Form 3222E Guide for Completing the Application for Refund Summary and Schedule 9 Tes - Tax Exempt Sales - Export out of Ontario - Ontario, Canada

Form 3222E is a guide that provides instructions for completing the Application for Refund Summary and Schedule 9 Tes. This form is specifically used for claiming tax exemptions on sales made to customers outside of Ontario, Canada.

The Form 3222E is filed by businesses or individuals seeking a refund for tax-exempt sales on exports out of Ontario, Canada.

FAQ

Q: What is Form 3222E?

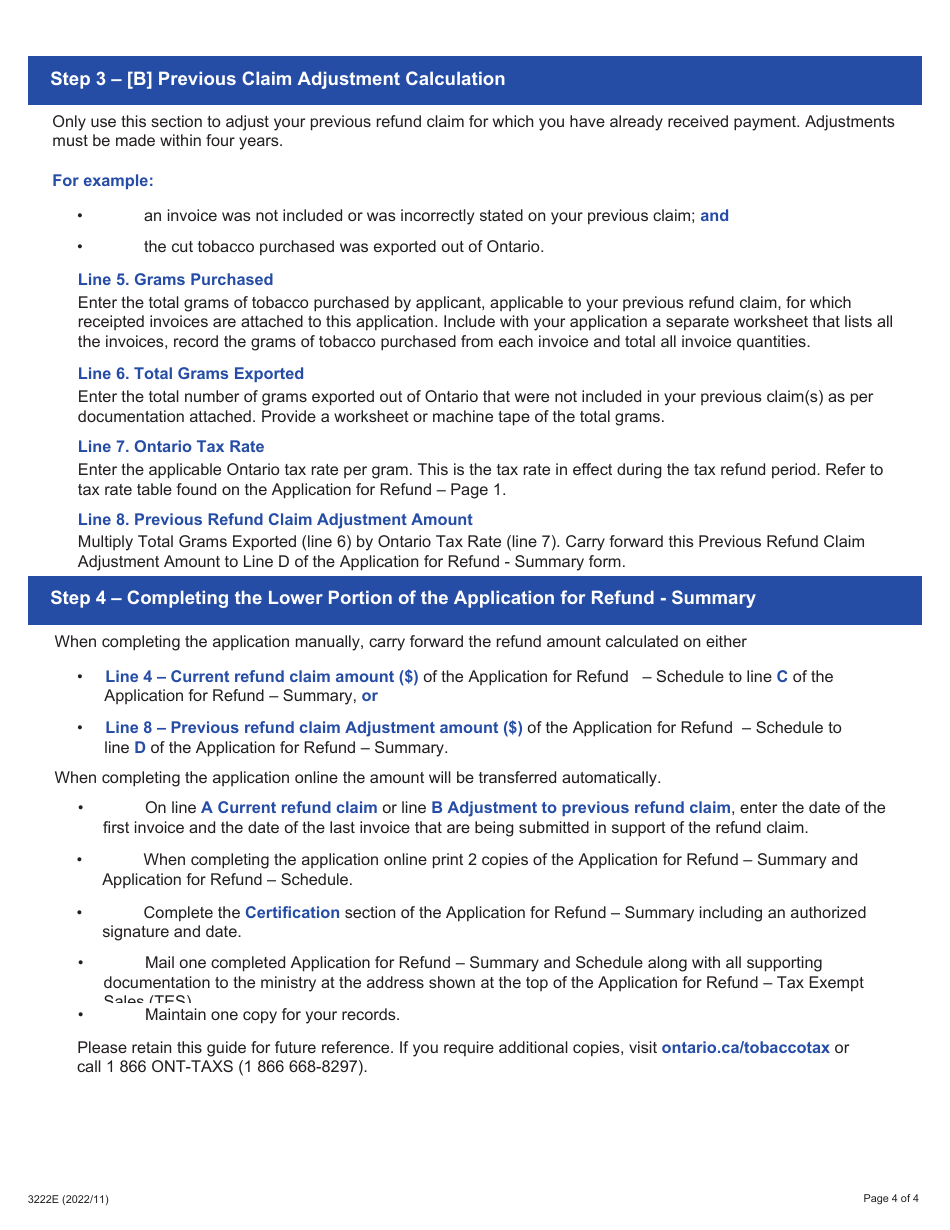

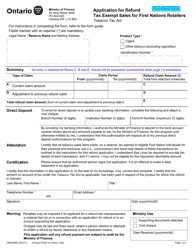

A: Form 3222E is a guide for completing the application for refund summary and Schedule 9.

Q: What is the purpose of Form 3222E?

A: The purpose of Form 3222E is to apply for a refund of tax exempt sales for exports out of Ontario, Canada.

Q: Who should use Form 3222E?

A: Form 3222E should be used by individuals or businesses who have made tax exempt sales that were exported out of Ontario, Canada.

Q: What is Schedule 9?

A: Schedule 9 is a part of the application for refund summary that specifically addresses tax exempt sales for exports out of Ontario, Canada.

Q: Are there any other documents or forms required?

A: Yes, along with Form 3222E, you may need to provide supporting documents such as invoices and receipts to substantiate your claim for a refund.

Q: What is the deadline to submit Form 3222E?

A: The deadline to submit Form 3222E depends on the specific tax period and should be verified with the Ontario Ministry of Finance.

Q: How long does it take to process a refund application?

A: The processing time for a refund application can vary, but it is typically within a few weeks to a couple of months.

Q: Is there a fee to submit Form 3222E?

A: There is no fee associated with submitting Form 3222E.