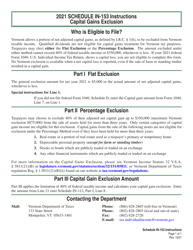

Instructions for Form IN-111 Schedule IN-153 Vermont Capital Gain Exclusion Calculation - Vermont

This document contains official instructions for Form IN-111 Schedule IN-153, Vermont Capital Gain Exclusion Calculation - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is Form IN-111?

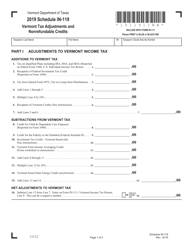

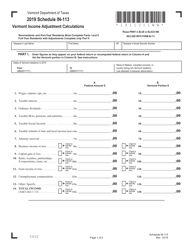

A: Form IN-111 is a tax form used in Vermont to calculate income tax.

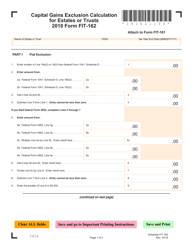

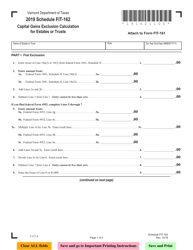

Q: What is Schedule IN-153?

A: Schedule IN-153 is a specific schedule within Form IN-111 used to calculate the Vermont Capital Gain Exclusion.

Q: What is the Vermont Capital Gain Exclusion?

A: The Vermont Capital Gain Exclusion is a tax benefit that allows Vermont residents to exclude a portion of their capital gains from their taxable income.

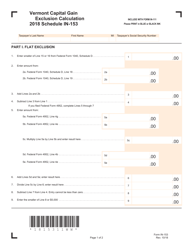

Q: How do I calculate the Vermont Capital Gain Exclusion?

A: You can calculate the Vermont Capital Gain Exclusion using Schedule IN-153 on Form IN-111. The schedule provides instructions and worksheets to help you determine the amount of the exclusion.

Q: Who is eligible for the Vermont Capital Gain Exclusion?

A: Vermont residents who meet certain criteria are eligible for the Capital Gain Exclusion. Please refer to the instructions on Form IN-111 for more details.

Q: Are there any other requirements or forms related to the Vermont Capital Gain Exclusion?

A: To claim the Vermont Capital Gain Exclusion, you may need to provide additional documentation or complete other forms. Please review the instructions on Form IN-111 for the complete requirements.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.