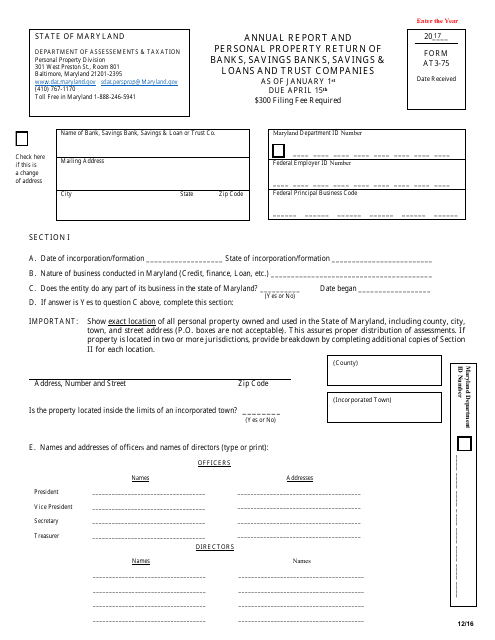

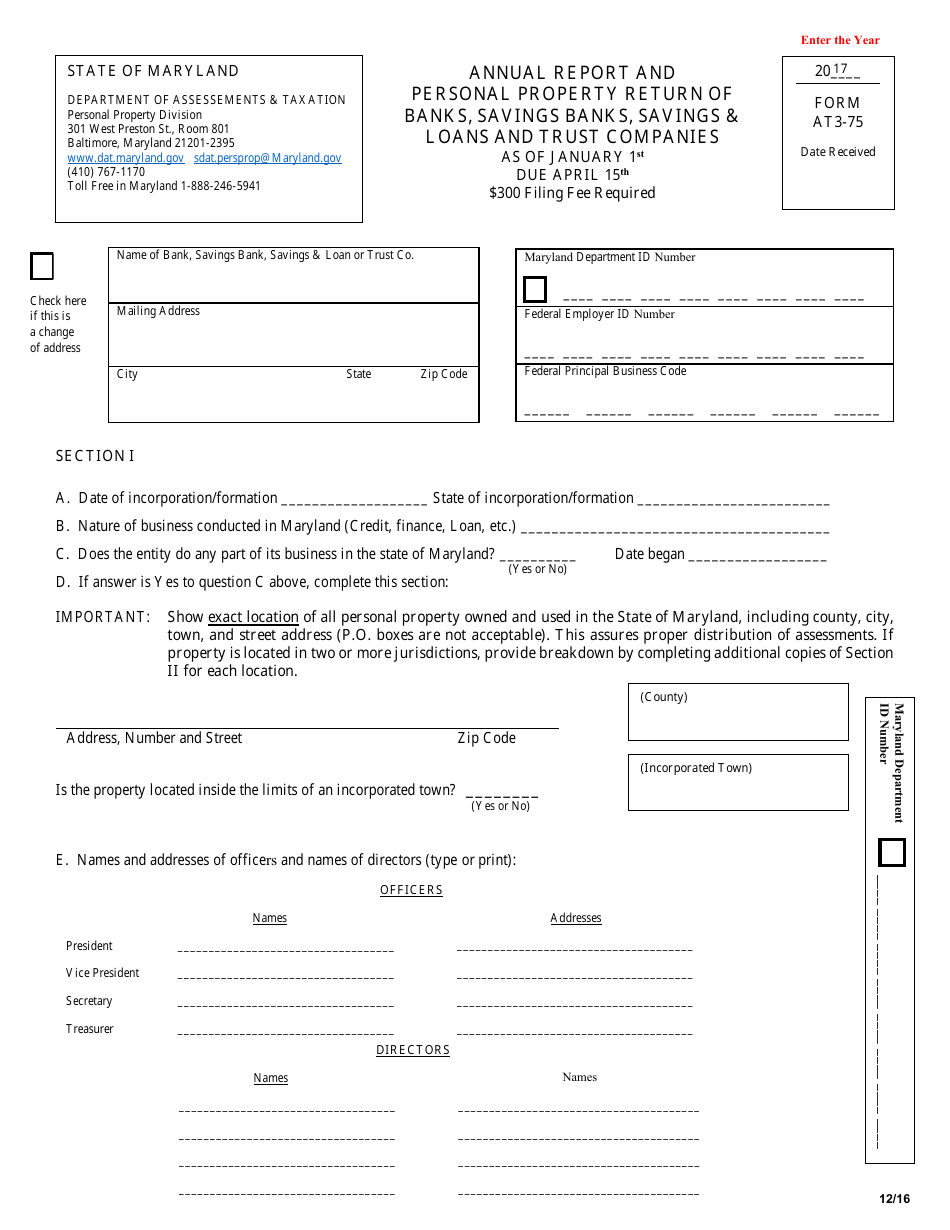

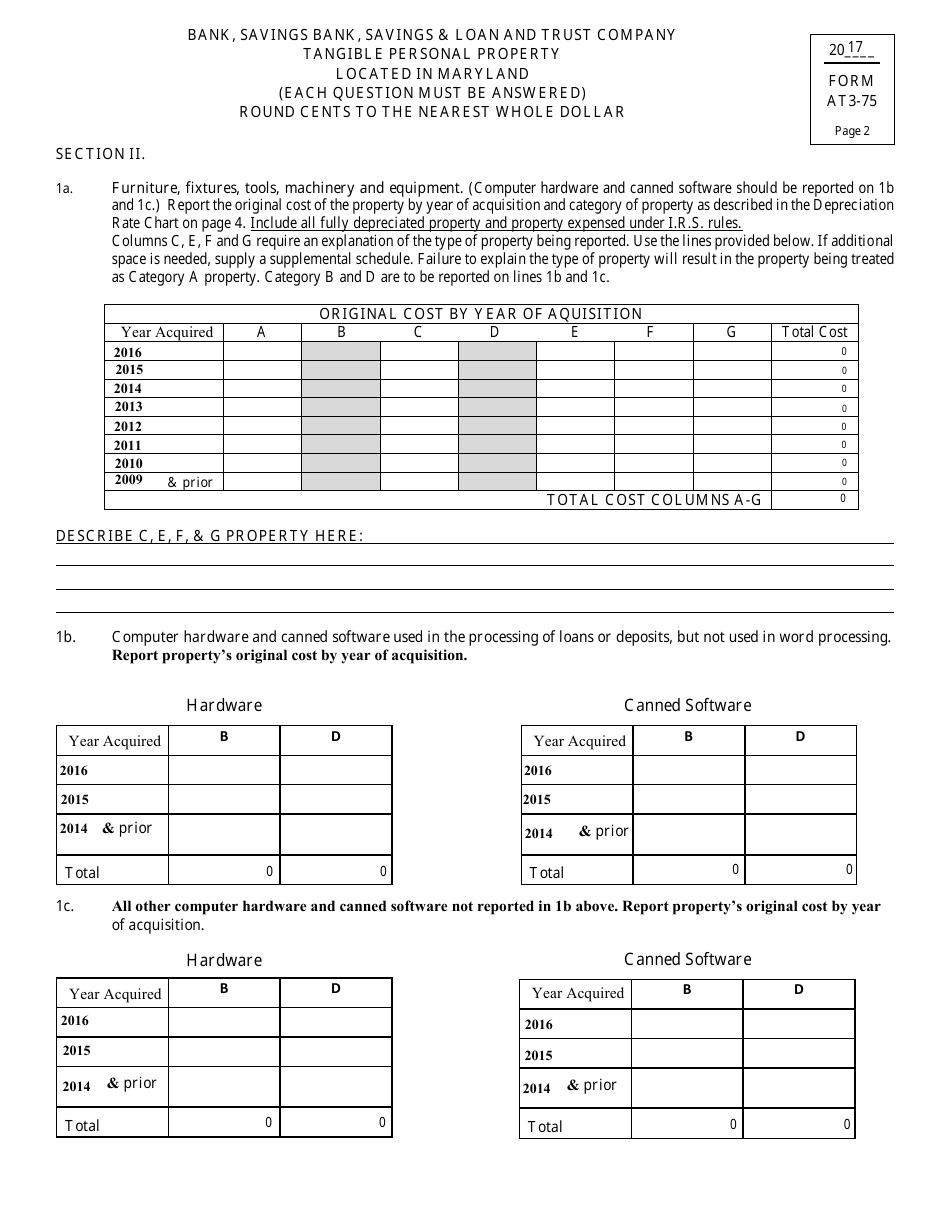

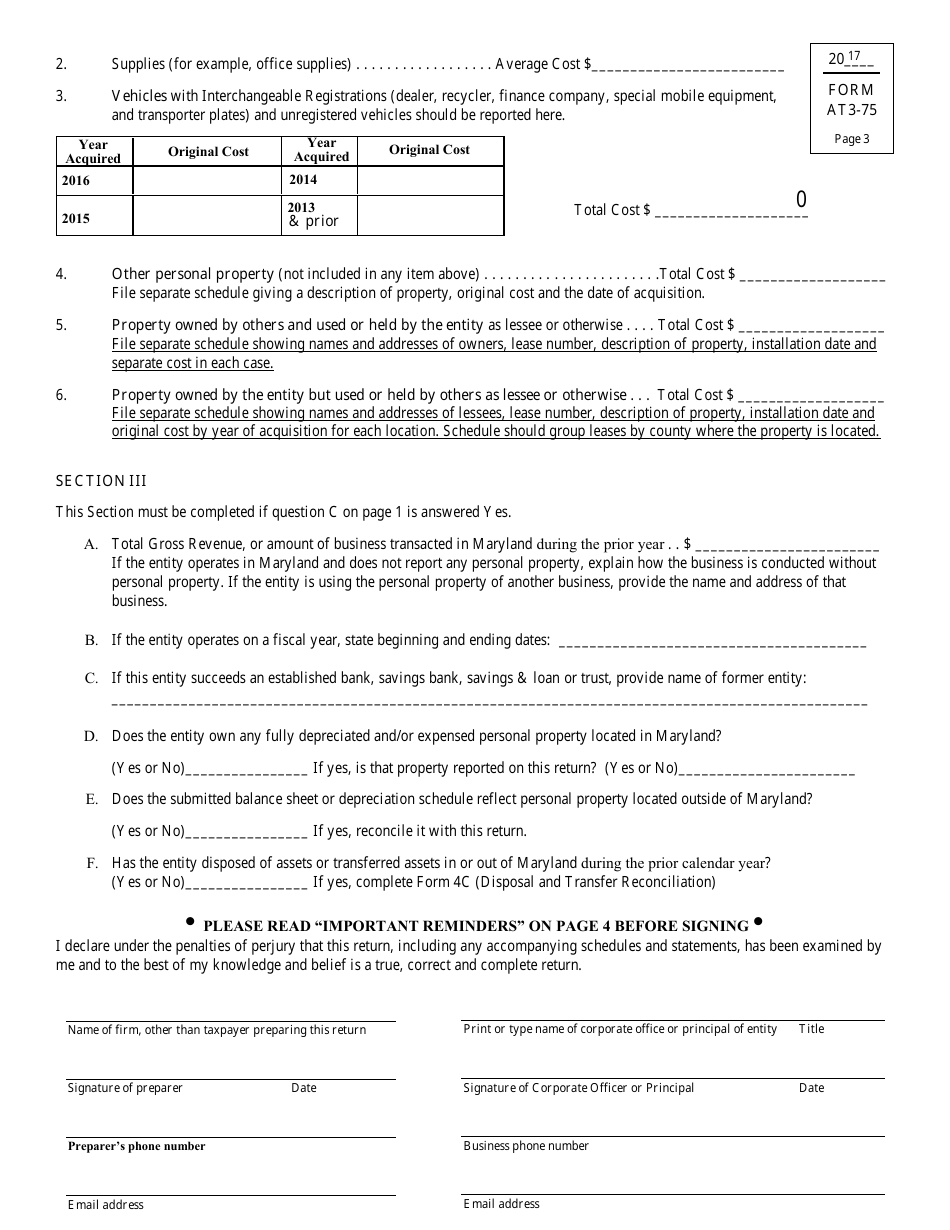

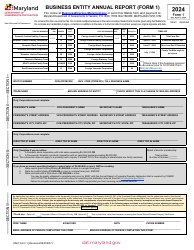

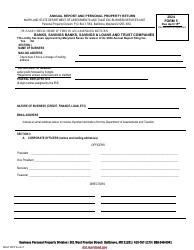

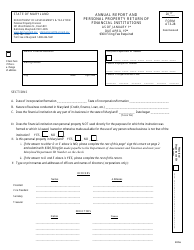

Form AT3-75 Annual Report and Personal Property Return of Banks, Savings Banks, Savings & Loans and Trust Companies - Maryland

What Is Form AT3-75?

This is a legal form that was released by the Maryland Department of Assessments and Taxation - a government authority operating within Maryland. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form AT3-75?

A: Form AT3-75 is the Annual Report and Personal Property Return of Banks, Savings Banks, Savings & Loans, and Trust Companies in Maryland.

Q: Who needs to file Form AT3-75?

A: Banks, Savings Banks, Savings & Loans, and Trust Companies in Maryland need to file Form AT3-75.

Q: What is the purpose of Form AT3-75?

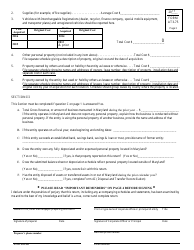

A: The purpose of Form AT3-75 is to report annual financial information and personal property holdings of banks, savings banks, savings & loans, and trust companies in Maryland.

Q: When is Form AT3-75 due?

A: Form AT3-75 is due on a specific date each year, typically in the first few months after the end of the calendar year. The exact due date can vary, so it's important to check with the Maryland Department of Assessments and Taxation for the current year's deadline.

Q: Are there any penalties for not filing Form AT3-75?

A: Yes, there are penalties for late or non-filing of Form AT3-75. The exact penalties can vary depending on the circumstances and the discretion of the Maryland Department of Assessments and Taxation. It is recommended to file the form on time to avoid any penalties.

Q: Are there any exemptions or exceptions for filing Form AT3-75?

A: There may be certain exemptions or exceptions for filing Form AT3-75, depending on the specific circumstances of the bank, savings bank, savings & loan, or trust company. It is best to consult with the Maryland Department of Assessments and Taxation for guidance if you believe you may qualify for an exemption or exception.

Q: Is there any additional documentation required along with Form AT3-75?

A: Along with Form AT3-75, banks, savings banks, savings & loans, and trust companies may be required to submit additional documentation and financial statements as specified by the Maryland Department of Assessments and Taxation. It is important to review the instructions provided with the form to determine any additional requirements.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Maryland Department of Assessments and Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AT3-75 by clicking the link below or browse more documents and templates provided by the Maryland Department of Assessments and Taxation.