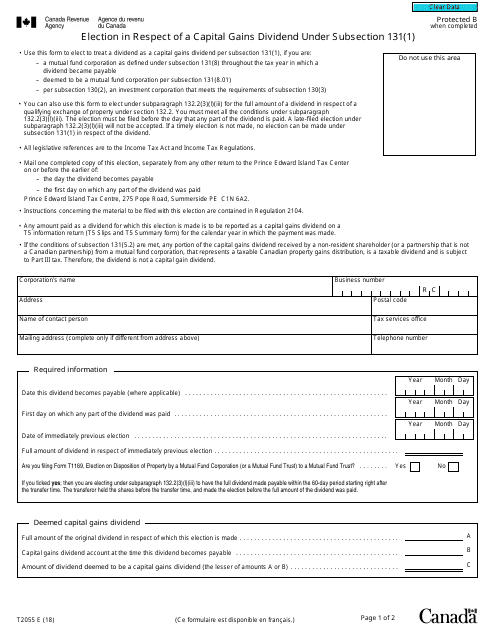

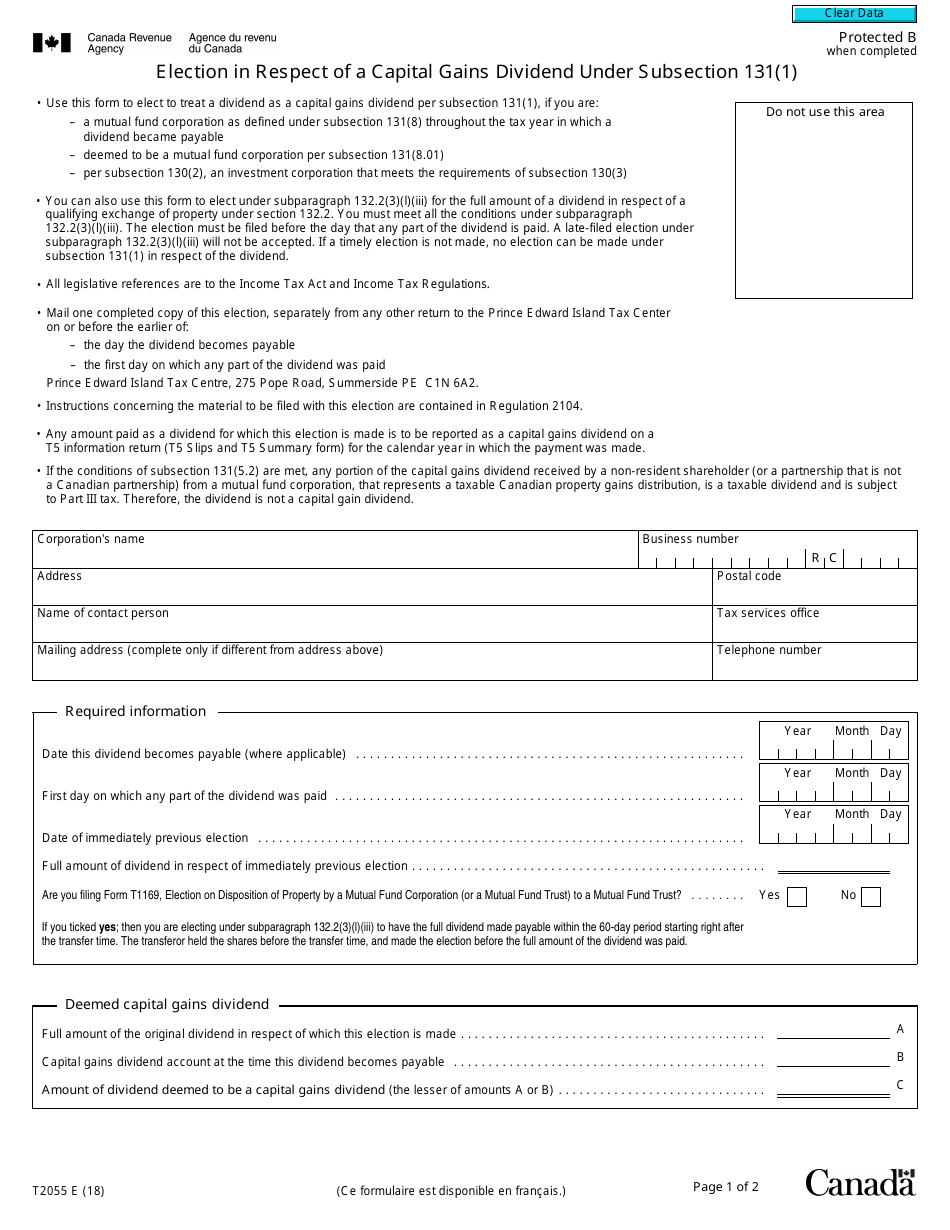

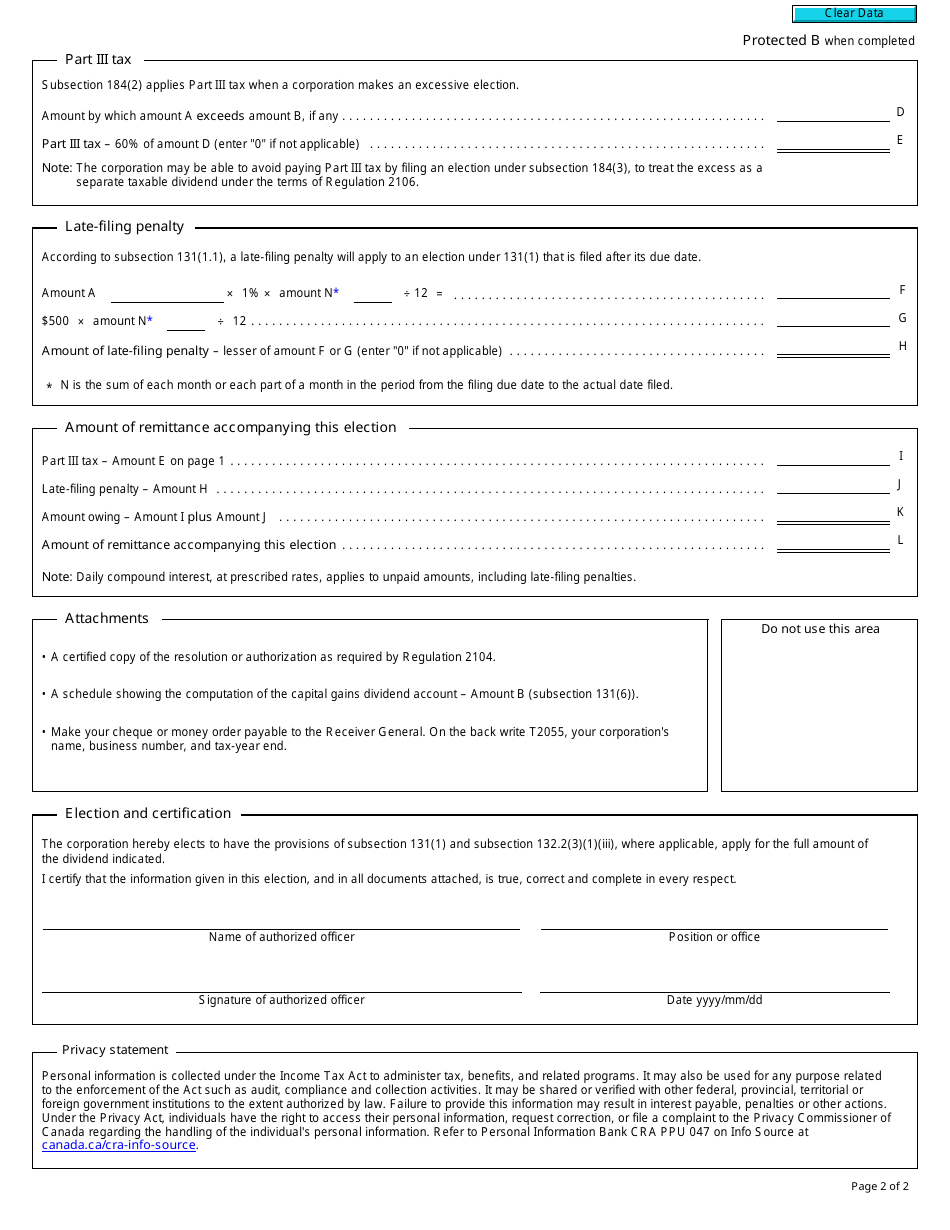

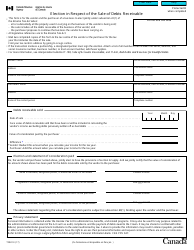

Form T2055 Election in Respect of a Capital Gains Dividend Under Subsection 131(1) - Canada

Form T2055 is a Canadian Revenue Agency form also known as the "Form T2055 "election In Respect Of A Capital Gains Dividend Under Subsection 131(1)" - Canada" . The latest edition of the form was released in January 1, 2018 and is available for digital filing.

Download a PDF version of the Form T2055 down below or find it on Canadian Revenue Agency Forms website.

FAQ

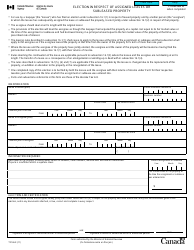

Q: What is Form T2055?

A: Form T2055 is an election form used in Canada in respect of a capital gains dividend under subsection 131(1).

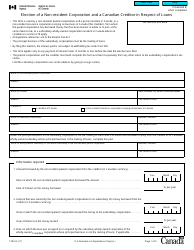

Q: Who uses Form T2055?

A: Form T2055 is used by individuals or entities in Canada who have received a capital gains dividend and want to make an election under subsection 131(1).

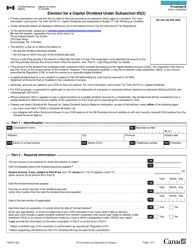

Q: What is a capital gains dividend?

A: A capital gains dividend is a type of dividend that is paid out by a Canadian corporation and is designated as a capital gain for tax purposes.

Q: What is subsection 131(1)?

A: Subsection 131(1) is a specific provision in the Canadian Income Tax Act that allows individuals or entities to make an election in respect of a capital gains dividend.

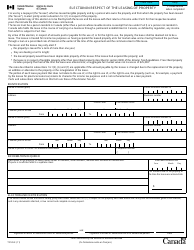

Q: Why would someone make an election under subsection 131(1)?

A: Someone might make an election under subsection 131(1) in order to have the capital gains dividend treated as a capital gain instead of as ordinary income for tax purposes.

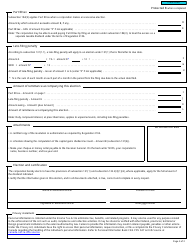

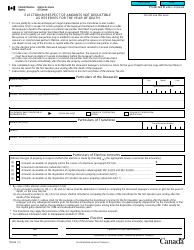

Q: How do I complete Form T2055?

A: To complete Form T2055, you will need to provide information about the capital gains dividend you received, as well as details about the corporation that paid the dividend.

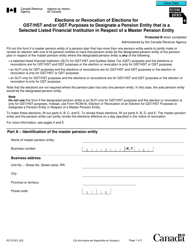

Q: Is there a deadline for filing Form T2055?

A: Yes, there is a deadline for filing Form T2055. The deadline is generally within 90 days after the end of the taxation year in which the capital gains dividend was received.