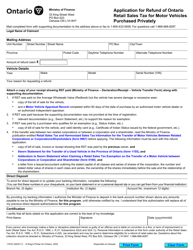

Form 3225E Guide for Completing the Application for Refund Summary and Schedule 12 Tes - Tax Exempt Sales - Export out of Ontario - Ontario, Canada

Form 3225E Guide is a document provided by the Ontario, Canada government to assist individuals or businesses in correctly filling out the Application for Refund Summary and Schedule 12 TES - Tax Exempt Sales exported out of Ontario. This document is important for businesses making sales or providing services that are tax-exempt and exported out of Ontario as it outlines the specific guidelines and procedures for requesting a tax refund. It helps to ensure the accuracy and completeness of the information provided, which is crucial for the government to process tax refunds effectively and efficiently. If the form is not filled out correctly, it could lead to delays or denial of tax refunds.

The Form 3225E Guide for Completing the Application for Refund Summary and Schedule 12 Tes - Tax Exempt Sales - Export out of Ontario is filed by any business or individual who has made a transaction that qualifies as a tax-exempt sale for export out of Ontario, Canada. This generally includes companies that have sold goods or services to customers outside of Canada and need to apply for a refund of sales tax due to the transaction being classified as tax-exempt. The form provides guidance on how to complete the application and must be filled out accurately and submitted to the Canada Revenue Agency for processing.

FAQ

Q: What is Form 3225E?

A: Form 3225E is an application for refund summary that individuals or businesses in Ontario, Canada, fill out to claim a refund for tax paid on certain goods or services that they later exported out of the province. It is also known as Schedule 12, or Tax Exempt Sales - Export out of Ontario.

Q: Who can use Form 3225E?

A: Form 3225E is for individuals or businesses in Ontario, Canada who have paid tax on certain goods or services that were later exported out of the province. This may include manufacturers, producers, wholesalers, and service providers.

Q: How does Form 3225E - Tax Exempt Sales - Export function?

A: Form 3225E serves as a declaration of taxable goods or services sold by the claimant and later exported out of Ontario — thus qualifying for a tax refund. The form requires detailed records of sales and exports and must be filed with the Ontario Ministry of Finance.

Q: What information is necessary to complete Form 3225E - Schedule 12?

A: Information needed to complete Form 3225E includes, but is not limited to: the claimant's name and contact details, description of goods or services sold, amount of tax paid, and details of the export like date, destination, and shipping documentation.

Q: When should I use Form 3225E?

A: You should use Form 3225E if you have paid tax on goods or services in Ontario and then exported these goods or services out of the province. The form lets you claim a refund for the provincial tax you paid on these exported items.