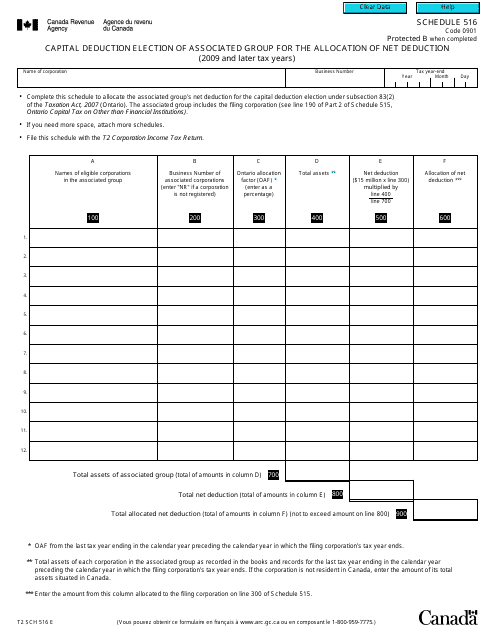

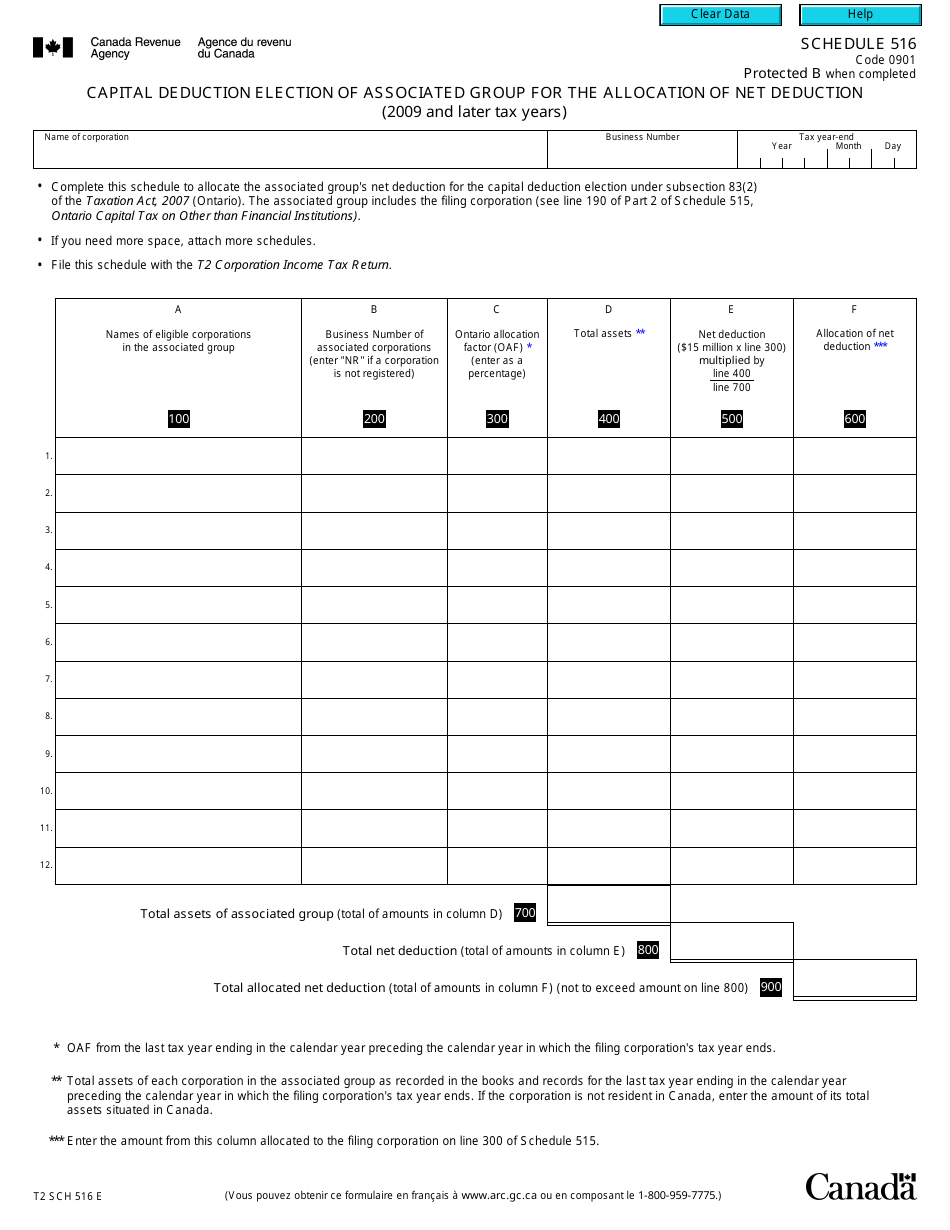

Form T2 Schedule 516 Capital Deduction Election of Associated Group for the Allocation of Net Deduction (2009 and Later Tax Years) - Canada

Form T2 Schedule 516 Capital Deduction Election of Associated Group for the Allocation of Net Deduction (2009 and Later Tax Years) in Canada is used to elect the allocation of net deductions within an associated group of corporations. It allows these groups to allocate capital deductions among the group members.

The Form T2 Schedule 516 Capital Deduction Election of Associated Group for the Allocation of Net Deduction (2009 and Later Tax Years) in Canada is filed by associated groups for the allocation of net deduction.

FAQ

Q: What is Form T2 Schedule 516?

A: Form T2 Schedule 516 is a tax form in Canada.

Q: What is the purpose of Form T2 Schedule 516?

A: The purpose of Form T2 Schedule 516 is to elect how net deductions are allocated among associated groups.

Q: Who needs to file Form T2 Schedule 516?

A: Companies in Canada that are part of an associated group and want to elect how net deductions are allocated need to file this form.

Q: What is a capital deduction?

A: A capital deduction is an allowable deduction on a company's tax return for certain capital expenses.

Q: What is an associated group?

A: An associated group is a group of corporations that are related to each other in terms of ownership or control.

Q: What is the benefit of making a capital deduction election?

A: Making a capital deduction election allows the associated group to allocate the deductions in a way that is most advantageous for tax purposes.

Q: What tax years does Form T2 Schedule 516 apply to?

A: Form T2 Schedule 516 applies to tax years starting from 2009 and onwards.

Q: Are there any deadlines for filing Form T2 Schedule 516?

A: The deadline for filing Form T2 Schedule 516 is the same as the deadline for filing the company's tax return.

Q: What should I do if I need help with Form T2 Schedule 516?

A: If you need help with Form T2 Schedule 516, you can contact the Canada Revenue Agency (CRA) for assistance.