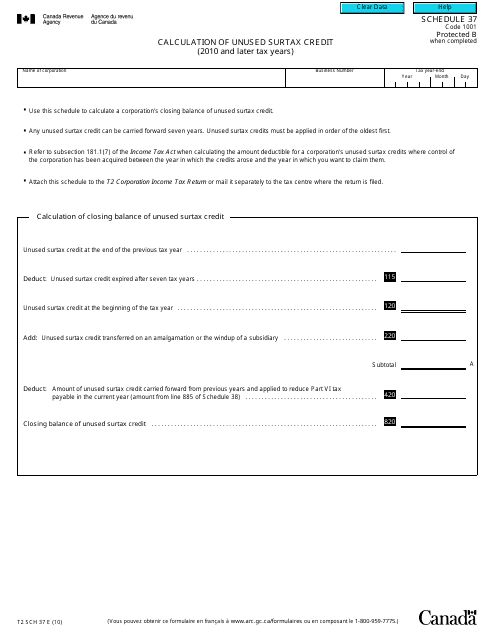

Form T2 Schedule 37 Calculation of Unused Surtax Credit (2010 and Later Tax Years) - Canada

Form T2 SCH 37 is a Canadian Revenue Agency form also known as the "Form T2 Sch 37 Schedule 37 "calculation Of Unused Surtax Credit (2010 And Later Tax Years)" - Canada" . The latest edition of the form was released in January 1, 2010 and is available for digital filing.

Download an up-to-date Form T2 SCH 37 in PDF-format down below or look it up on the Canadian Revenue Agency Forms website.

FAQ

Q: What is Form T2 Schedule 37?

A: Form T2 Schedule 37 is used to calculate the unused surtax credit for tax years 2010 and later in Canada.

Q: What does the unused surtax credit mean?

A: The unused surtax credit refers to any surtax credit that a corporation is entitled to, but has not yet claimed or utilized in a particular tax year.

Q: When should Form T2 Schedule 37 be filed?

A: Form T2 Schedule 37 should be filed along with a corporation's T2 income tax return for the applicable tax year.

Q: What information is required to complete Form T2 Schedule 37?

A: To complete Form T2 Schedule 37, you will need information related to your corporation's surtax credits, including the amount of unused surtax credits from previous tax years.

Q: Are there any specific instructions or guidelines for completing Form T2 Schedule 37?

A: Yes, the CRA provides detailed instructions and guidelines on how to complete Form T2 Schedule 37. It is recommended to review these instructions before filling out the form.