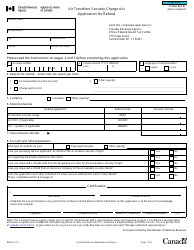

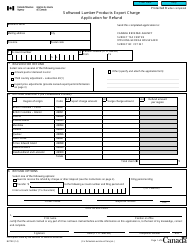

Instructions for Form 0549E Application for Refund Auxiliary Power Take off (Pto) Equipment (Pto Activity Prior to July 1, 2017) - Ontario, Canada

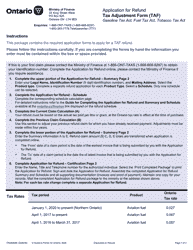

Form 0549E, titled "Application for Refund Auxiliary Power Take off (PTO) Equipment (PTO Activity Prior to July 1, 2017)" is a document provided by the government of Ontario, Canada. This form is used when individuals or companies are seeking a tax refund related to the use of Auxiliary Power Take Off (PTO) equipment. PTO equipment generally refers to devices used in vehicles that provide power for tools or machinery.

For activities occurring before July 1, 2017, individuals or companies must fill out this form with relevant details about the equipment, such as its purchase date, cost, and the nature of its use. After the form is completed, it is submitted to the Ontario Ministry of Revenue. If approved, a tax refund may be provided. However, it's crucial to note that this particular form (0549E) is specifically for PTO activities that happened before July 1, 2017. For later activities, a different form may be necessary.

The Instructions for Form 0549E Application for Refund Auxiliary Power Take Off (PTO) Equipment (PTO Activity Prior to July 1, 2017) - Ontario, Canada are filed by residents or businesses in Ontario who purchased or paid the tax on equipment or vehicles that are equipped with auxiliary power take off (PTO). This includes any resident or business who were eligible and had PTO activity prior to July 1, 2017. The form is specifically provided and processed by the Ministry of Revenue in Ontario, Canada.

FAQ

Q: What is Form 0549E Application for Refund Auxiliary Power Take off (PTO) Equipment?

A: Form 0549E is a document required to apply for a refund of Auxiliary Power Take-off (PTO) equipment in Ontario, Canada. It is specifically for PTO activity prior to July 1, 2017.

Q: What is Auxiliary Power Take off (PTO) Equipment?

A: Auxiliary Power Take-off (PTO) equipment is machinery that transfers power from a vehicle's engine or transmission to operate auxiliary equipment, such as a hydraulic pump or a gearbox.

Q: Who can apply for the refund via Form 0549E?

A: Those who owned or used Auxiliary PTO equipment in Ontario, Canada before July 1, 2017 can apply for a refund using Form 0549E.

Q: How can I apply for a refund using Form 0549E?

A: You must complete and submit Form 0549E to apply for refund. Be sure to include the necessary information about the Auxiliary PTO equipment and its use prior to July 1, 2017, and the reason for the refund claim.

Q: What information is needed to complete Form 0549E?

A: The information required for completing Form 0549E typically includes personal information, equipment details, and a detailed explanation of the PTO activity prior to July 1, 2017.