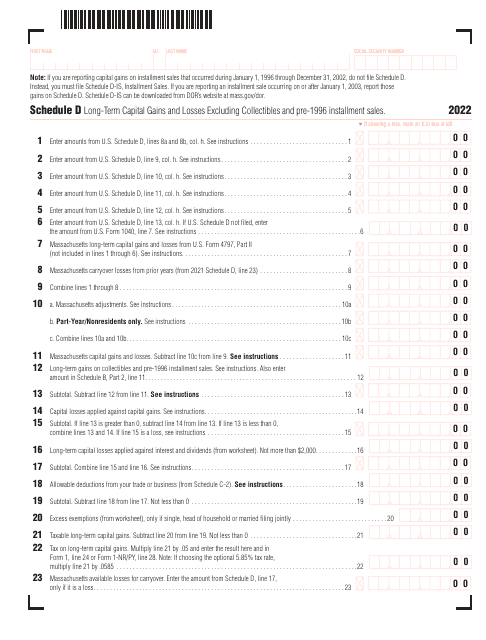

This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule D

for the current year.

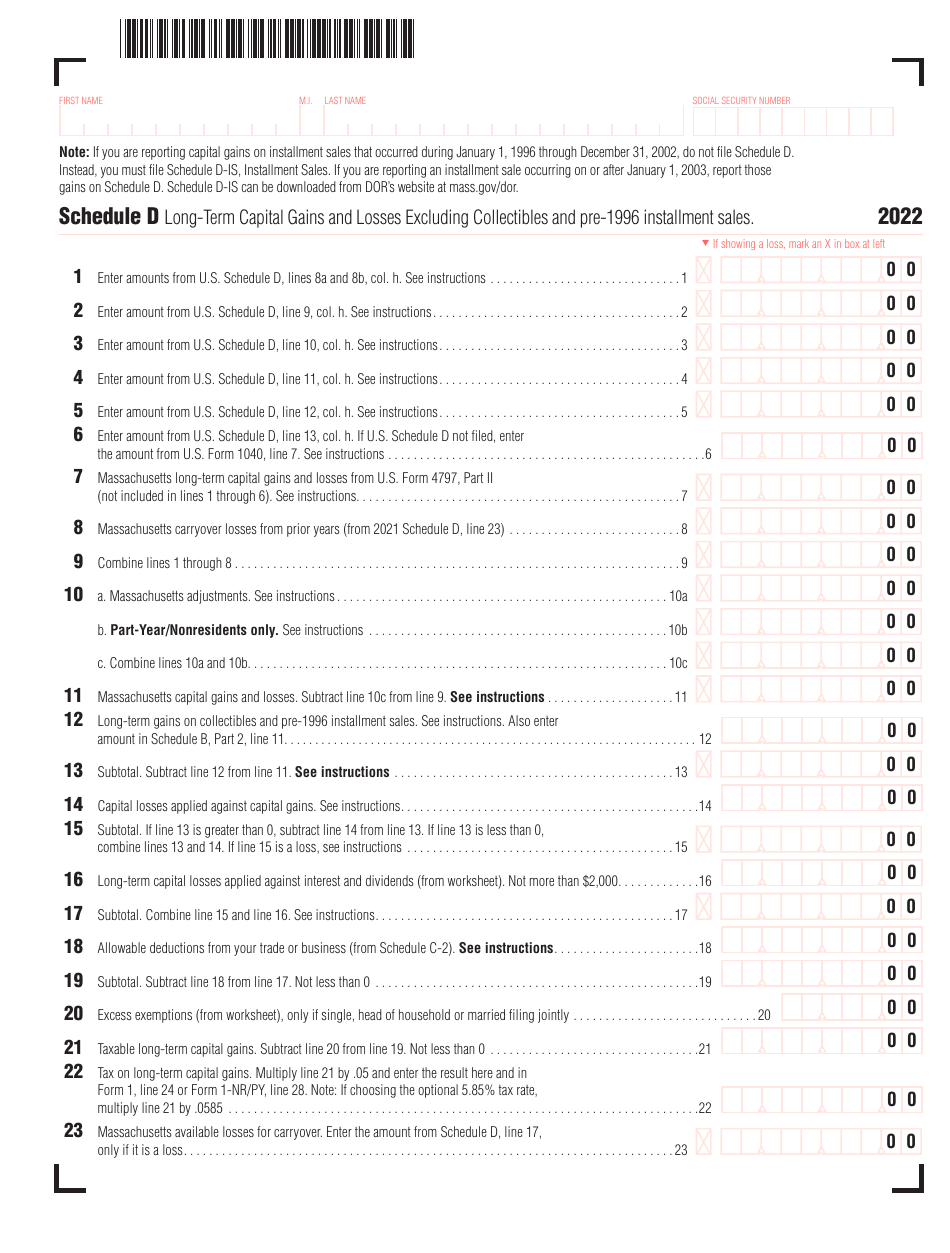

Schedule D Long-Term Capital Gains and Losses Excluding Collectibles and Pre-1996 Installment Sales - Massachusetts

What Is Schedule D?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule D?

A: Schedule D is a tax form used to report capital gains and losses.

Q: What are long-term capital gains and losses?

A: Long-term capital gains and losses are profits or losses from the sale of assets held for more than one year.

Q: What are collectibles?

A: Collectibles refer to items like coins, stamps, artwork, and antiques.

Q: What are pre-1996 installment sales?

A: Pre-1996 installment sales are sales of property where the payments are received in installments and the contract was entered into before 1996.

Q: Does Schedule D include collectibles and pre-1996 installment sales?

A: No, the Massachusetts version of Schedule D excludes collectibles and pre-1996 installment sales.

Q: Why is Massachusetts mentioned in the title?

A: Massachusetts is mentioned in the title to indicate that the information is specific to the tax requirements of this state.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule D by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.