This version of the form is not currently in use and is provided for reference only. Download this version of

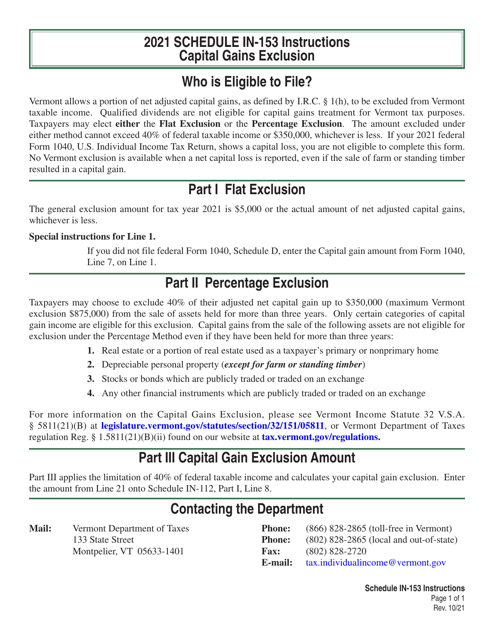

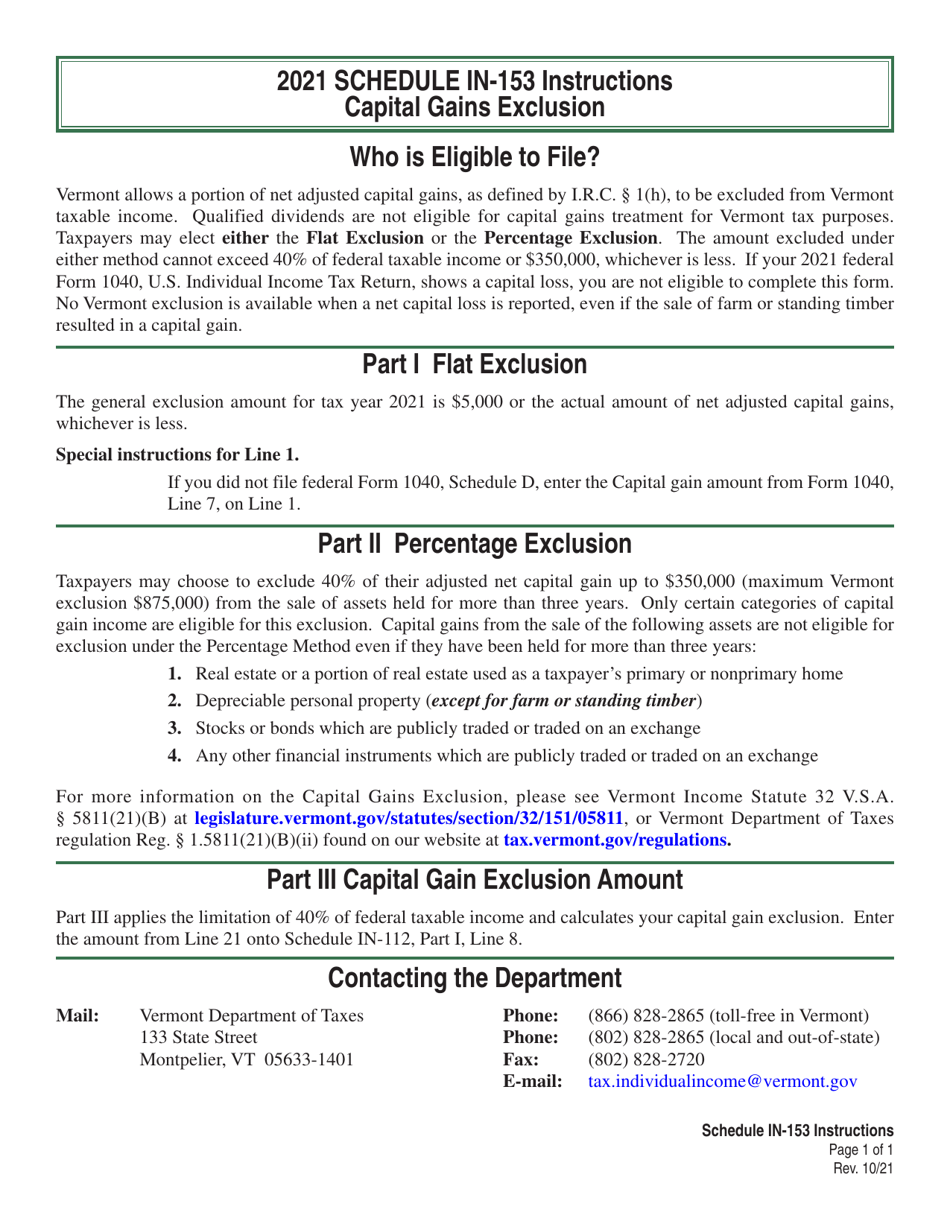

Instructions for Schedule IN-153

for the current year.

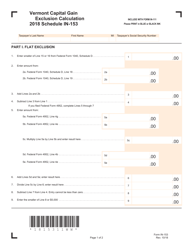

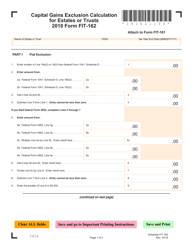

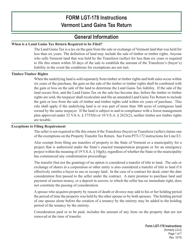

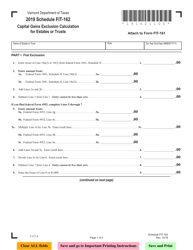

Instructions for Schedule IN-153 Vermont Capital Gain Exclusion Calculation - Vermont

This document contains official instructions for Schedule IN-153 , Vermont Capital Gain Exclusion Calculation - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Schedule IN-153?

A: Schedule IN-153 is a form used in Vermont to calculate the capital gain exclusion.

Q: What is the purpose of Schedule IN-153?

A: The purpose of Schedule IN-153 is to determine the amount of capital gain that may be excluded from Vermont income tax.

Q: Who needs to file Schedule IN-153?

A: Any Vermont resident who has realized a capital gain and wishes to claim the capital gain exclusion must file Schedule IN-153.

Q: How do I calculate the capital gain exclusion?

A: To calculate the capital gain exclusion, you will need to fill in the appropriate sections of Schedule IN-153, which include details about the sale of the property, the basis of the property, and the exclusions available.

Q: What types of exclusions are available?

A: There are several exclusions available, including the principal residence exclusion, the small business stock exclusion, and the farm property exclusion. The specific exclusions and their requirements are outlined in Schedule IN-153.

Q: When is the deadline to file Schedule IN-153?

A: The deadline to file Schedule IN-153 is the same as the deadline for filing your Vermont income tax return, which is typically April 15th, or the next business day if it falls on a weekend or holiday.

Instruction Details:

- This 1-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.