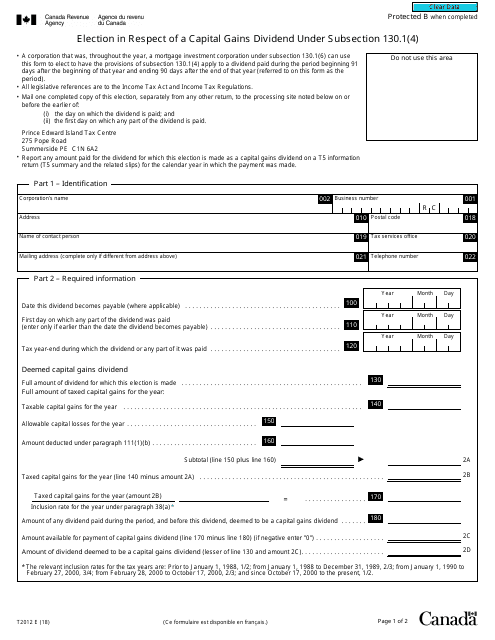

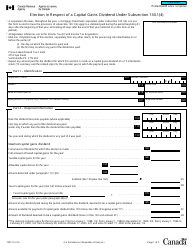

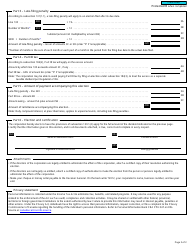

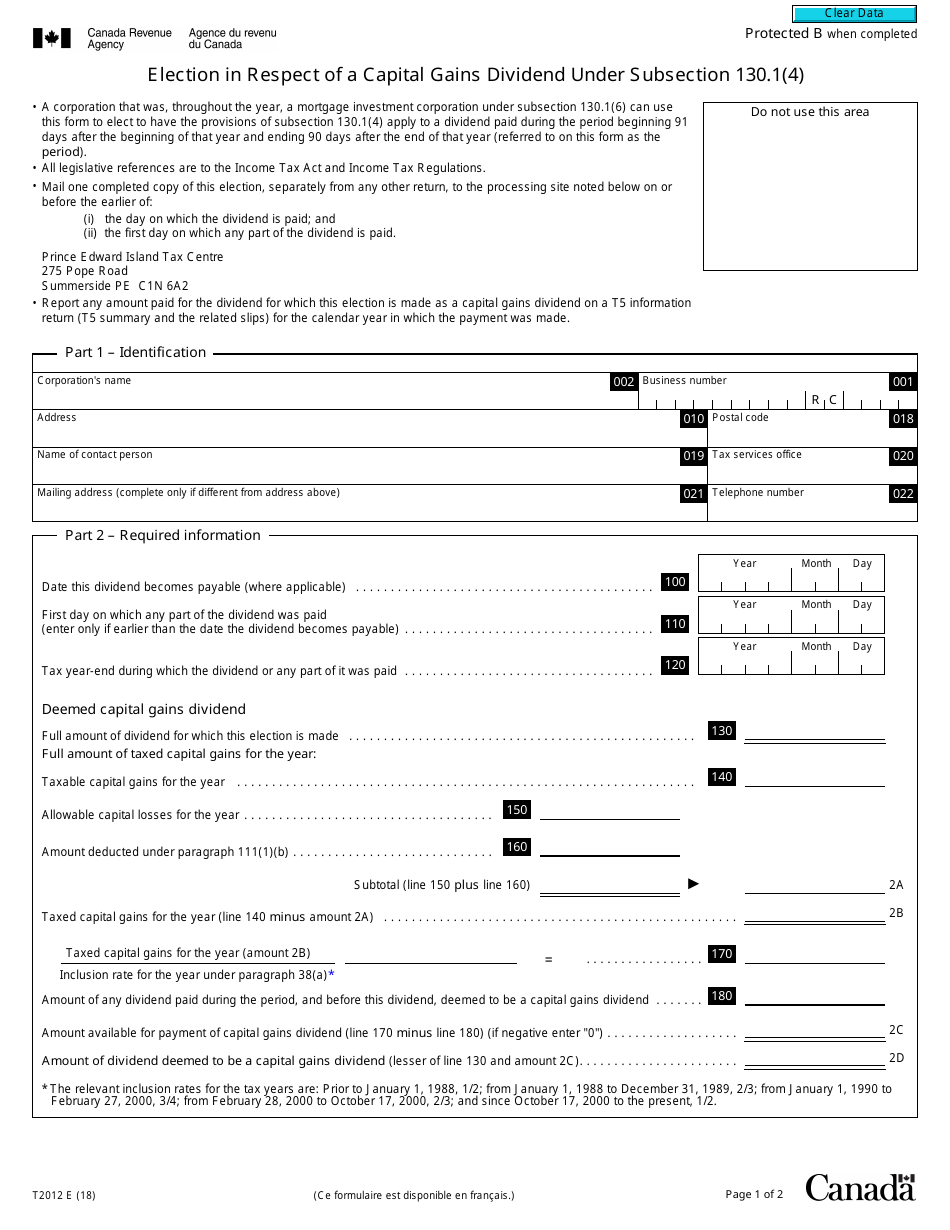

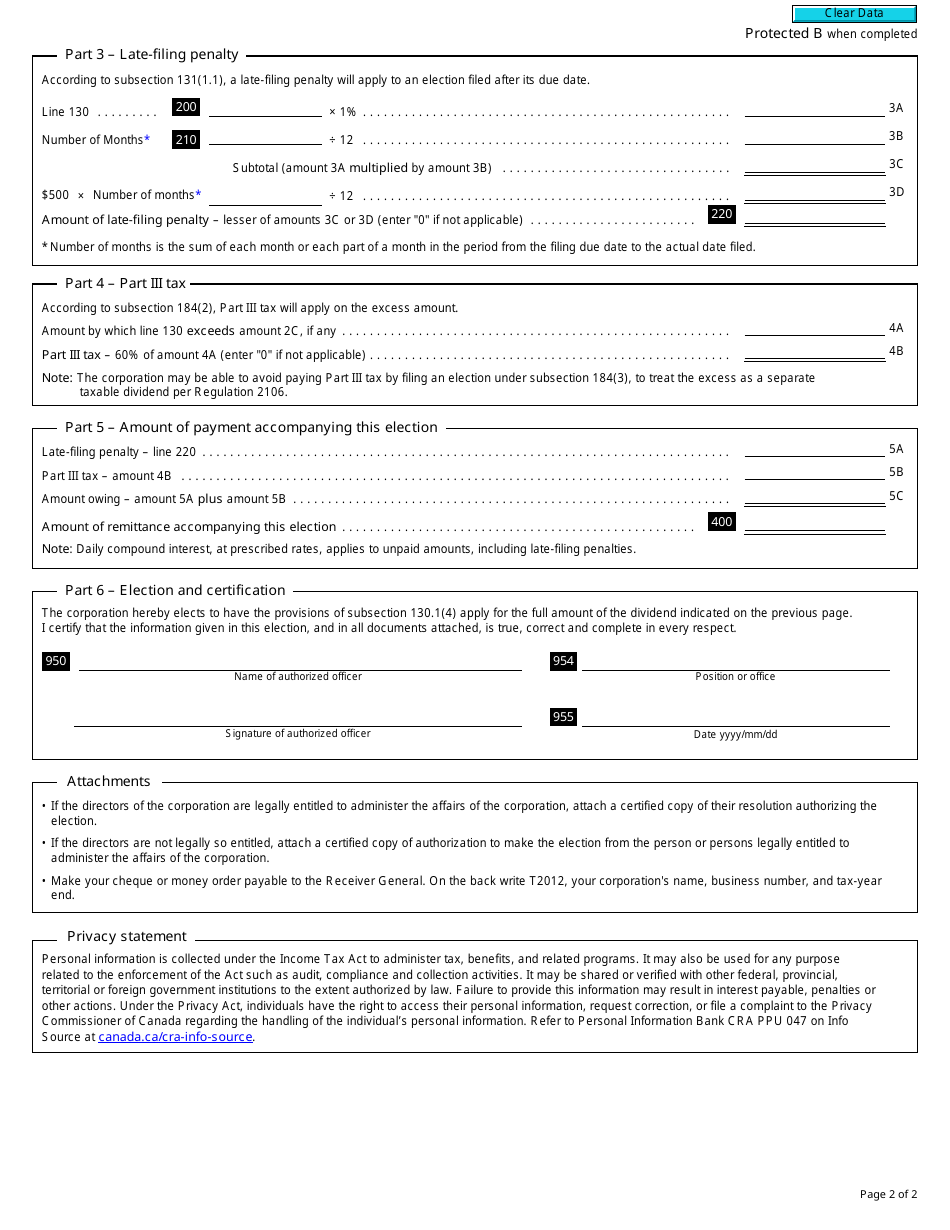

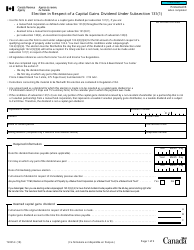

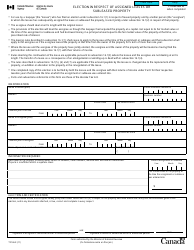

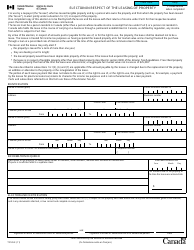

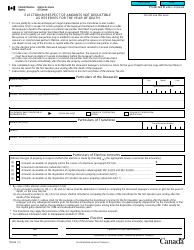

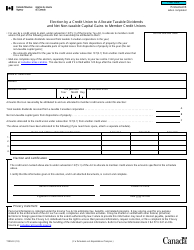

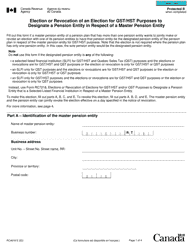

Form T2012 Election in Respect of a Capital Gains Dividend Under Subsection 130.1(4) - Canada

Form T2012 is a Canadian Revenue Agency form also known as the "Form T2012 "election In Respect Of A Capital Gains Dividend Under Subsection 130.1(4)" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form T2012 down below or find it on Canadian Revenue Agency Forms website.

FAQ

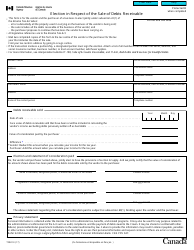

Q: What is Form T2012?

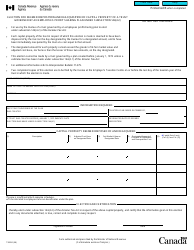

A: Form T2012 is a tax form used by Canadian taxpayers to make an election in respect to a capital gains dividend under subsection 130.1(4) of the Canadian Income Tax Act.

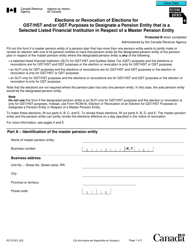

Q: Who needs to file Form T2012?

A: Canadian taxpayers who have received a capital gains dividend and want to make an election under subsection 130.1(4) of the Income Tax Act must file Form T2012.

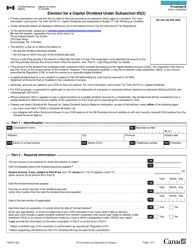

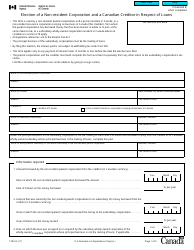

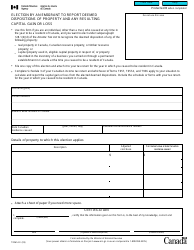

Q: What is a capital gains dividend?

A: A capital gains dividend is a type of dividend paid by a Canadian mutual fund or a publicly traded trust that includes a taxable capital gain.

Q: What does subsection 130.1(4) of the Income Tax Act refer to?

A: Subsection 130.1(4) allows taxpayers to elect to change the tax treatment of a capital gains dividend they receive from a mutual fund or publicly traded trust.

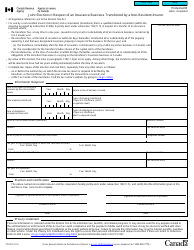

Q: How do I make an election using Form T2012?

A: To make an election, fill out Form T2012 with the necessary information and attach it to your tax return.