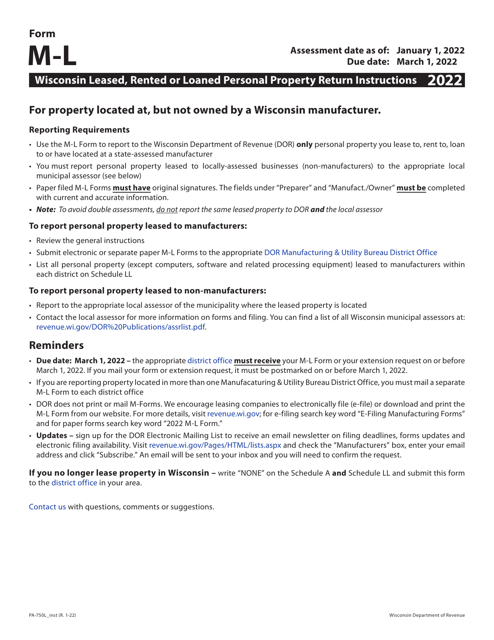

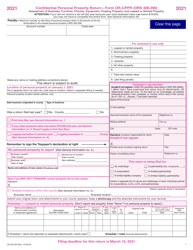

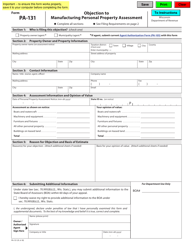

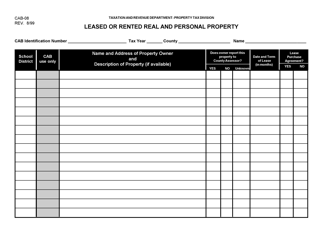

Instructions for Form M-L, PA-750L Wisconsin Leased, Rented or Loaned Personal Property Return - Wisconsin

This document contains official instructions for Form M-L , and Form PA-750L . Both forms are released and collected by the Wisconsin Department of Revenue.

FAQ

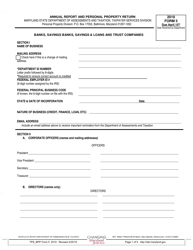

Q: What is Form M-L, PA-750L?

A: Form M-L, PA-750L is a Wisconsin tax form for reporting leased, rented, or loaned personal property.

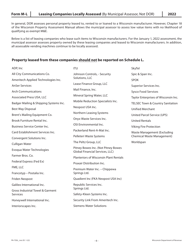

Q: Who needs to file Form M-L, PA-750L?

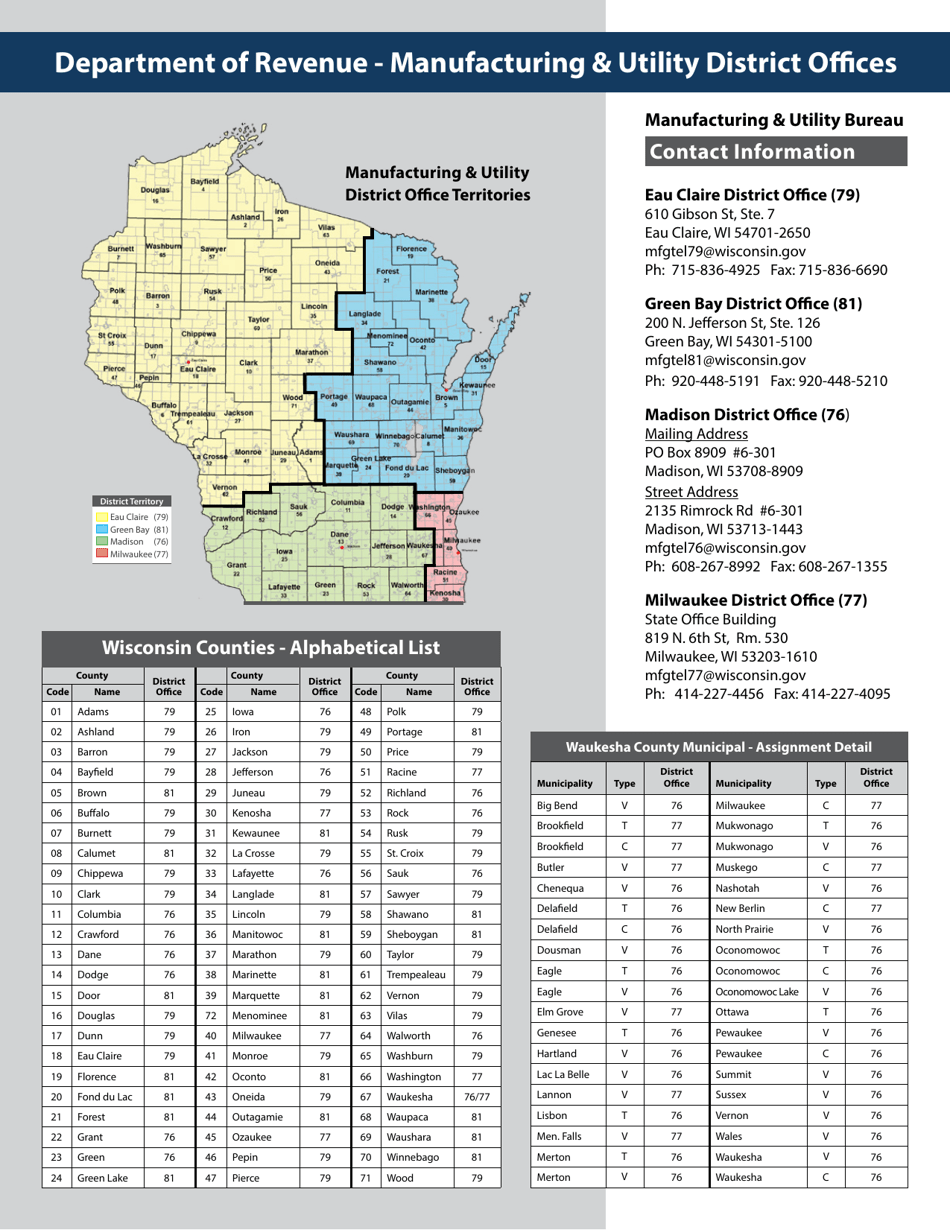

A: Anyone who leases, rents, or loans personal property in Wisconsin needs to file Form M-L, PA-750L.

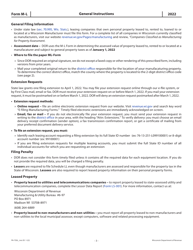

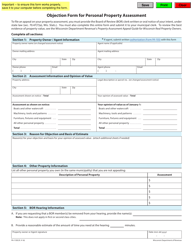

Q: What information is required on Form M-L, PA-750L?

A: Form M-L, PA-750L requires information such as the type and value of the property, the location where it is used, and the name and address of the owner.

Q: When is the deadline for filing Form M-L, PA-750L?

A: Form M-L, PA-750L must be filed by March 1st of each year.

Q: Are there any penalties for not filing Form M-L, PA-750L?

A: Yes, failure to file Form M-L, PA-750L or filing it late may result in penalties and interest.

Q: Do I need to include supporting documentation with Form M-L, PA-750L?

A: You may be required to include supporting documentation such as lease agreements or loan documents with your Form M-L, PA-750L.

Q: Who can I contact for help with Form M-L, PA-750L?

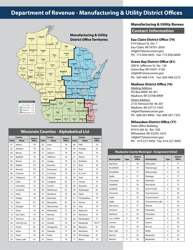

A: You can contact the Wisconsin Department of Revenue's customer service for assistance with Form M-L, PA-750L.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.