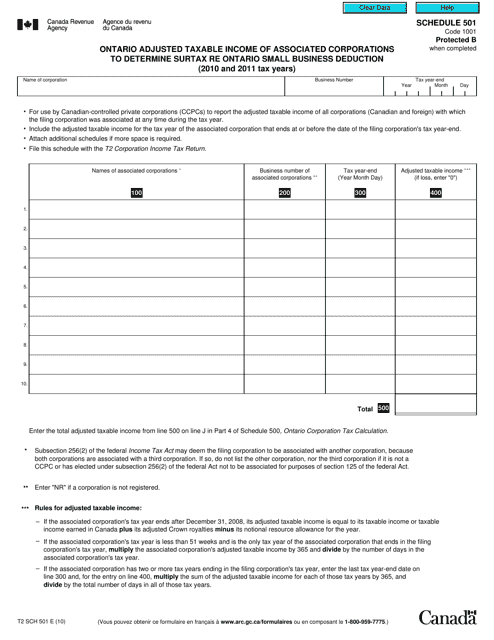

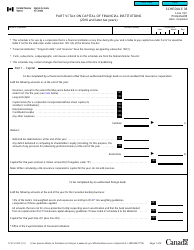

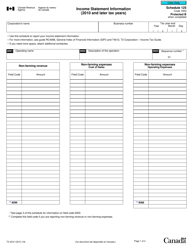

Form T2 Schedule 501 Ontario Adjusted Taxable Income of Associated Corporations to Determine Surtax Re Ontario Small Business Deduction (2010 and 2011 Tax Years) - Canada

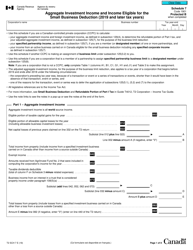

Form T2 Schedule 501 is used in Canada for determining the adjusted taxable income of associated corporations in Ontario in order to determine the surtax and the Ontario small business deduction for the tax years 2010 and 2011. It helps in calculating the amount of taxable income and the deductions available for small businesses.

The form T2 Schedule 501 Ontario Adjusted Taxable Income of Associated Corporations is filed by corporations in Canada.

FAQ

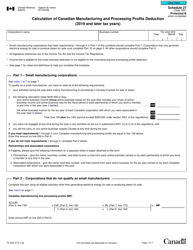

Q: What is Form T2 Schedule 501?

A: Form T2 Schedule 501 is a form used in Canada to determine the surtax for Ontario small businesses.

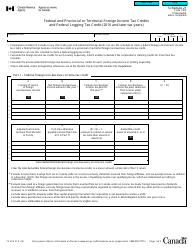

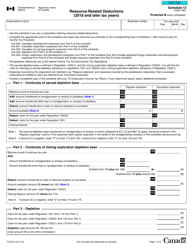

Q: What does Form T2 Schedule 501 calculate?

A: Form T2 Schedule 501 calculates the adjusted taxable income of associated corporations to determine the surtax for Ontario small businesses.

Q: What are the tax years covered by Form T2 Schedule 501?

A: Form T2 Schedule 501 covers the 2010 and 2011 tax years.

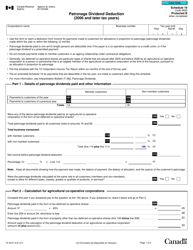

Q: What is the purpose of the surtax?

A: The surtax is levied on certain businesses to help fund government programs and services in Ontario.

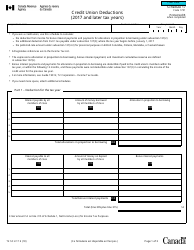

Q: What is the Ontario Small Business Deduction?

A: The Ontario Small Business Deduction is a tax deduction available to qualifying small businesses in Ontario.