it is recommended to reach out to fiscal authorities and request to pay in installments.

This statement was issued by the Internal Revenue Service (IRS) on September 1, 2020 - previous editions of the form are now obsolete. Download an IRS Form 9465 fillable version below.

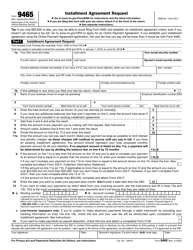

Form 9465 Instructions

Instructions for Form 9465 are as follows:

-

Specify what tax form the request is prepared for and add the tax periods covered by the documentation . Provide your personal information and contact details. It is also necessary to identify your spouse in case you are filing a joint return and list the details of the business you managed in the past.

-

Elaborate on your debt and additional balances due . Specify how much money you are able to pay every month and record the date of the proposed payment.

-

Add your banking account information to authorize the IRS to withdraw payments from your funds . Certify the paperwork by signing and dating the form - you and your spouse both need to verify the details you put in the request.

-

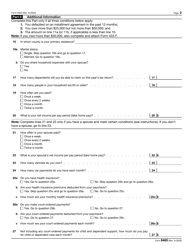

Answer additional questions to tell tax authorities more about the factors that affect your financial situation - your residence, marital status, household expenses, frequency of getting paid, and mandatory payments you have to deal with every month.

Where to Mail Form 9465?

Here is where you need to send Form 9465:

-

Alaska, Arizona, Colorado, Connecticut, Delaware, District of Columbia, Hawaii, Idaho, Illinois, Maine, Maryland, Massachusetts, Montana, Nevada, New Hampshire, New Jersey, New Mexico, North Dakota, Oregon, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, Wisconsin, and Wyoming residents must submit the paperwork to the Department of the Treasury, IRS, 310 Lowell St., Stop 830, Andover, MA 01810 .

-

Send the document to the Department of the Treasury, IRS, P.O. Box 47421, Stop 74, Doraville, GA 30362 if you reside in Alabama, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, South Carolina, Texas, or Virginia.

-

If you live in Arkansas, California, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, New York, Ohio, Oklahoma, Pennsylvania, or West Virginia, file the form with the Department of the Treasury, IRS, Stop P-4 5000, Kansas City, MO 64999-0250 .

There are different rules for taxpayers that file an income statement with Schedule C, E, or F:

-

Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont taxpayers are supposed to send the papers to the Department of the Treasury, IRS, P.O. Box 480, Stop 660, Holtsville, NY 11742-0480 .

-

File the request with the Department of the Treasury, IRS, P.O. Box 69, Stop 811, Memphis, TN 38101-0069 if you reside in Alabama, Arkansas, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, West Virginia, or Wisconsin.

-

Residents of Alaska, Arizona, California, Colorado, Hawaii, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming must send the paperwork to the Department of the Treasury, IRS, P.O. Box 9941, Stop 5500, Ogden, UT 84409 .

-

Submit the document to the Department of the Treasury, IRS, Stop 4-N31.142, Philadelphia, PA 19255-0030 if you live in the District of Columbia, Delaware, Florida, Maryland, North Carolina, South Carolina, or Virginia.