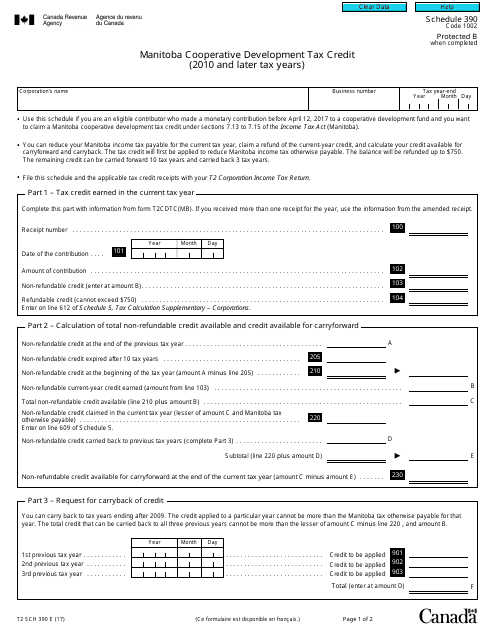

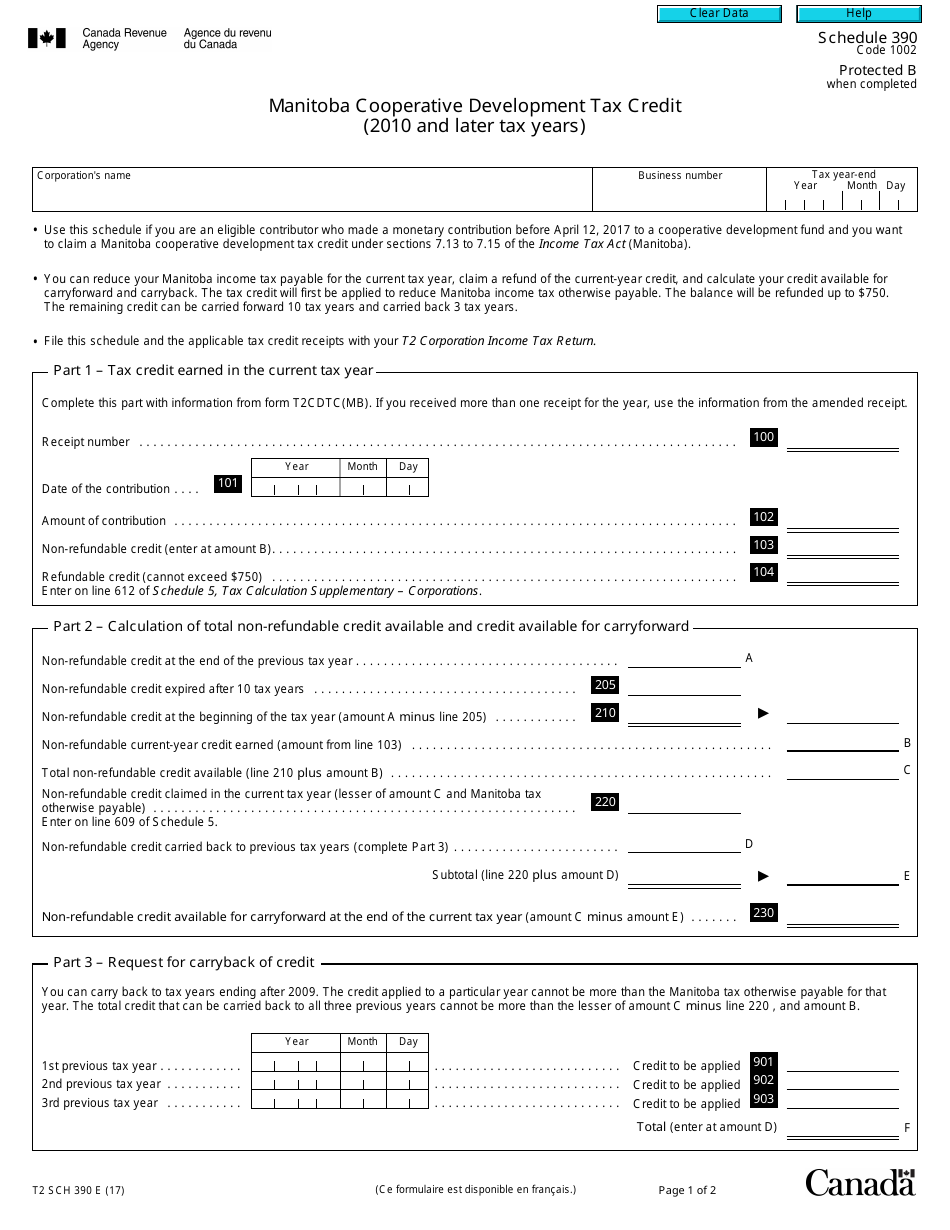

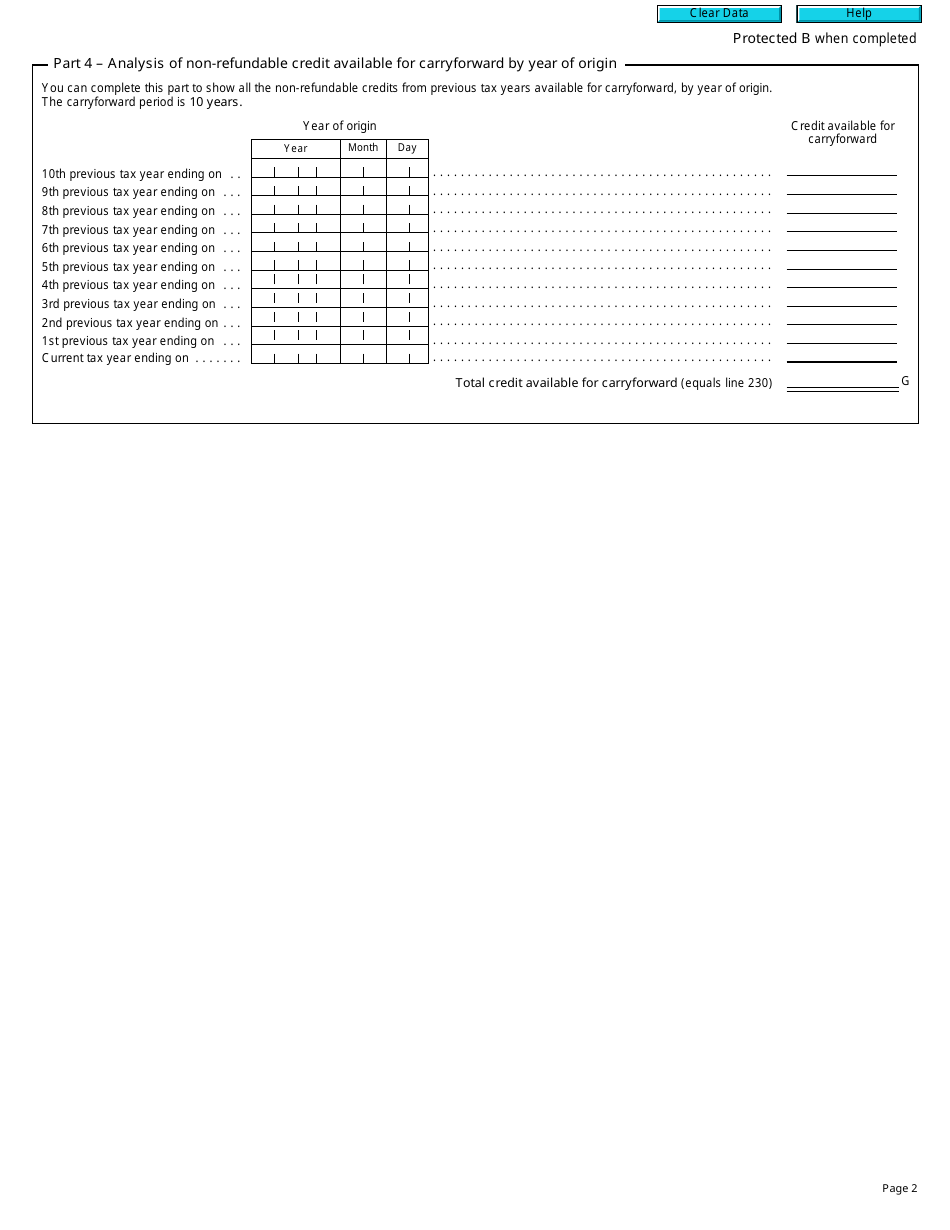

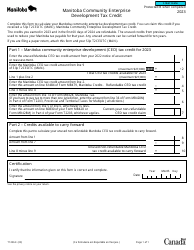

Form T2 Schedule 390 Manitoba Cooperative Development Tax Credit (2010 and Later Tax Years) - Canada

Form T2 Schedule 390 is used in Canada for claiming the Manitoba Cooperative Development Tax Credit for the tax years 2010 and onwards. It is a tax credit available to eligible corporations in Manitoba that invest in cooperative development activities.

The Form T2 Schedule 390 Manitoba Cooperative Development Tax Credit is filed by corporations that are eligible for this tax credit in Manitoba, Canada.

FAQ

Q: What is Form T2 Schedule 390?

A: Form T2 Schedule 390 is a tax form in Canada.

Q: What is the Manitoba Cooperative Development Tax Credit?

A: The Manitoba Cooperative Development Tax Credit is a tax credit available to cooperatives in Manitoba.

Q: Who can claim the Manitoba Cooperative Development Tax Credit?

A: Cooperatives in Manitoba can claim the Manitoba Cooperative Development Tax Credit.

Q: What are the requirements to qualify for the Manitoba Cooperative Development Tax Credit?

A: To qualify for the Manitoba Cooperative Development Tax Credit, a cooperative must meet certain criteria set by the government of Manitoba.

Q: What are the tax years covered by Form T2 Schedule 390?

A: Form T2 Schedule 390 covers the 2010 and later tax years.