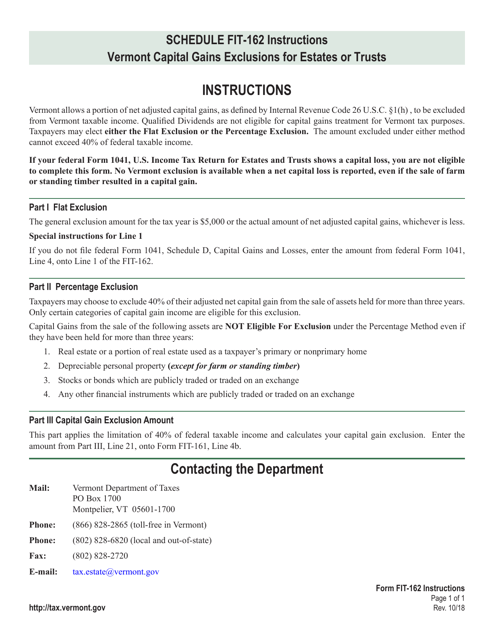

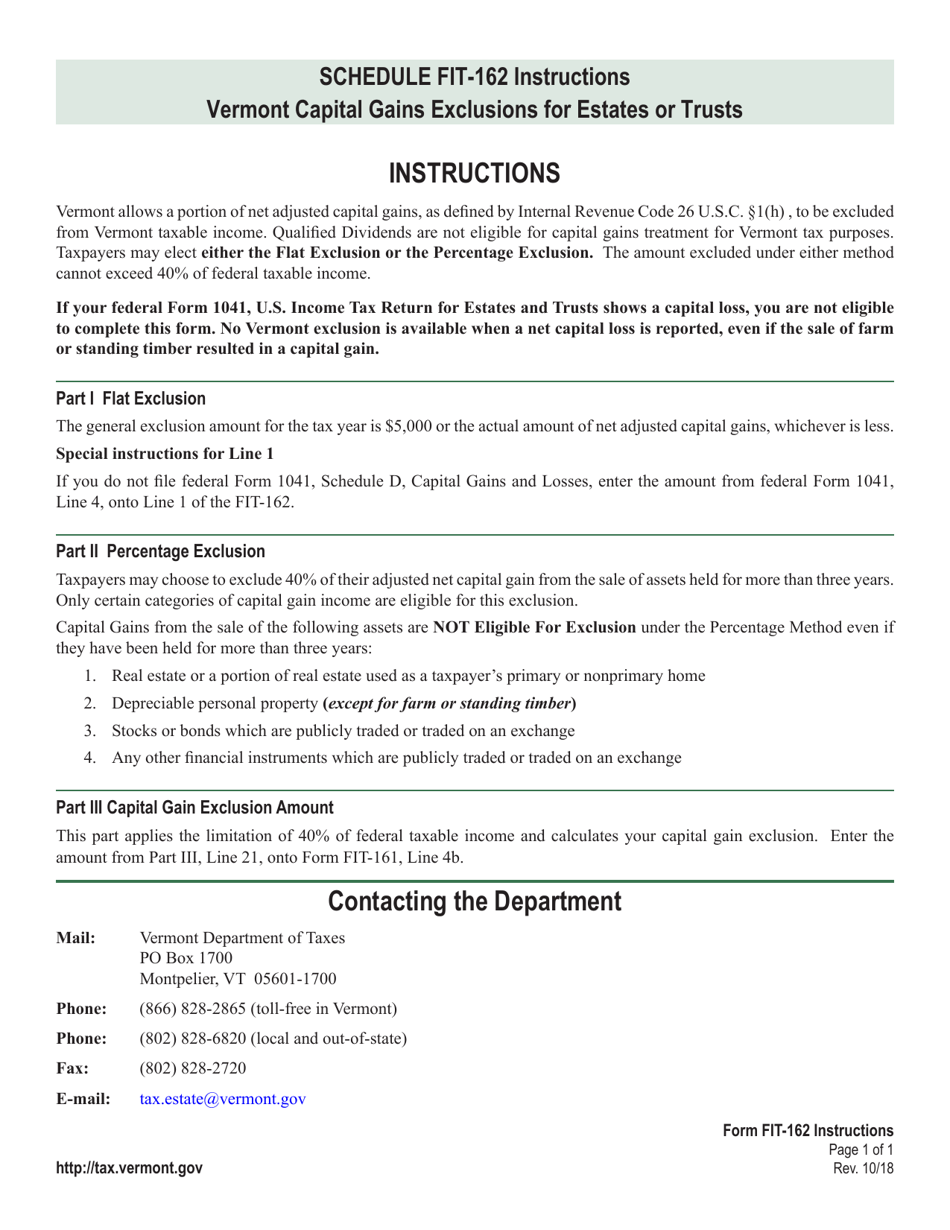

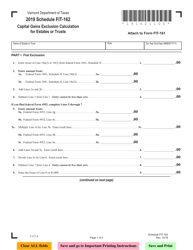

Instructions for VT Form FIT-162 Capital Gains Exclusion Calculation for Estates or Trusts - Vermont

This document contains official instructions for VT Form FIT-162 , Capital Gains Exclusion Calculation for Estates or Trusts - a form released and collected by the Vermont Department of Taxes.

FAQ

Q: What is the VT Form FIT-162?

A: The VT Form FIT-162 is a form used for calculating the capital gains exclusion for estates or trusts in Vermont.

Q: Who needs to file VT Form FIT-162?

A: Estates or trusts in Vermont that have capital gains to exclude need to file VT Form FIT-162.

Q: What is the purpose of filing VT Form FIT-162?

A: The purpose of filing VT Form FIT-162 is to calculate the capital gains exclusion for estates or trusts in Vermont.

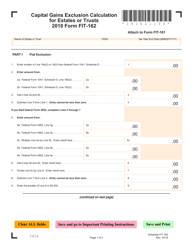

Q: How do I calculate the capital gains exclusion using VT Form FIT-162?

A: You can calculate the capital gains exclusion using the instructions provided on VT Form FIT-162.

Q: When is the deadline to file VT Form FIT-162?

A: The deadline to file VT Form FIT-162 is the same as the deadline for filing the estate or trust tax return in Vermont.

Q: Are there any other forms or documents required to be submitted with VT Form FIT-162?

A: It depends on the specific circumstances of the estate or trust. Additional forms or documents may be required.

Q: What happens if I make a mistake on VT Form FIT-162?

A: If you make a mistake on VT Form FIT-162, you should correct it as soon as possible. Consult with a tax professional or contact the Vermont Department of Taxes for guidance.

Q: Can I file VT Form FIT-162 electronically?

A: Yes, VT Form FIT-162 can be filed electronically if you are using the Vermont Department of Taxes' e-file system.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Vermont Department of Taxes.