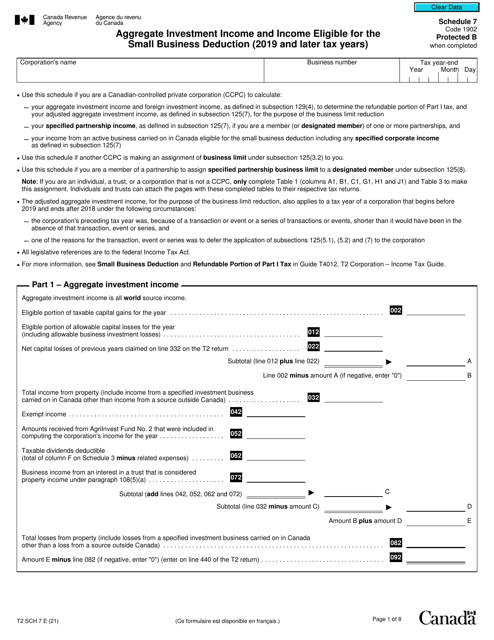

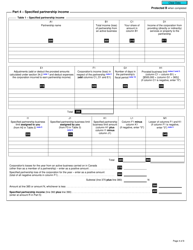

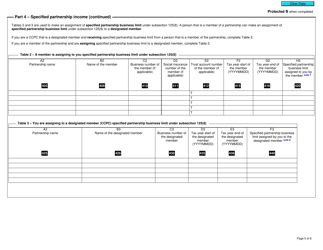

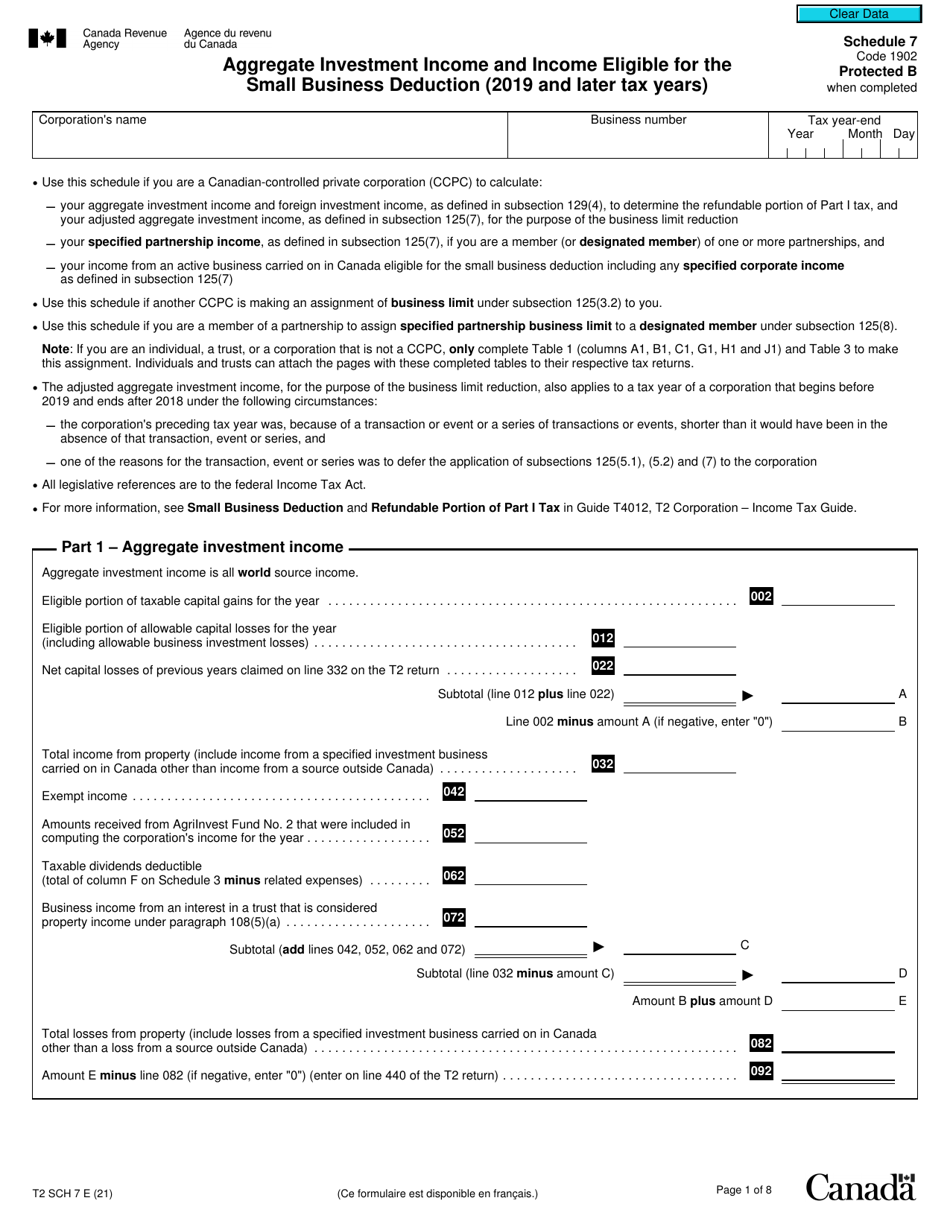

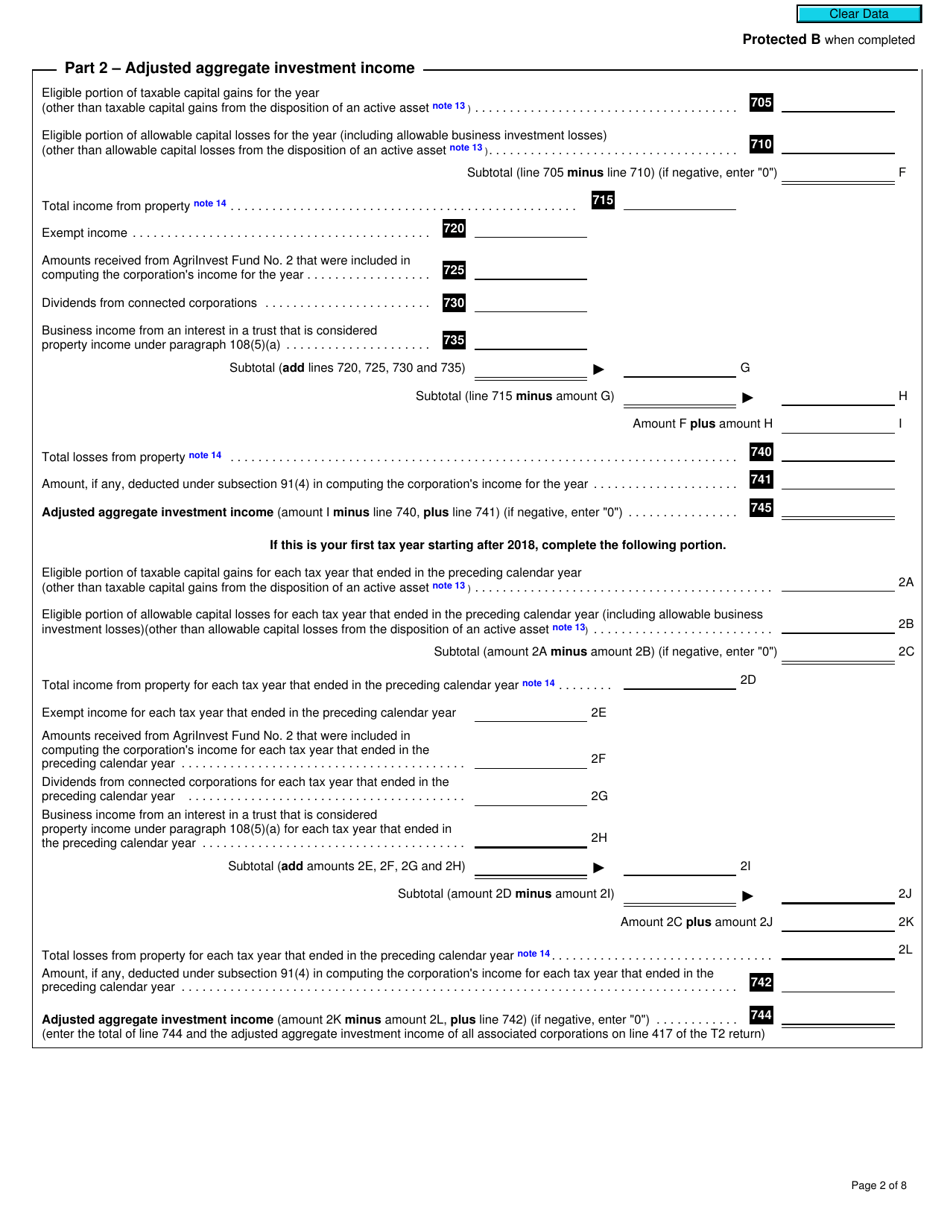

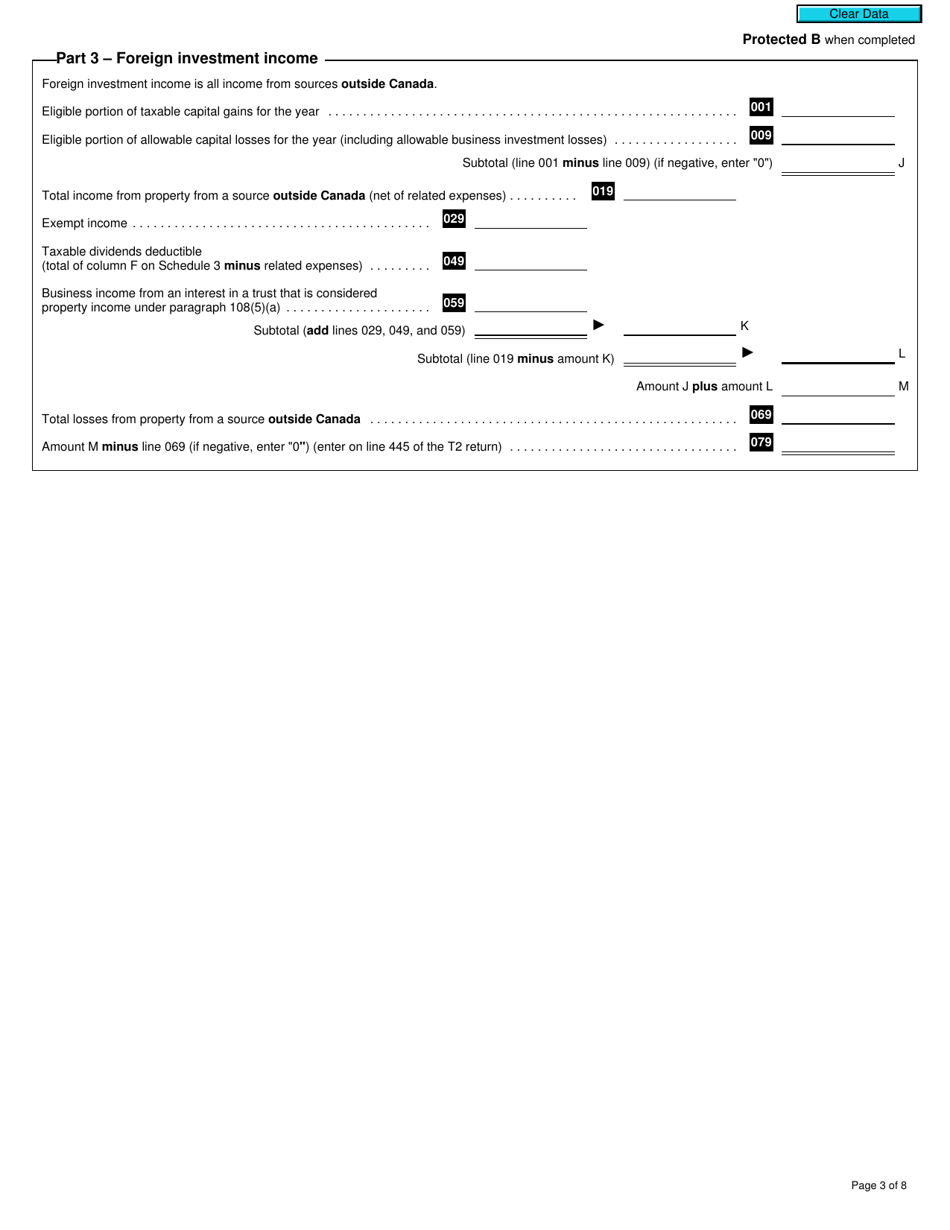

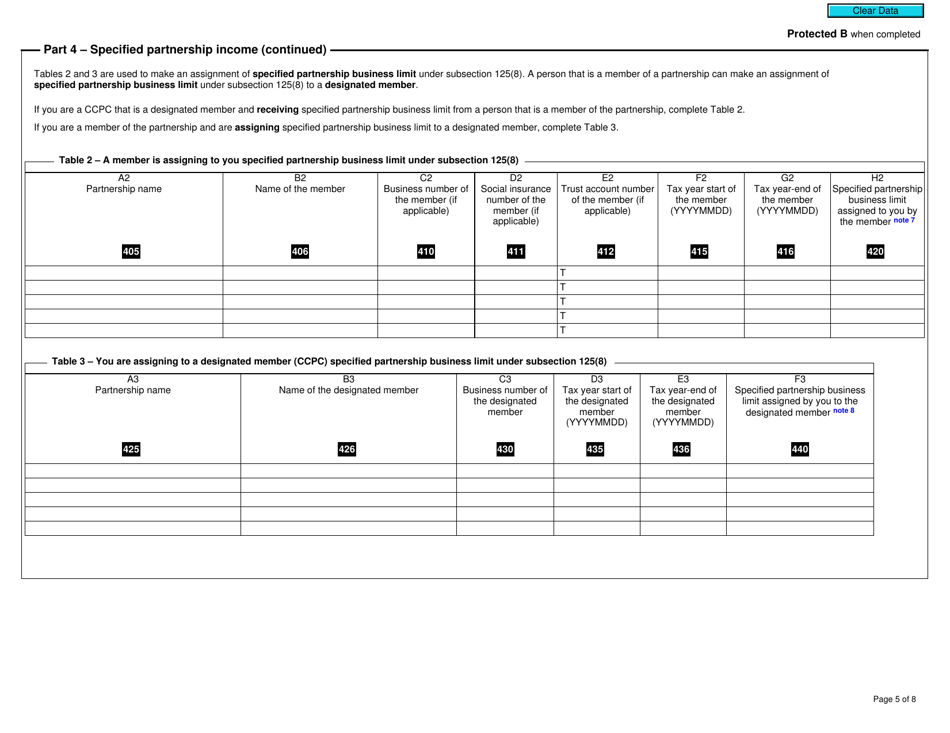

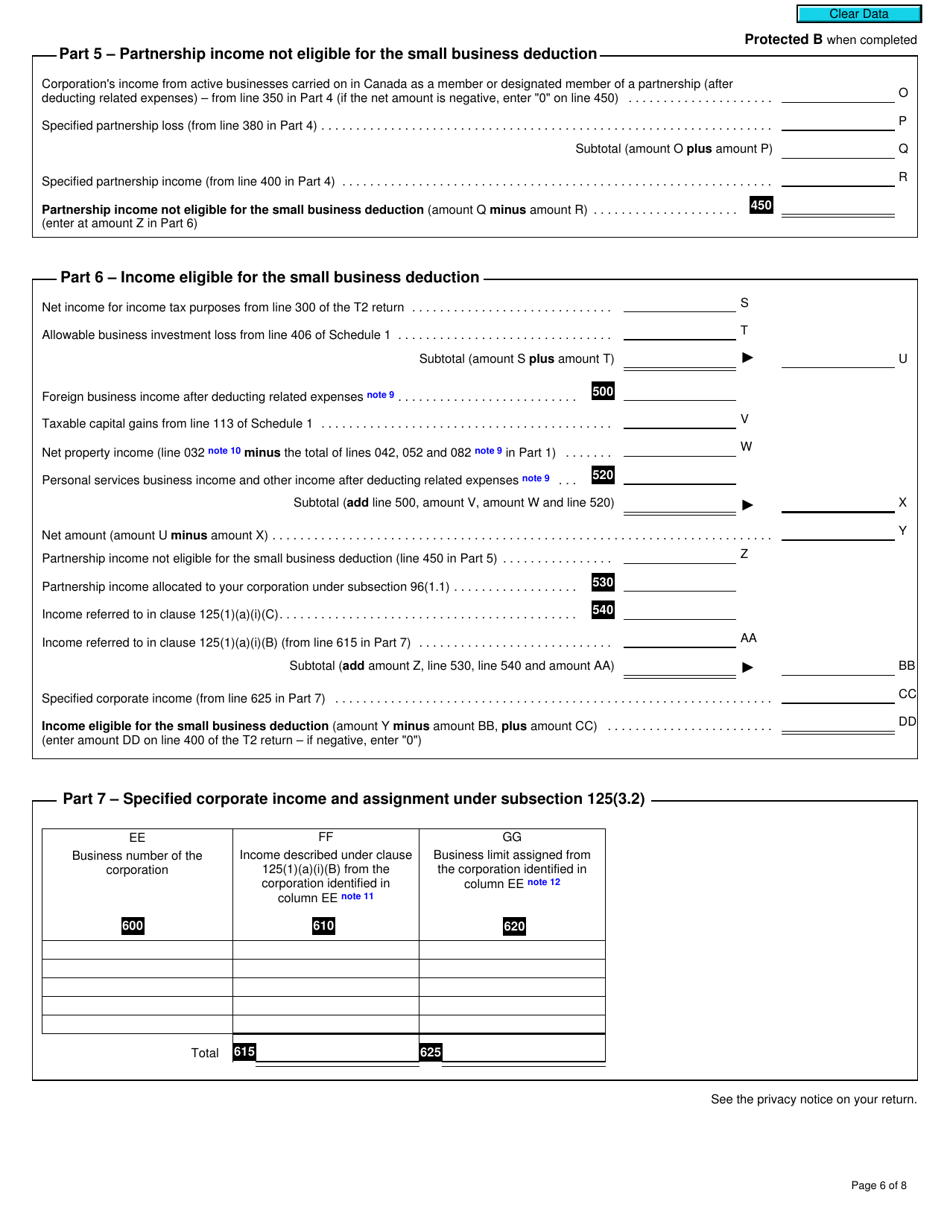

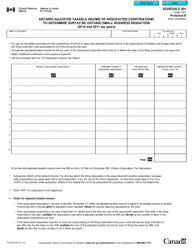

Form T2 Schedule 7 Aggregate Investment Income and Income Eligible for the Small Business Deduction (2019 and Later Tax Years) - Canada

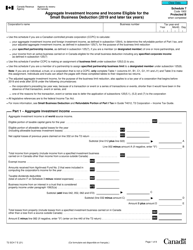

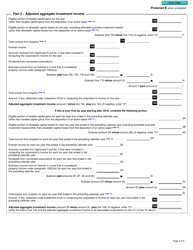

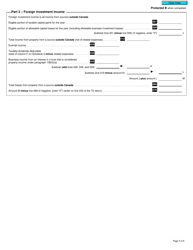

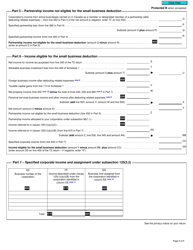

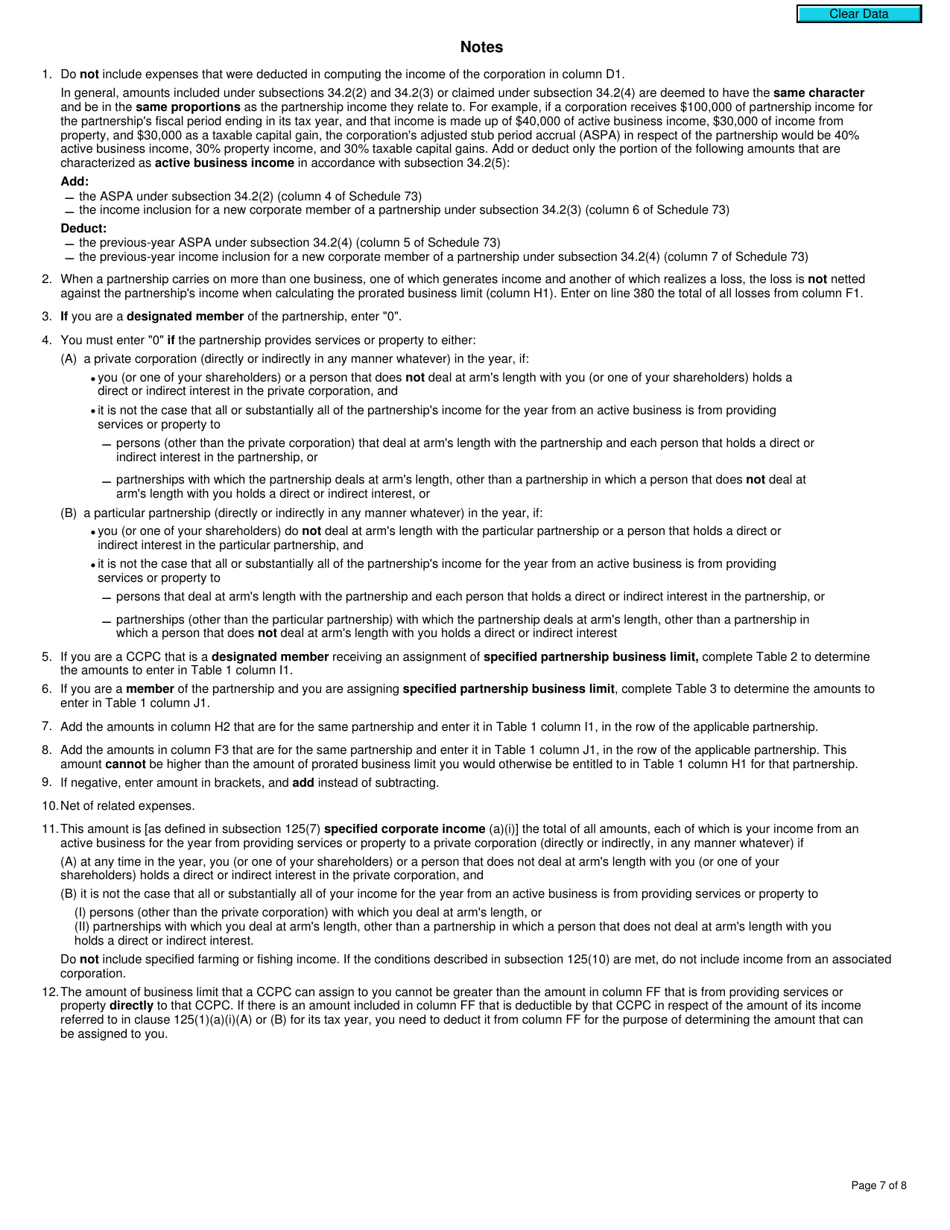

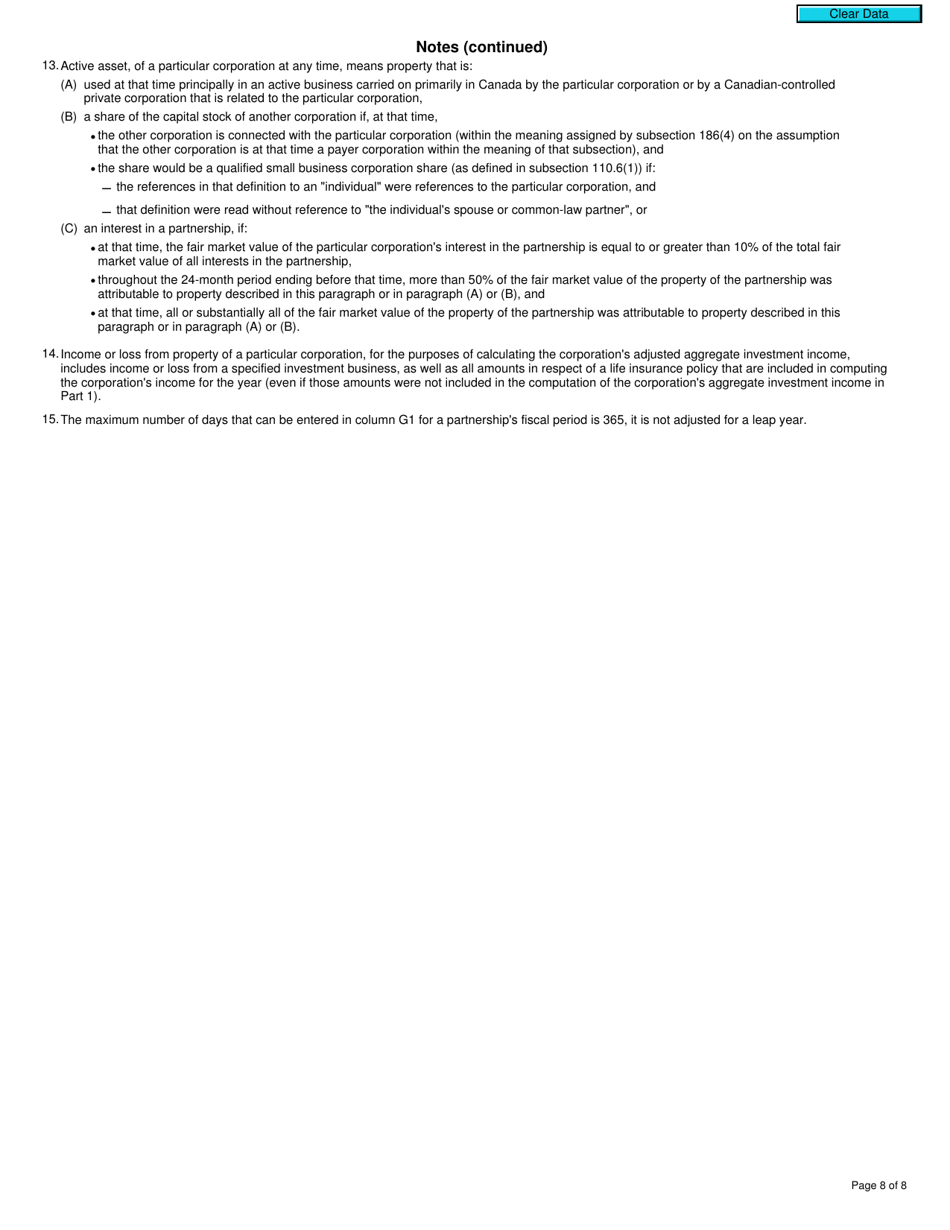

Form T2 Schedule 7 Aggregate Investment Income and Income Eligible for the Small Business Deduction (2019 and Later Tax Years) in Canada is used to calculate and report the aggregate investment income earned by a corporation and income eligible for the small business deduction. It is part of the income tax return filing process for Canadian corporations.

The Form T2 Schedule 7 is filed by certain Canadian businesses that need to report their aggregate investment income and income eligible for the small business deduction.

Form T2 Schedule 7 Aggregate Investment Income and Income Eligible for the Small Business Deduction (2019 and Later Tax Years) - Canada - Frequently Asked Questions (FAQ)

Q: What is Form T2 Schedule 7?

A: Form T2 Schedule 7 is a tax form used in Canada to report aggregate investment income and income eligible for the small business deduction for the tax years 2019 and later.

Q: What is aggregate investment income?

A: Aggregate investment income refers to the total income generated from investments such as interest, dividends, and capital gains.

Q: What is the small business deduction?

A: The small business deduction is a tax deduction available to Canadian corporations that meet certain criteria and helps to reduce the amount of income that is subject to taxation.

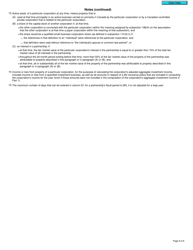

Q: What information is required to complete Form T2 Schedule 7?

A: To complete Form T2 Schedule 7, you will need to provide information about your aggregate investment income, income eligible for the small business deduction, and other related details.

Q: Who is required to file Form T2 Schedule 7?

A: Canadian corporations that have aggregate investment income and income eligible for the small business deduction in the tax years 2019 and later are required to file Form T2 Schedule 7.