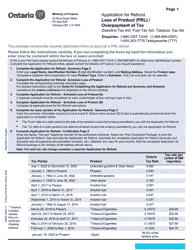

Instructions for Form 3207E Guide for Completing the Application for Refund Summary and Clear Fuel Schedule 2 Prl - Loss of Product / Overpayment of Tax - Ontario, Canada

The Instructions for Form 3207E guide individuals on how to complete the Application for Refund Summary and Clear Fuel Schedule 2 Prl - Loss of Product/Overpayment of Tax specifically for Ontario, Canada. It helps individuals understand the process of applying for a refund when there has been a loss of product or overpayment of tax related to clear fuel.

FAQ

Q: What is Form 3207E?

A: Form 3207E is an application for refund summary and clear fuel schedule for loss of product/overpayment of tax in Ontario, Canada.

Q: Who should complete Form 3207E?

A: Those who have experienced loss of product or made an overpayment of tax on clear fuel in Ontario, Canada should complete Form 3207E.

Q: What is the purpose of Form 3207E?

A: The purpose of Form 3207E is to apply for a refund for the loss of product or overpayment of tax on clear fuel in Ontario, Canada.

Q: What information is required to complete Form 3207E?

A: To complete Form 3207E, you need to provide details such as your name, address, contact information, product information, quantity, and reasons for the claim.

Q: Is there a deadline for submitting Form 3207E?

A: Yes, there is a deadline for submitting Form 3207E. You should submit the form within four years from the end of the calendar year in which the claim arises.

Q: What supporting documents need to be included with Form 3207E?

A: You should include supporting documents such as invoices, receipts, or any other relevant documents that substantiate your claim with Form 3207E.

Q: How long does it take to process Form 3207E?

A: The processing time for Form 3207E may vary. It is recommended to allow several weeks for the Ministry of Finance to review and process your refund application.

Q: Can I submit Form 3207E electronically?

A: No, Form 3207E cannot be submitted electronically. It must be submitted by mail or in person to the Ontario Ministry of Finance.