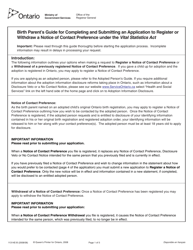

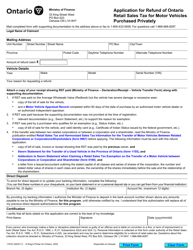

Form 3220E Guide for Completing the Application for Refund Summary and Schedule 7 Tes - Tax Exempt Sales to Consumers - Ontario, Canada

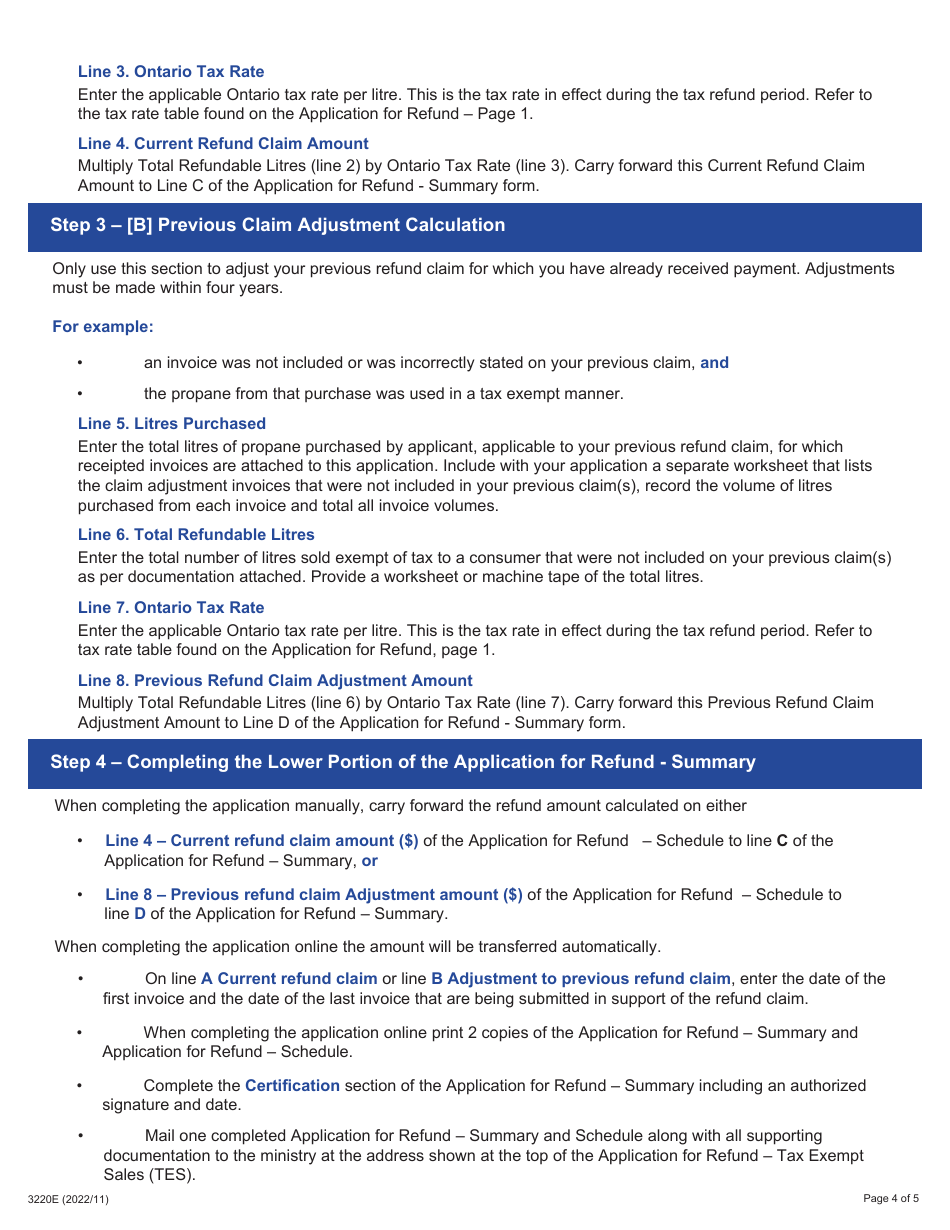

Form 3220E is a guide for completing the Application for Refund Summary and Schedule 7 Tes in Ontario, Canada. This form is used for claiming a refund of the Retail Sales Tax (RST) paid on purchases that are exempt from tax. It specifically applies to tax-exempt sales made to consumers in Ontario.

The Form 3220E Guide for Completing the Application for Refund Summary and Schedule 7 Tes - Tax Exempt Sales to Consumers in Ontario, Canada is typically filed by businesses or individuals who have made tax-exempt sales to consumers in Ontario.

FAQ

Q: What is Form 3220E?

A: Form 3220E is a guide for completing the application for refund summary and Schedule 7 Tes.

Q: What is the purpose of Form 3220E?

A: The purpose of Form 3220E is to provide instructions on how to complete the application for refund summary and Schedule 7 Tes.

Q: What is Schedule 7 Tes?

A: Schedule 7 Tes is a tax form specifically related to tax exempt sales to consumers in Ontario, Canada.

Q: Who should use Form 3220E?

A: Form 3220E should be used by individuals or businesses that need to complete the application for refund summary and Schedule 7 Tes.

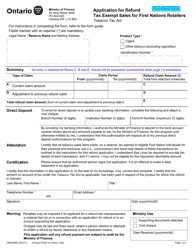

Q: What does the application for refund summary entail?

A: The application for refund summary is a form where details of tax exempt sales to consumers in Ontario are recorded.

Q: What information is needed to complete Form 3220E?

A: To complete Form 3220E, you will need information about your tax exempt sales to consumers in Ontario.

Q: Are tax exempt sales to consumers taxable in Ontario?

A: No, tax exempt sales to consumers in Ontario are not subject to taxation.