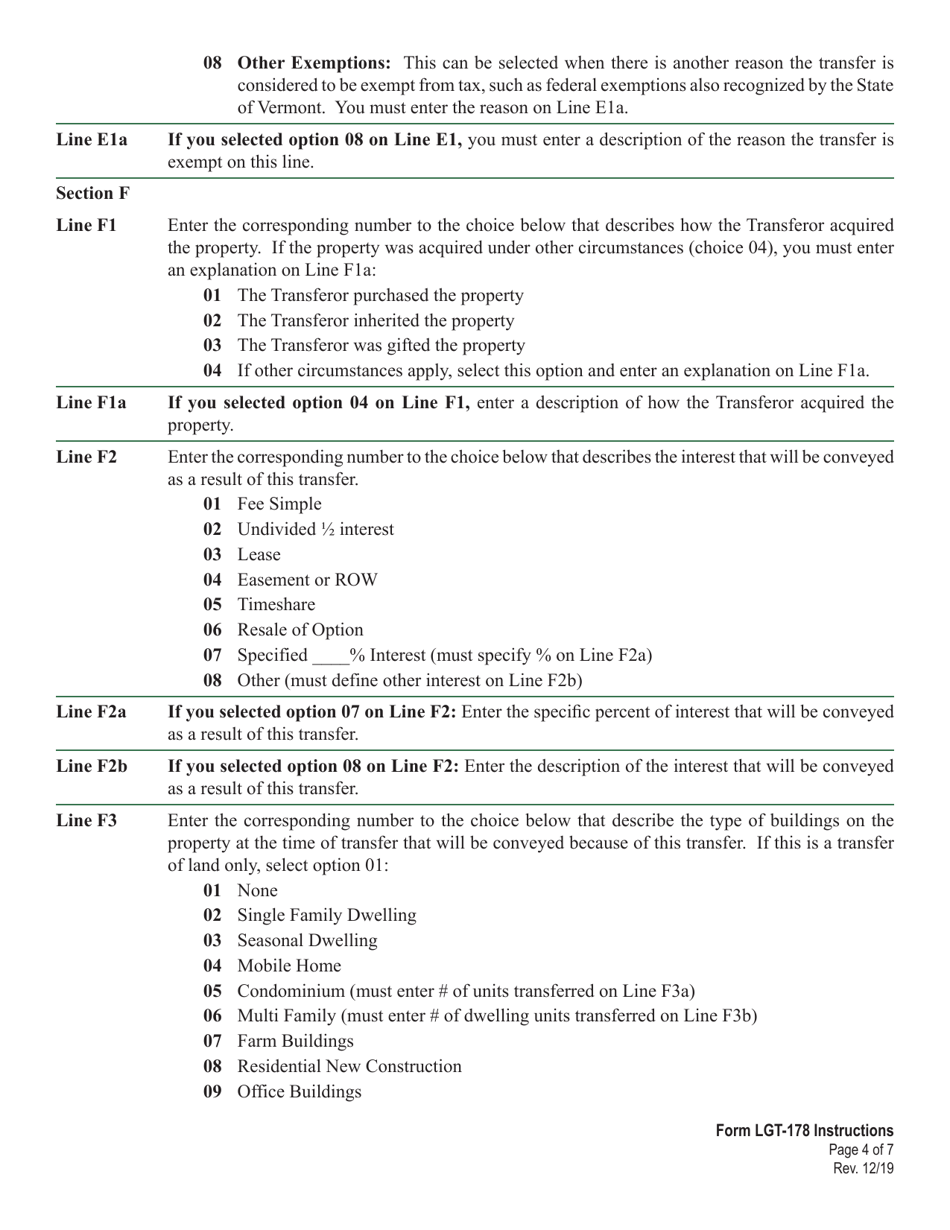

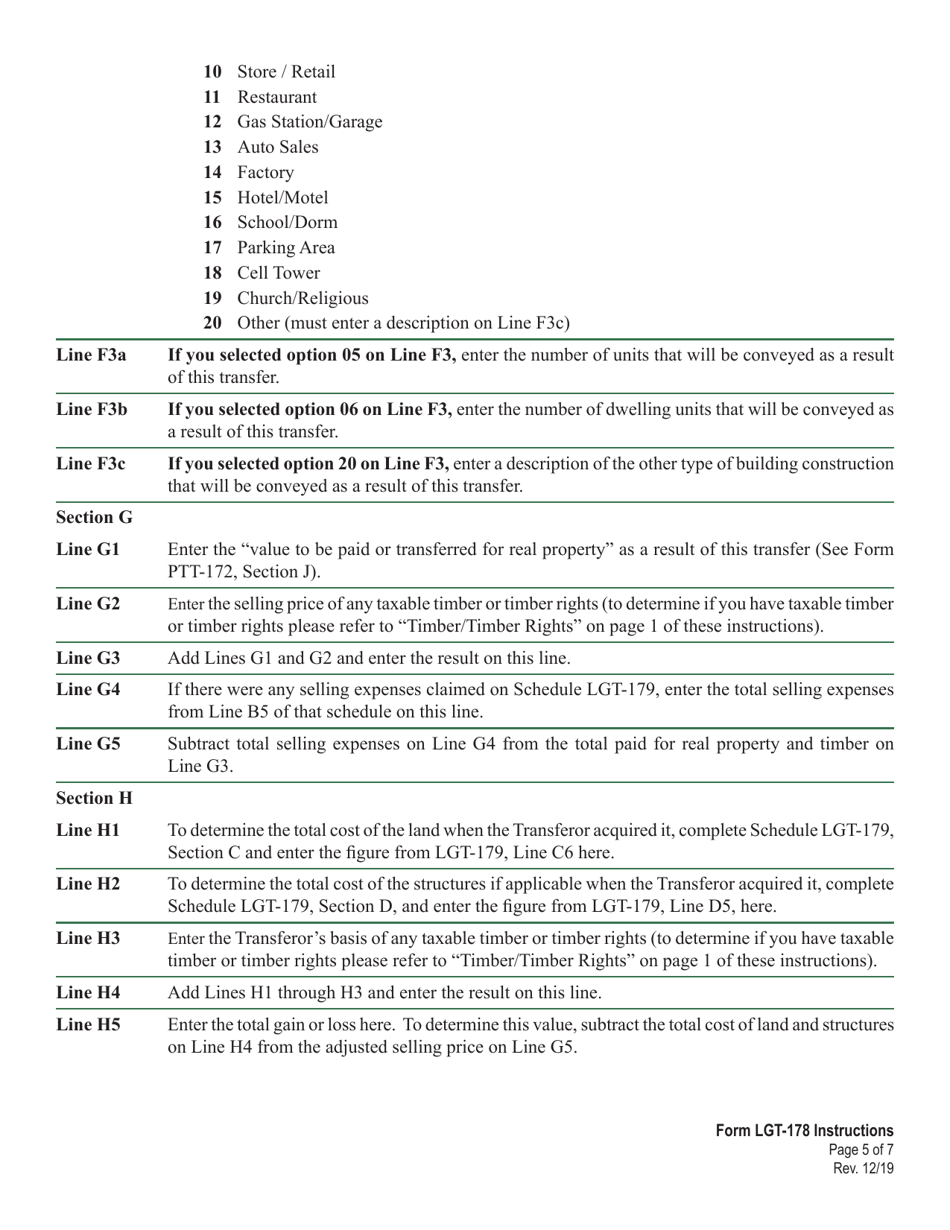

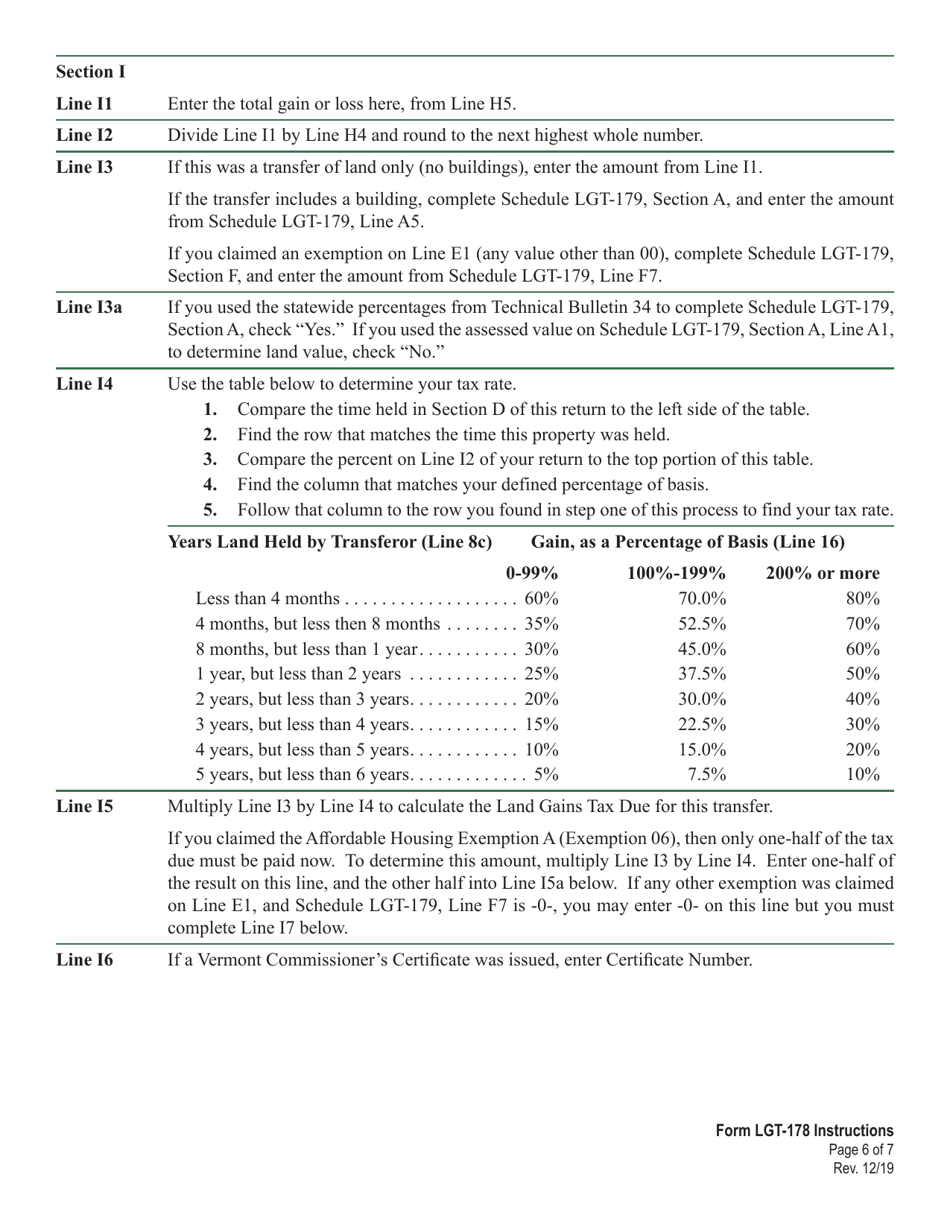

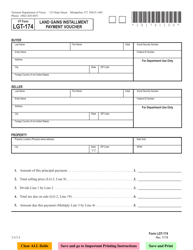

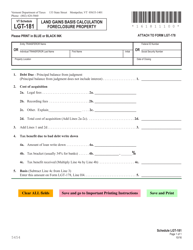

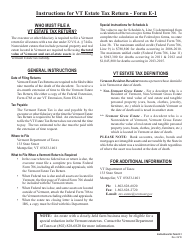

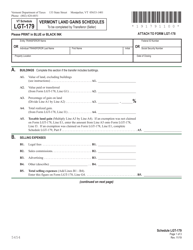

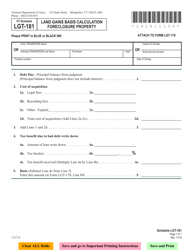

Instructions for Form LGT-178 Vermont Land Gains Tax Return - Vermont

This document contains official instructions for Form LGT-178 , Vermont Land Gains Tax Return - a form released and collected by the Vermont Department of Taxes. An up-to-date fillable VT Form LGT-178 is available for download through this link.

FAQ

Q: What is Form LGT-178?

A: Form LGT-178 is the Vermont Land Gains Tax Return.

Q: Who is required to file Form LGT-178?

A: Any individual or entity who realizes a gain from the sale of Vermont property is required to file Form LGT-178.

Q: What is the purpose of Form LGT-178?

A: The purpose of Form LGT-178 is to report and pay the Vermont Land Gains Tax on any capital gains resulting from the sale of Vermont property.

Q: When is Form LGT-178 due?

A: Form LGT-178 is due on or before April 15th of the year following the sale of the Vermont property.

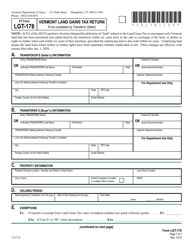

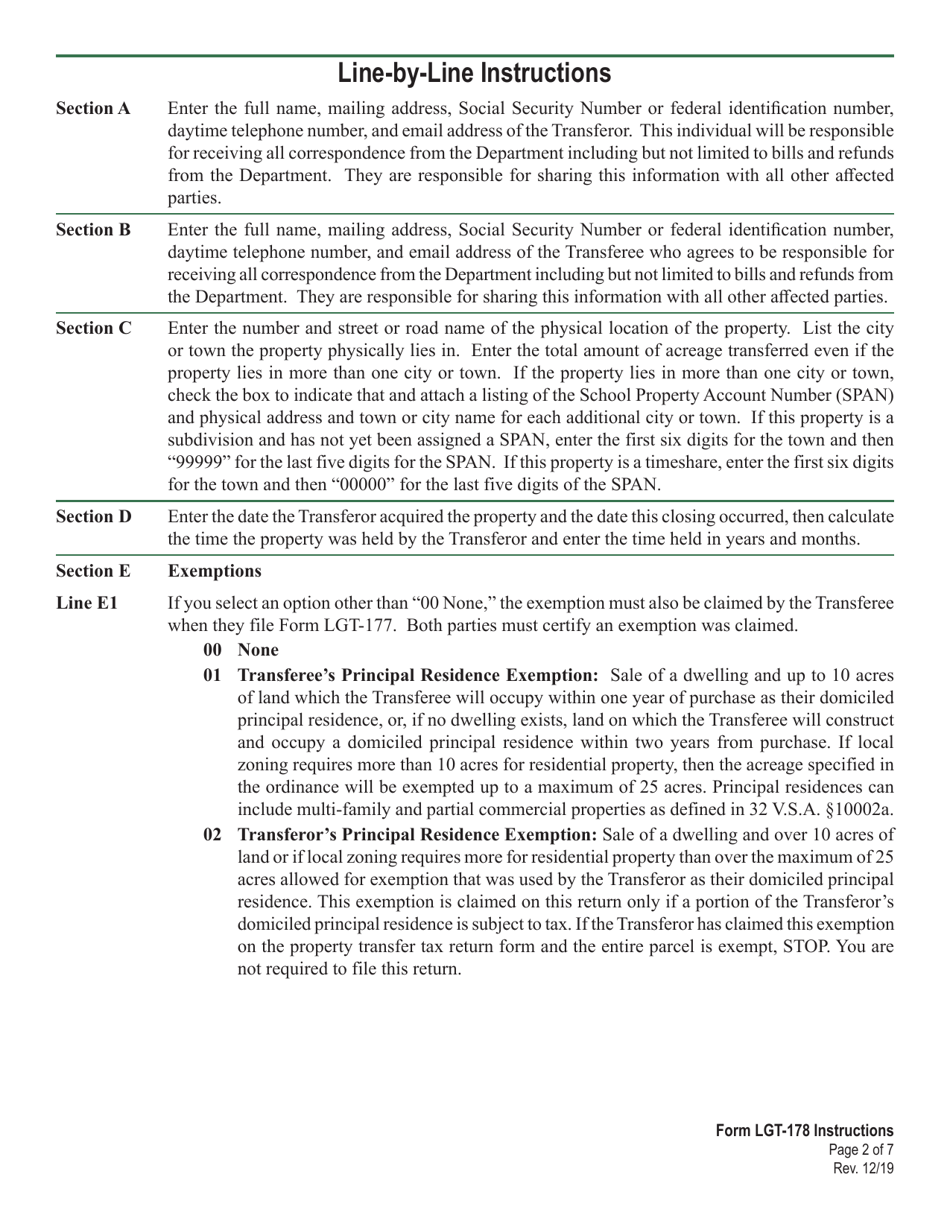

Q: What information is required on Form LGT-178?

A: Some of the information required on Form LGT-178 includes the taxpayer's contact information, details about the property sold, and calculation of the capital gains.

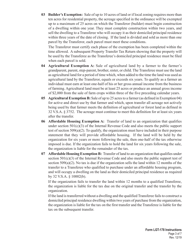

Q: Are there any exemptions or deductions available on Form LGT-178?

A: Yes, there are certain exemptions and deductions available for the Vermont Land Gains Tax. It's recommended to consult the instructions for Form LGT-178 or a tax professional for more information.

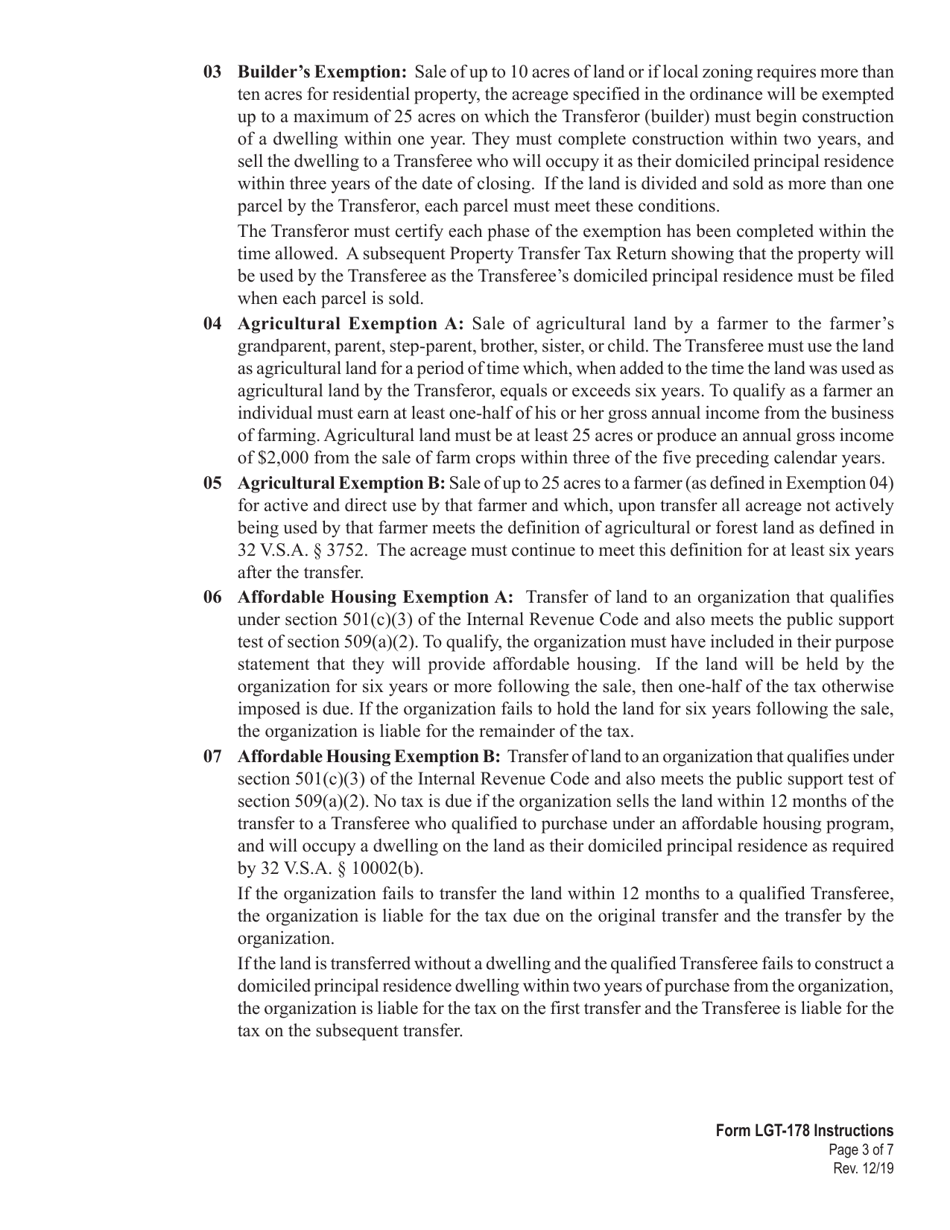

Q: What happens if I don't file Form LGT-178?

A: If you are required to file Form LGT-178 and fail to do so, you may be subject to penalties and interest on the unpaid tax amount.

Q: Can I e-file Form LGT-178?

A: No, as of now, electronic filing is not available for Form LGT-178. It must be filed by mail or in person.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.