Instructions for Form 3215E, 0547E Application for Refund Summary and Schedule 2 Tes - Tax Exempt Deliveries, in Bulk, to First Nations Individuals, Bands, Band-Empowered Entities and Tribal Councils on a Reserve for Their Exclusive Use - Ontario, Canada

FAQ

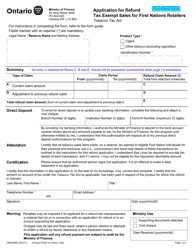

Q: What is Form 3215E, 0547E?

A: Form 3215E, 0547E is an application for refund summary and Schedule 2 Tes - Tax Exempt Deliveries, in Bulk, to First Nations Individuals, Bands, Band-Empowered Entities and Tribal Councils on a Reserve for Their Exclusive Use in Ontario, Canada.

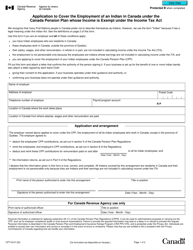

Q: Who is eligible to use this form?

A: First Nations Individuals, Bands, Band-Empowered Entities, and Tribal Councils on a Reserve in Ontario, Canada are eligible to use this form.

Q: What is the purpose of this form?

A: The purpose of this form is to apply for a refund summary and Schedule 2 Tes for tax-exempt deliveries in bulk to First Nations Individuals, Bands, Band-Empowered Entities, and Tribal Councils on a Reserve for their exclusive use in Ontario, Canada.

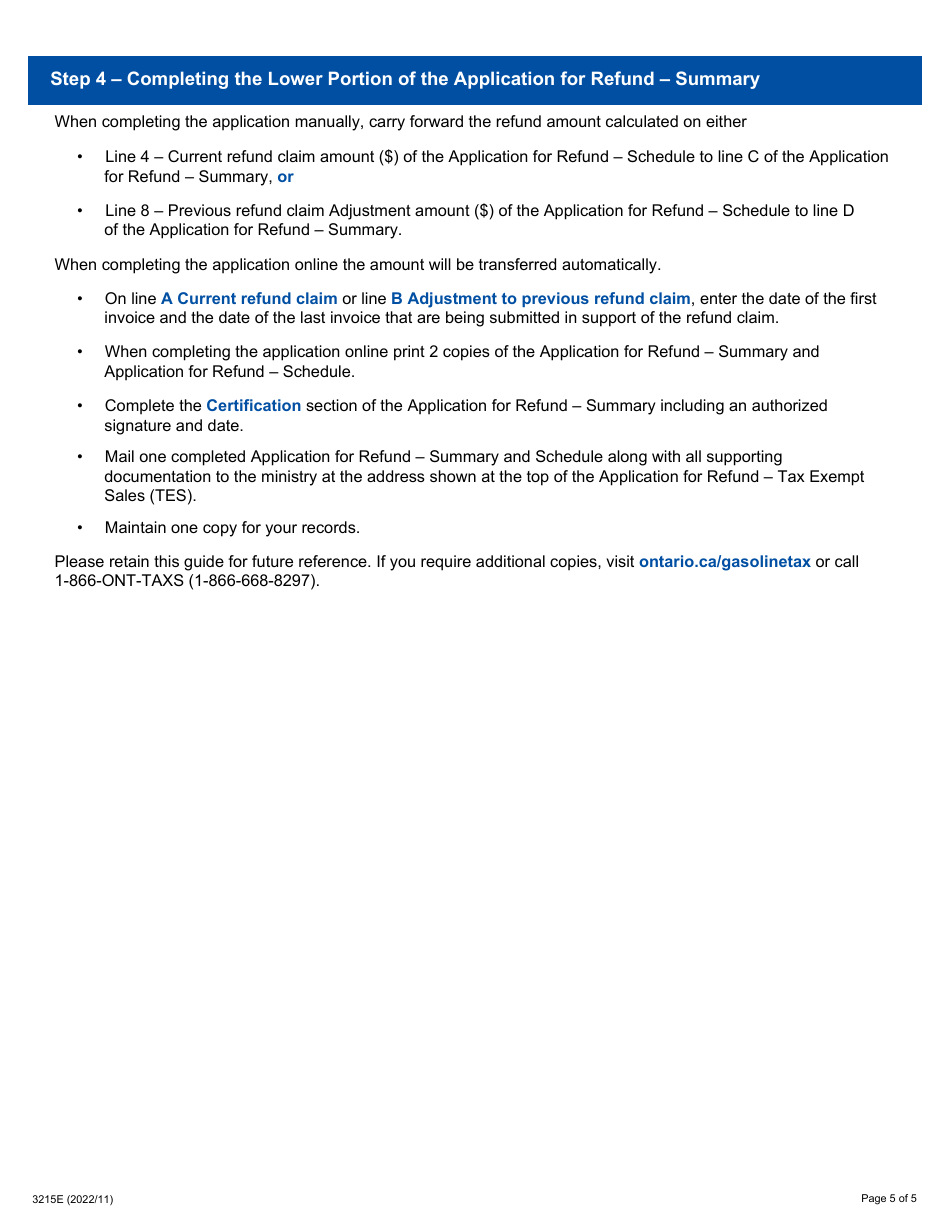

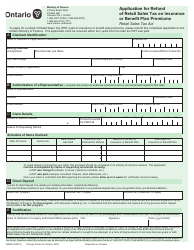

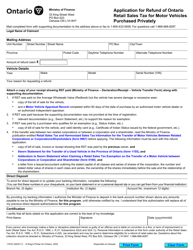

Q: What information is required on this form?

A: This form requires information such as the applicant's name, address, contact information, delivery details, and supporting documentation.

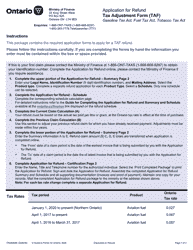

Q: Are there any additional forms or documents required?

A: Yes, there may be additional forms or documents required depending on the specific situation. The instructions for Form 3215E, 0547E will provide more information on any additional requirements.

Q: How long does it take to process this application?

A: The processing time for this application can vary. It is recommended to allow sufficient time for processing, especially if a refund is needed by a specific date.

Q: Who should I contact for more information or assistance?

A: For more information or assistance, you can contact the Canada Revenue Agency directly or refer to the instructions for Form 3215E, 0547E.