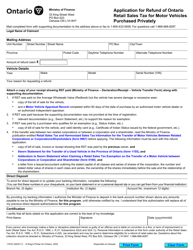

Form 3216E Guide for Completing the Application for Refund Summary and Schedule 3 Tes - Tax Exempt Sales - Export to Quebec - Ontario, Canada

Form 3216E is filed by businesses who want to claim a refund for tax-exempt sales when exporting goods to Quebec and Ontario, Canada.

FAQ

Q: What is Form 3216E?

A: Form 3216E is the Application for Refund Summary and Schedule 3 Tes - Tax Exempt Sales - Export to Quebec - Ontario, Canada.

Q: What is the purpose of Form 3216E?

A: The purpose of Form 3216E is to claim a refund for tax exempt sales and exports to Quebec and Ontario, Canada.

Q: Who should complete Form 3216E?

A: Anyone who wants to claim a refund for tax exempt sales and exports to Quebec and Ontario, Canada should complete Form 3216E.

Q: What information do I need to complete Form 3216E?

A: To complete Form 3216E, you will need information about your tax exempt sales and exports to Quebec and Ontario, Canada.

Q: Are there any guidelines for completing Form 3216E?

A: Yes, there is a guide available to help you complete Form 3216E. It is called the Guide for Completing the Application for Refund Summary and Schedule 3 Tes - Tax Exempt Sales - Export to Quebec - Ontario, Canada.

Q: Can I claim a refund for tax exempt sales and exports to other provinces?

A: No, Form 3216E is specifically for claiming a refund for tax exempt sales and exports to Quebec and Ontario, Canada.

Q: Is there a deadline for submitting Form 3216E?

A: Yes, there is a deadline for submitting Form 3216E. The specific deadline can be found in the guide.

Q: How long does it take to receive a refund after submitting Form 3216E?

A: The processing time for refunds may vary, but it typically takes several weeks to receive a refund after submitting Form 3216E.

Q: Can I submit Form 3216E electronically?

A: Yes, you can submit Form 3216E electronically if the tax authority provides that option.