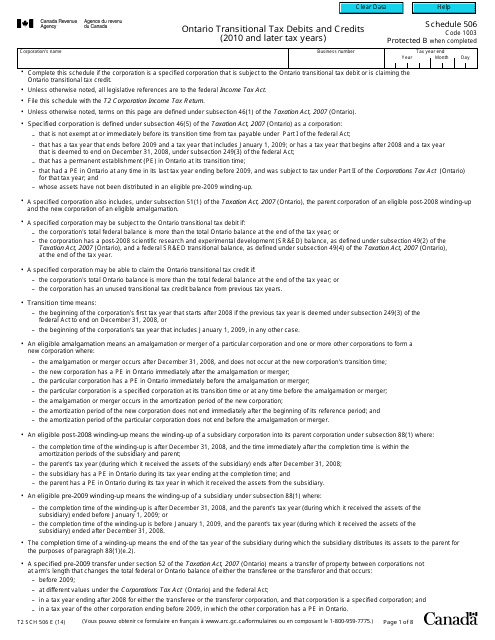

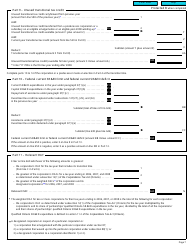

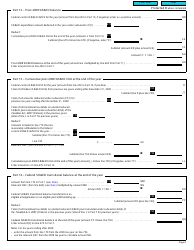

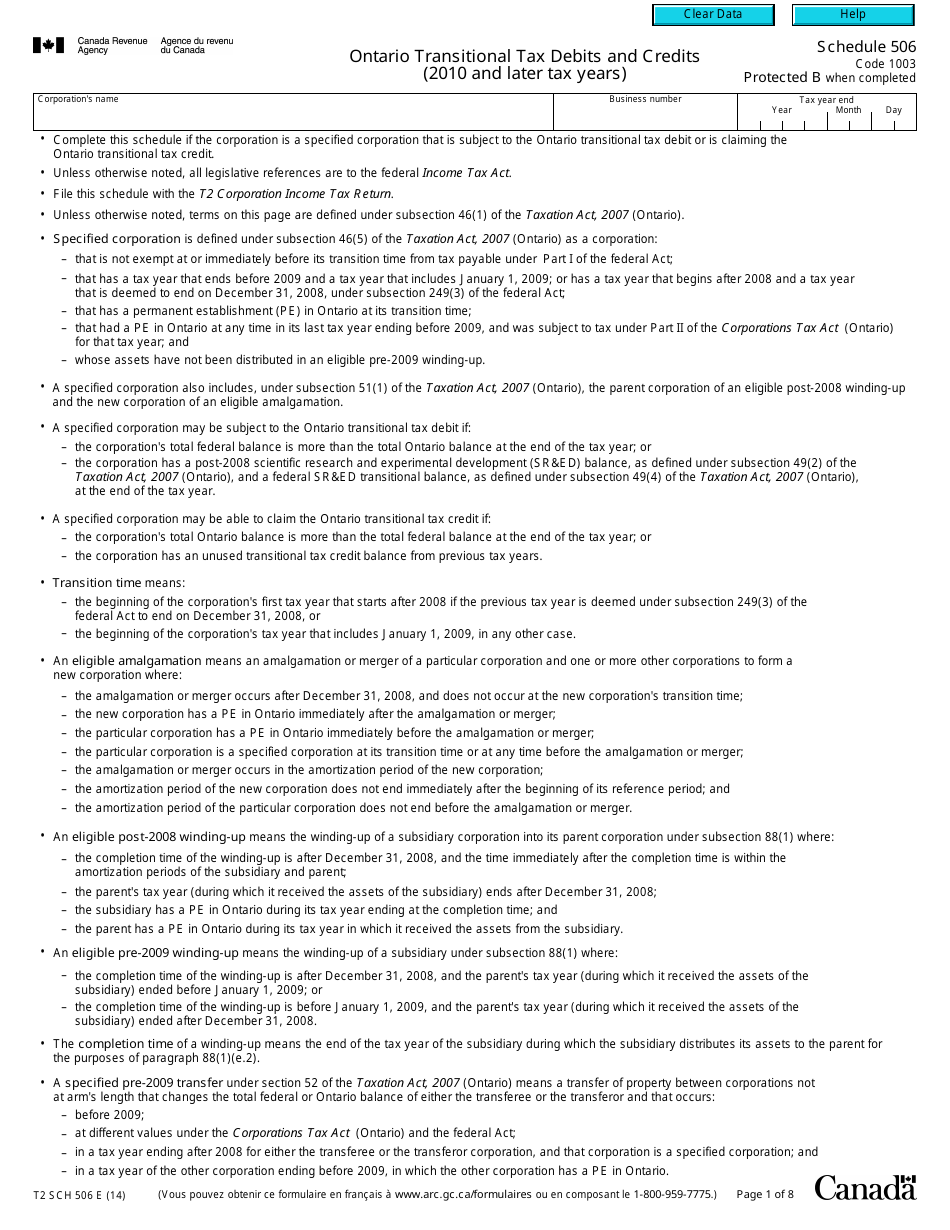

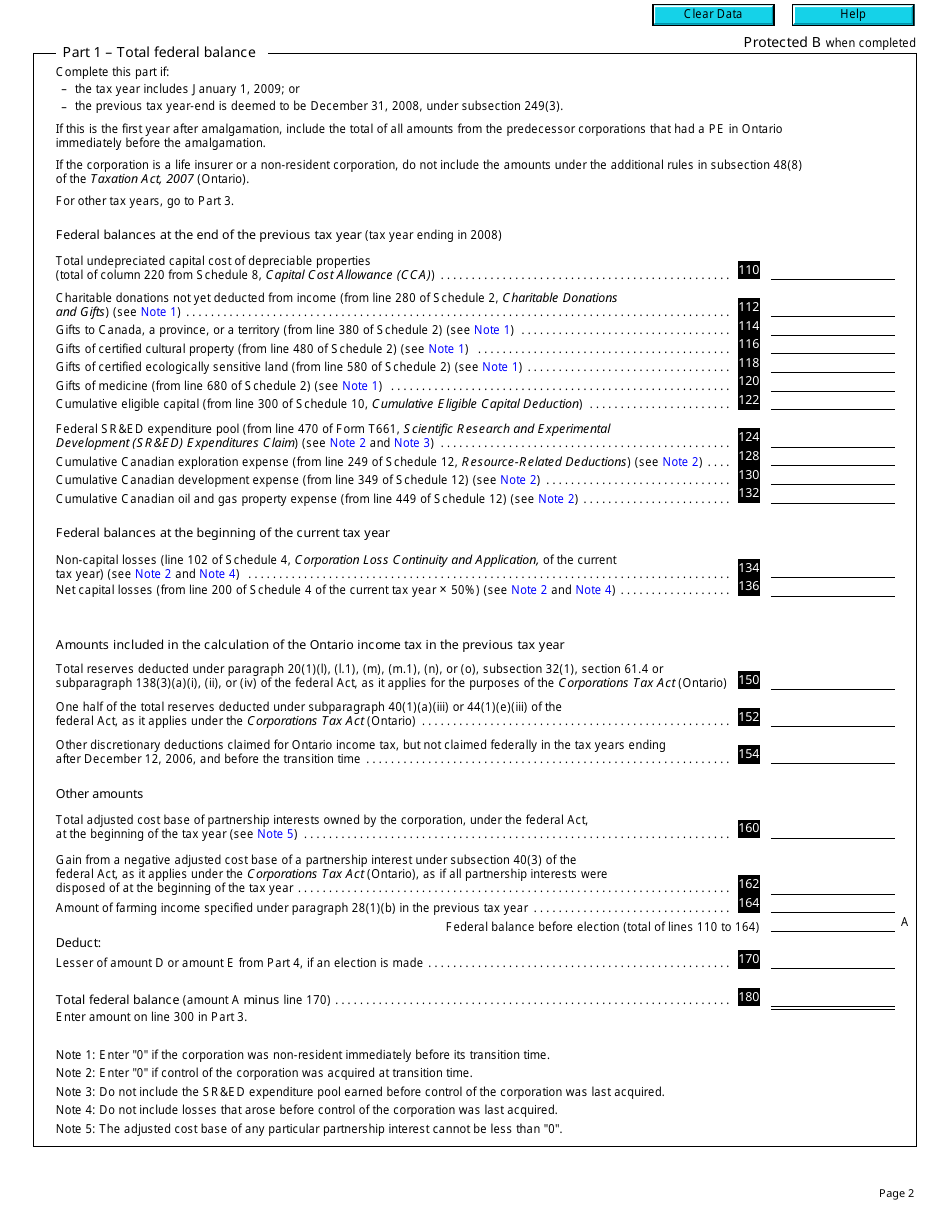

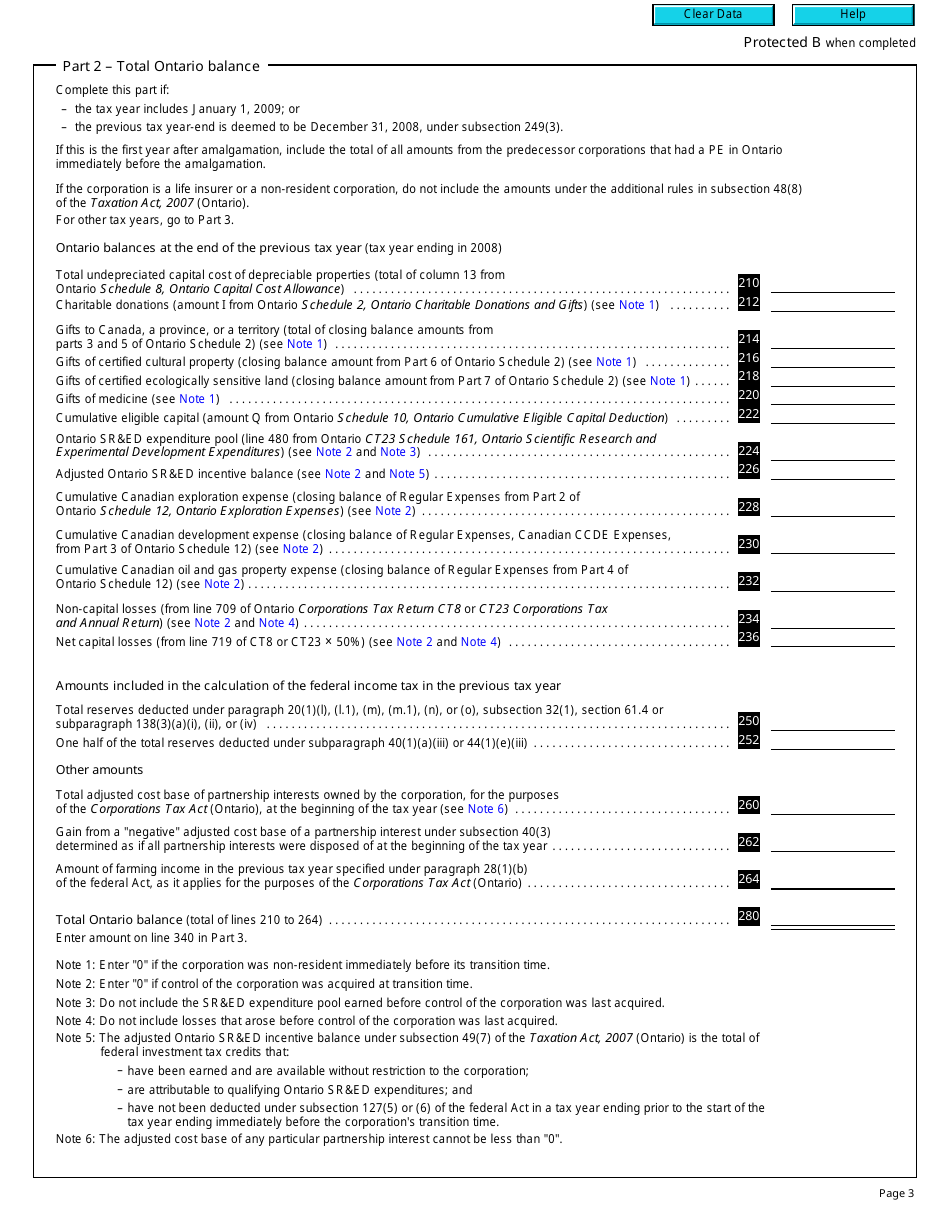

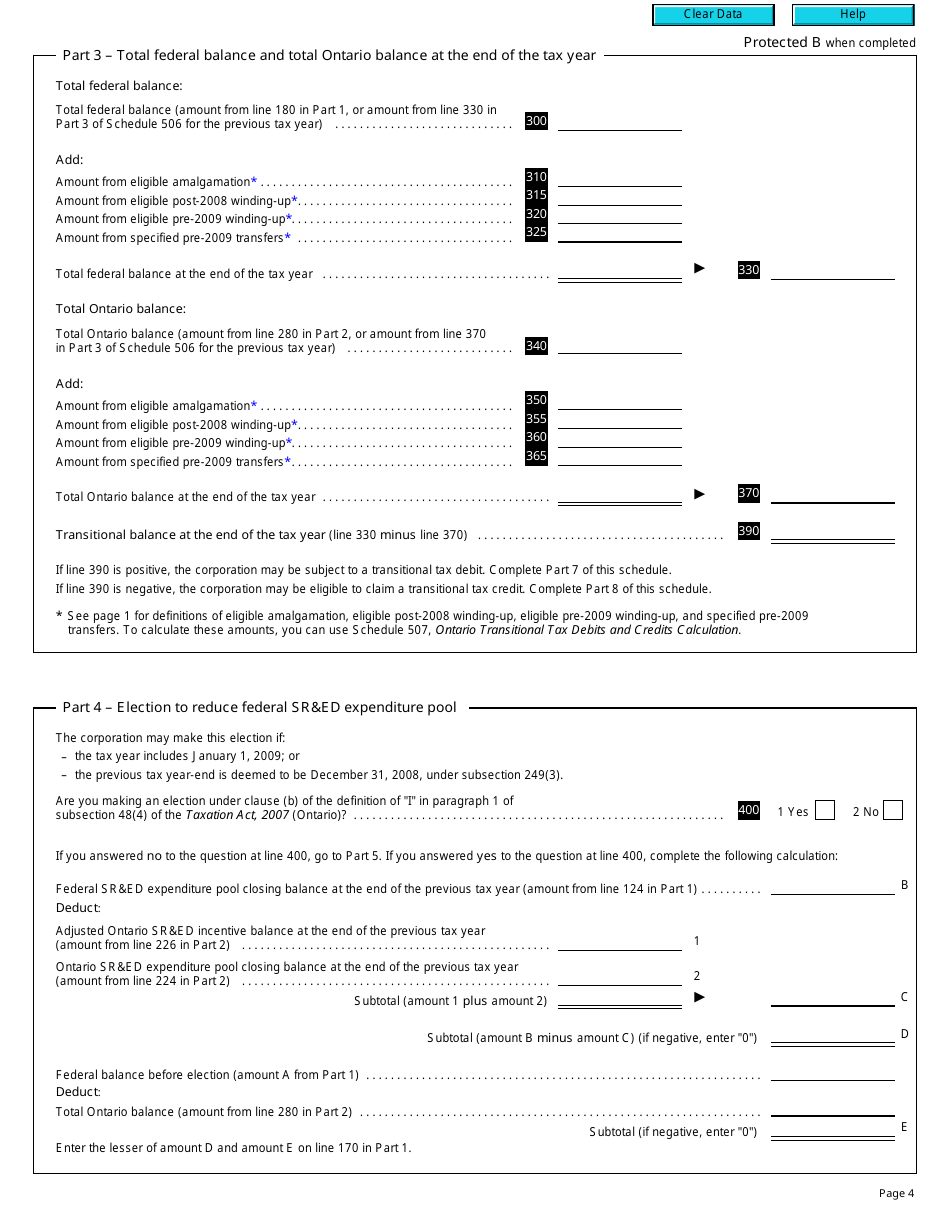

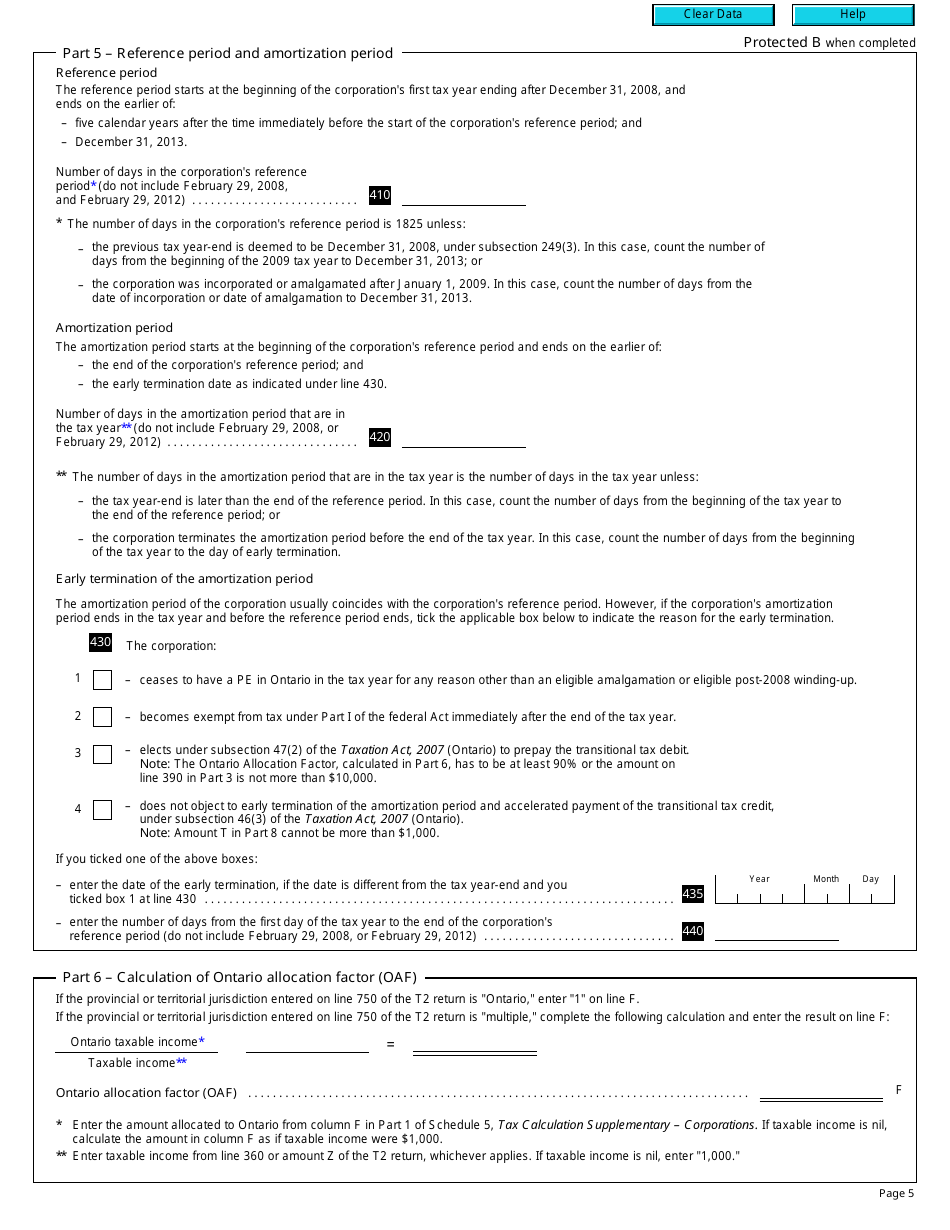

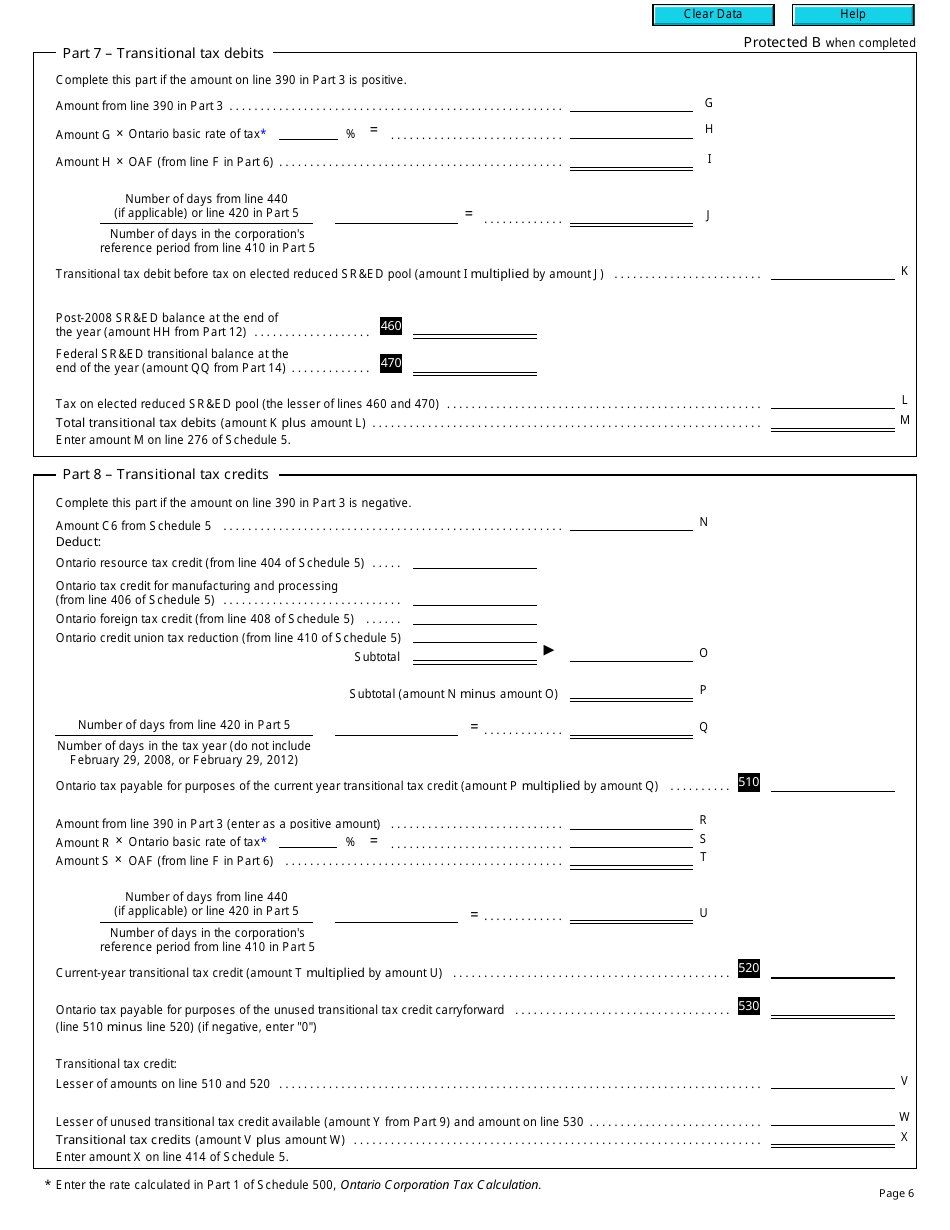

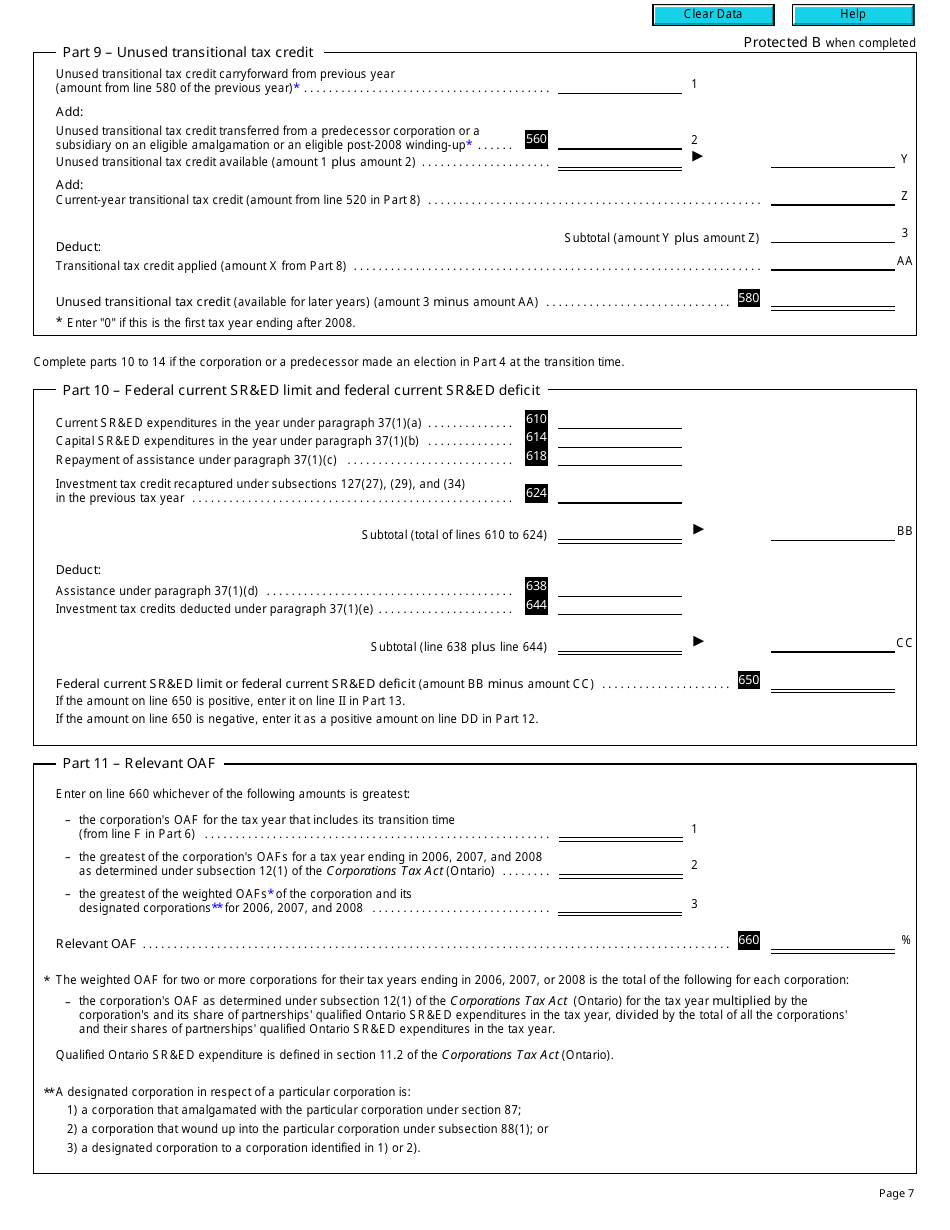

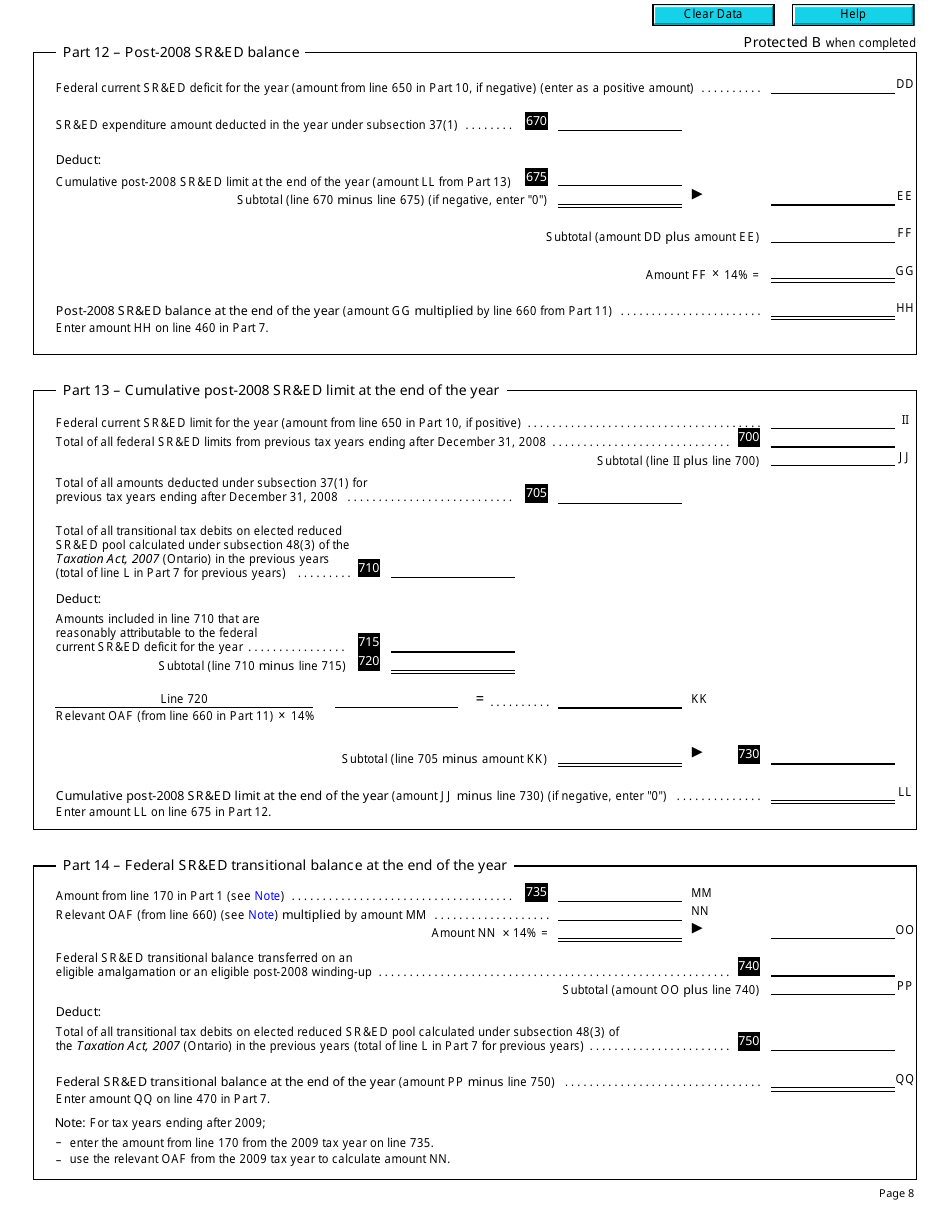

Form T2 Schedule 506 Ontario Transitional Tax Debits and Credits (2010 and Later Tax Years) - Canada

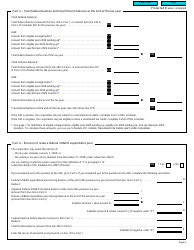

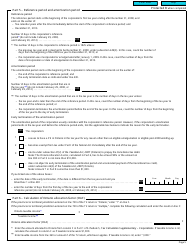

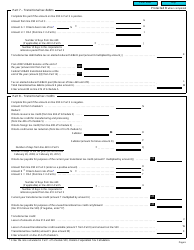

The Form T2 Schedule 506 Ontario Transitional Tax Debits and Credits is used in Canada for reporting any transitional tax debits and credits specific to the province of Ontario for the tax years from 2010 onwards.

The Form T2 Schedule 506 Ontario Transitional Tax Debits and Credits is filed by corporations or organizations that are subject to taxation in Ontario, Canada.

FAQ

Q: What is T2 Schedule 506?

A: T2 Schedule 506 is a form used in Canada for reporting Ontario Transitional Tax Debits and Credits.

Q: What are Ontario Transitional Tax Debits and Credits?

A: Ontario Transitional Tax Debits and Credits are adjustments to the tax liability of a corporation in Ontario.

Q: What tax years does T2 Schedule 506 cover?

A: T2 Schedule 506 covers tax years starting from 2010 and onwards.

Q: Who needs to file T2 Schedule 506?

A: Corporations that are subject to taxation in Ontario and have transitional tax debits or credits need to file T2 Schedule 506.

Q: Is there a deadline for filing T2 Schedule 506?

A: Yes, the deadline for filing T2 Schedule 506 is the same as the corporation's tax return filing deadline for the relevant tax year.