Form 3223E Guide for Completing the Application for Refund Summary and Schedule 10 Tes - Tax Exempt Sales " Export out of Ontario - Ontario, Canada

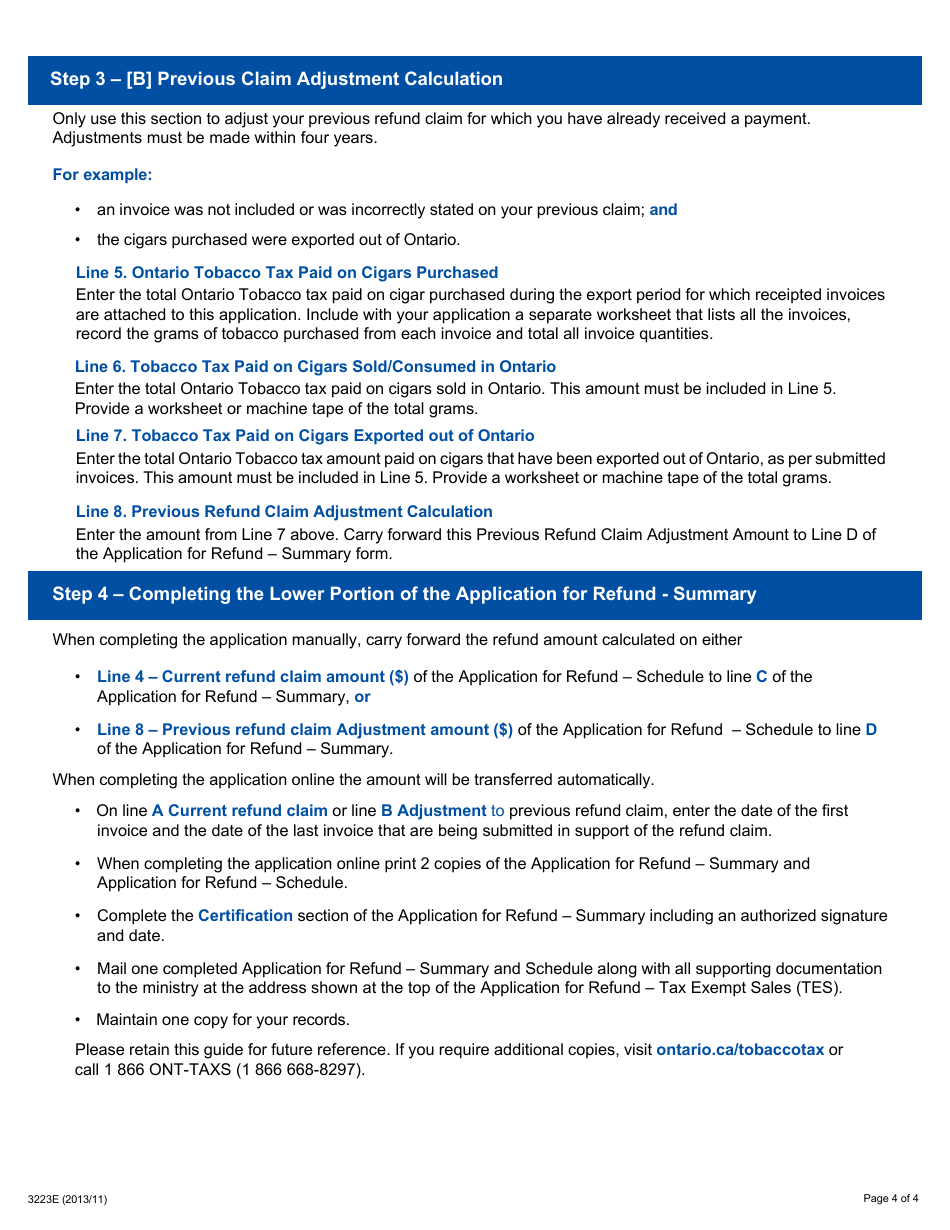

Form 3223E, Guide for Completing the Application for Refund Summary and Schedule 10 Tes - Tax Exempt Sales " Export out of Ontario - Ontario, Canada, is used for applying for a refund of taxes paid on tax-exempt sales made when exporting goods out of Ontario, Canada.

The Form 3223E is filed by Ontario, Canada residents who are applying for a refund for tax-exempt sales made outside of Ontario.

FAQ

Q: What is Form 3223E?

A: Form 3223E is the Application for Refund Summary and Schedule 10 Tes - Tax Exempt Sales for export out of Ontario, Canada.

Q: What is the purpose of Form 3223E?

A: The purpose of Form 3223E is to apply for a refund for tax exempt sales made for export out of Ontario, Canada.

Q: What is Schedule 10 Tes?

A: Schedule 10 Tes is a schedule included in Form 3223E that provides details of the tax exempt sales for export.

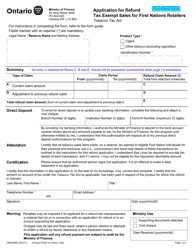

Q: What is the process of completing Form 3223E?

A: The process of completing Form 3223E involves providing the necessary information about the tax exempt sales, including sales amounts, purchaser information, and export details.

Q: Who can use Form 3223E?

A: Form 3223E can be used by businesses or individuals who have made tax exempt sales for export out of Ontario, Canada.

Q: What should I do with the completed Form 3223E?

A: Once completed, Form 3223E should be submitted to the CRA for processing and consideration of the refund.

Q: Is there a deadline for submitting Form 3223E?

A: Yes, Form 3223E should be submitted within four years from the end of the year in which the tax exempt sales were made.

Q: Are there any supporting documents required with Form 3223E?

A: Yes, supporting documents such as invoices and proof of export may be required to accompany Form 3223E.

Q: How long does it take to process a refund application with Form 3223E?

A: The processing time for a refund application with Form 3223E can vary, but it generally takes several weeks to several months.