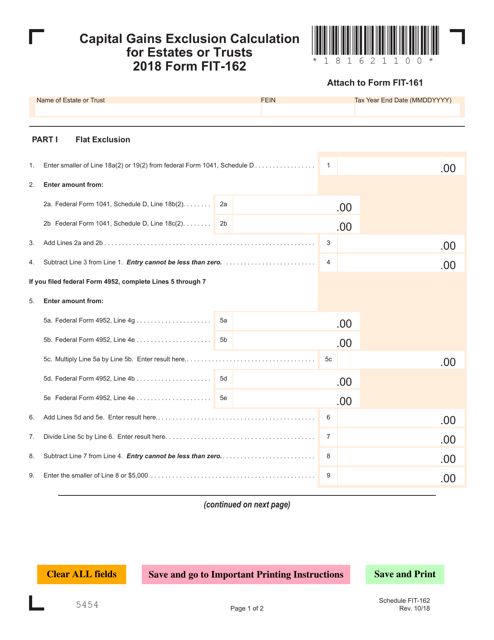

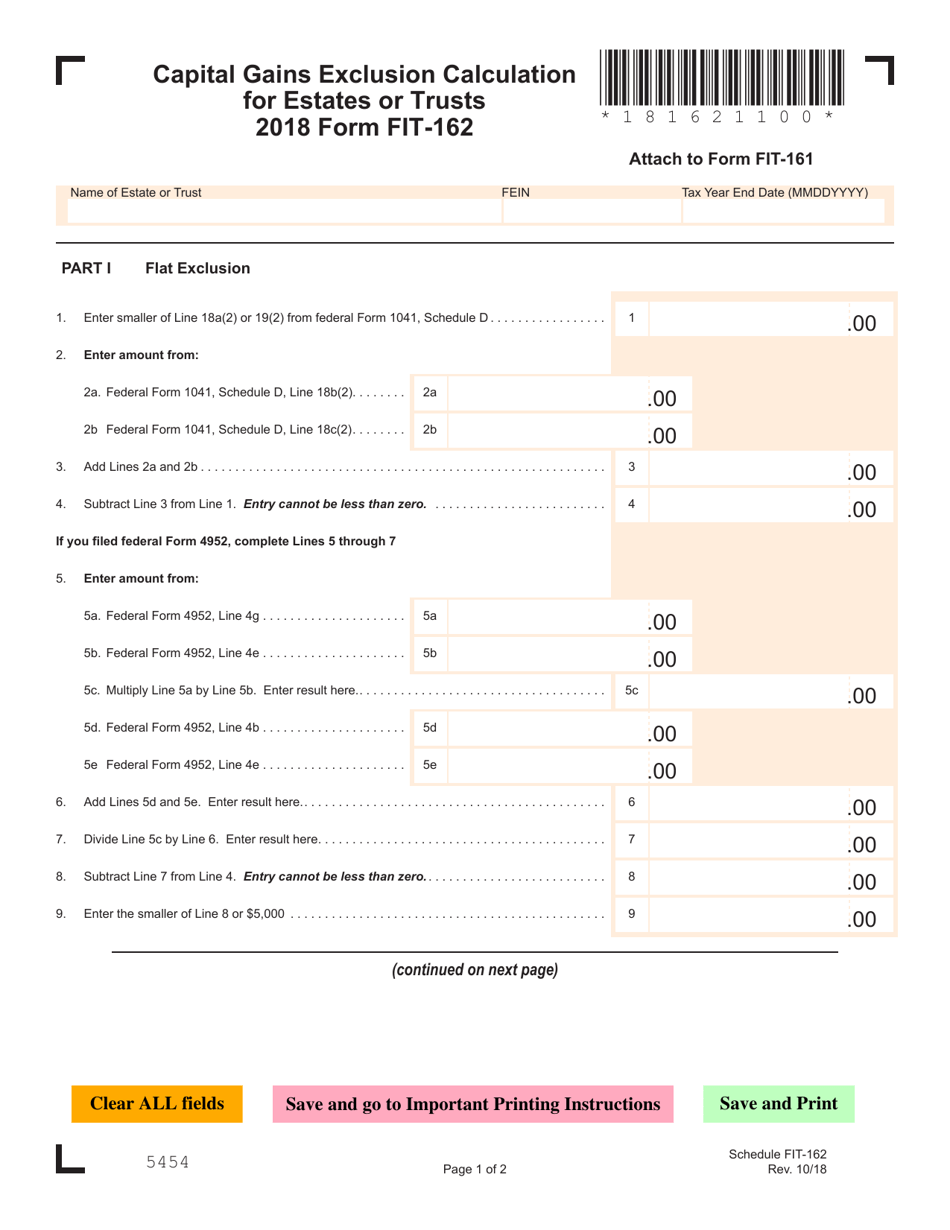

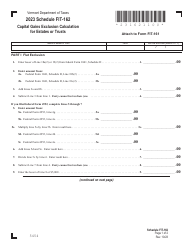

VT Form FIT-162 Capital Gains Exclusion Calculation for Estates or Trusts - Vermont

What Is VT Form FIT-162?

This is a legal form that was released by the Vermont Department of Taxes - a government authority operating within Vermont. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the FIT-162 form?

A: The FIT-162 form is the Vermont tax form used to calculate the capital gains exclusion for estates or trusts.

Q: What is a capital gains exclusion?

A: A capital gains exclusion is a tax benefit that allows individuals or entities to exclude a portion of their capital gains from being taxed.

Q: Who uses the FIT-162 form?

A: The FIT-162 form is used by estates or trusts in Vermont to calculate their capital gains exclusion.

Q: Why would an estate or trust need to calculate a capital gains exclusion?

A: An estate or trust may need to calculate a capital gains exclusion to reduce the amount of taxable income and lower their overall tax liability.

Q: How is the capital gains exclusion calculated on the FIT-162 form?

A: The specific calculation for the capital gains exclusion on the FIT-162 form can be found in the instructions provided with the form.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Vermont Department of Taxes;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of VT Form FIT-162 by clicking the link below or browse more documents and templates provided by the Vermont Department of Taxes.