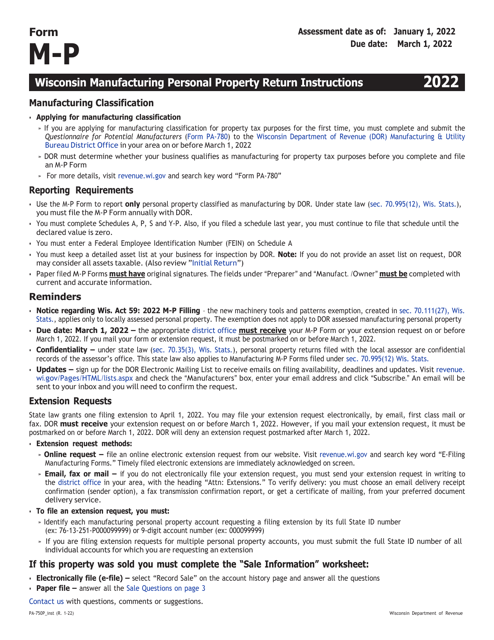

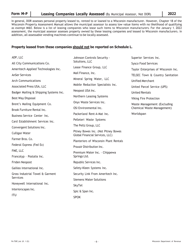

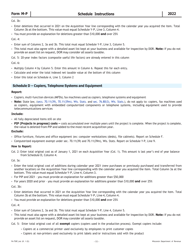

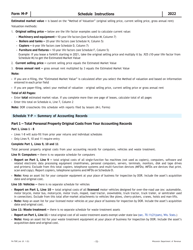

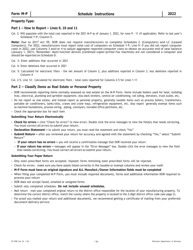

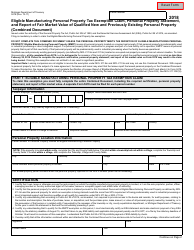

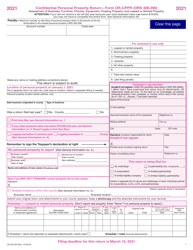

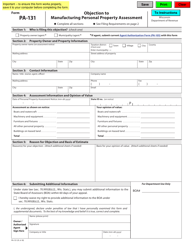

Instructions for Form M-P, PA-750P Wisconsin Manufacturing Personal Property Return - Wisconsin

This document contains official instructions for Form M-P , and Form PA-750P . Both forms are released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form M-P, PA-750P?

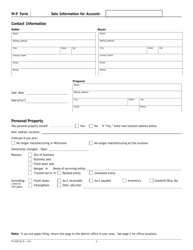

A: Form M-P, PA-750P is a Wisconsin Manufacturing Personal Property Return.

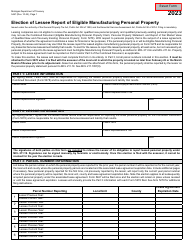

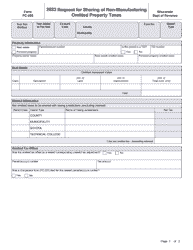

Q: Who needs to file Form M-P, PA-750P?

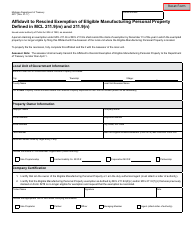

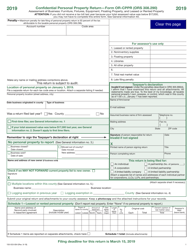

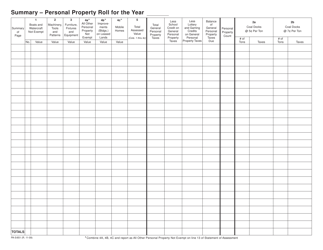

A: Businesses engaged in manufacturing or processing activities in Wisconsin must file Form M-P, PA-750P.

Q: What is the purpose of Form M-P, PA-750P?

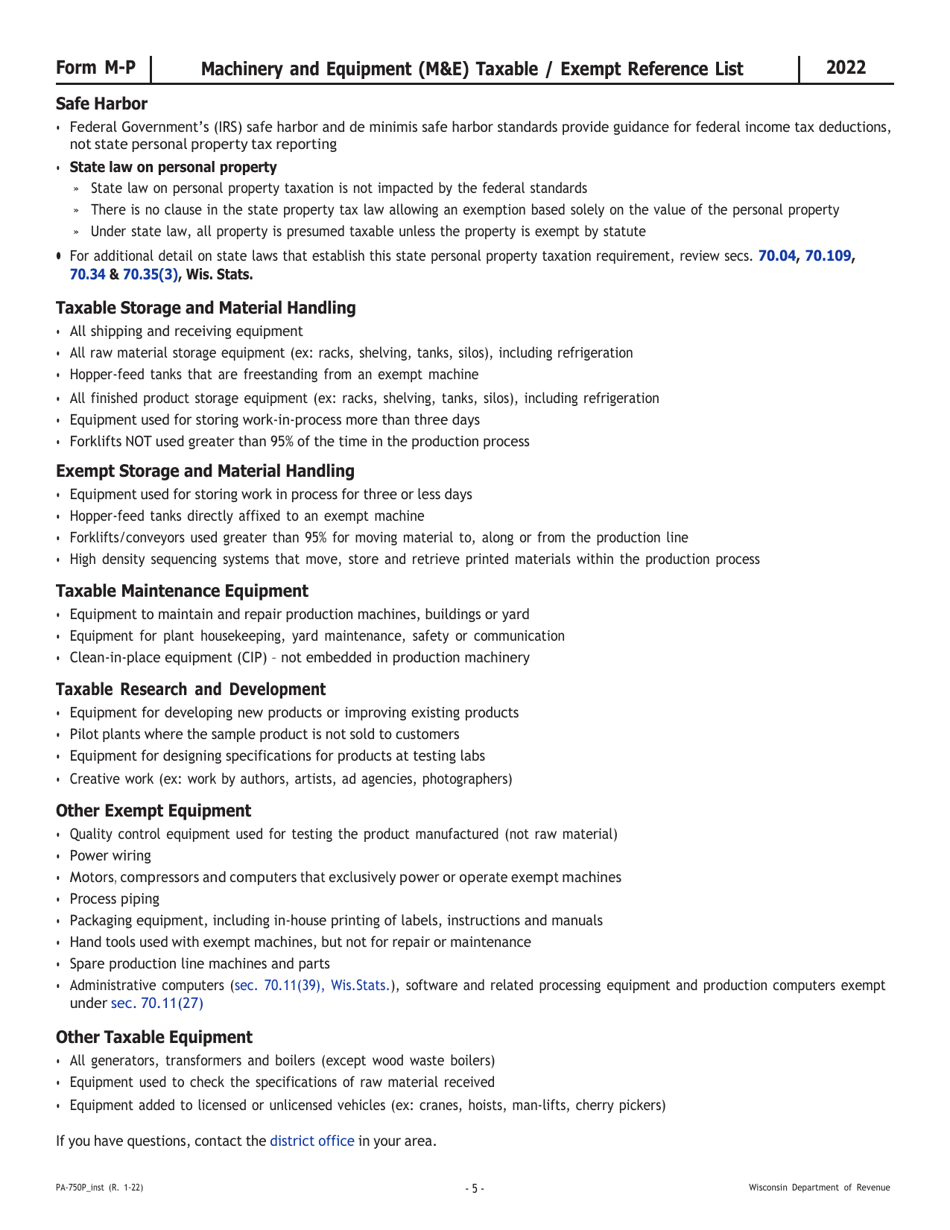

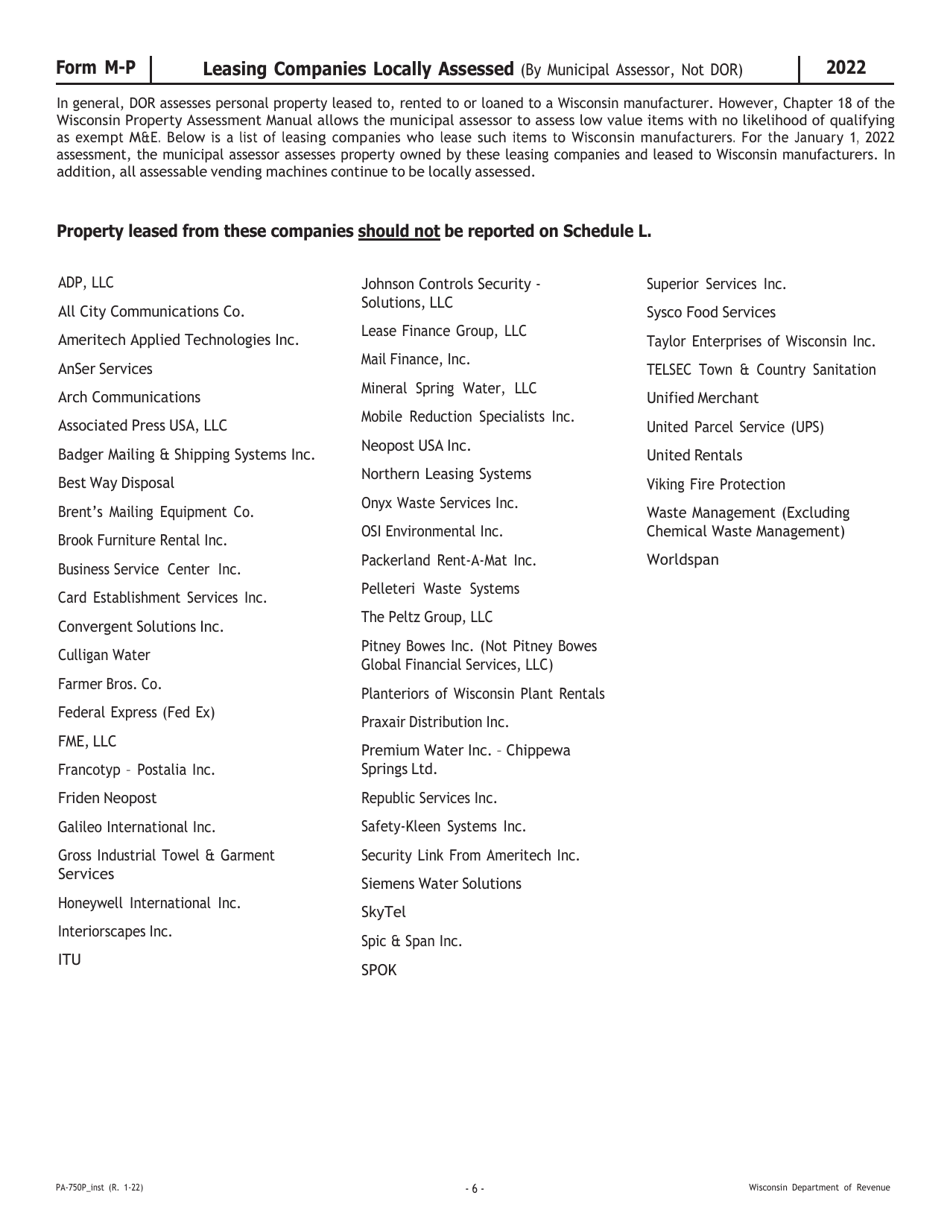

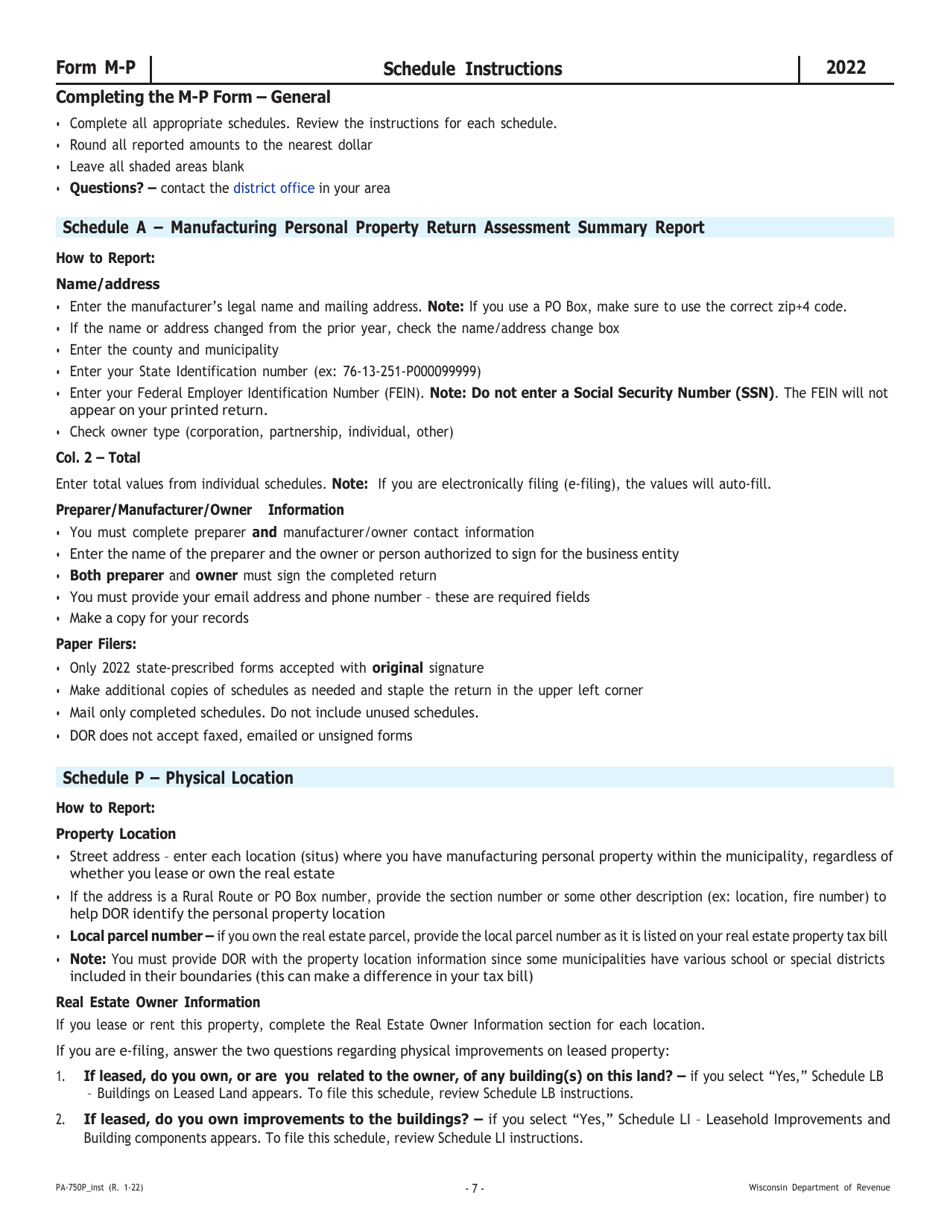

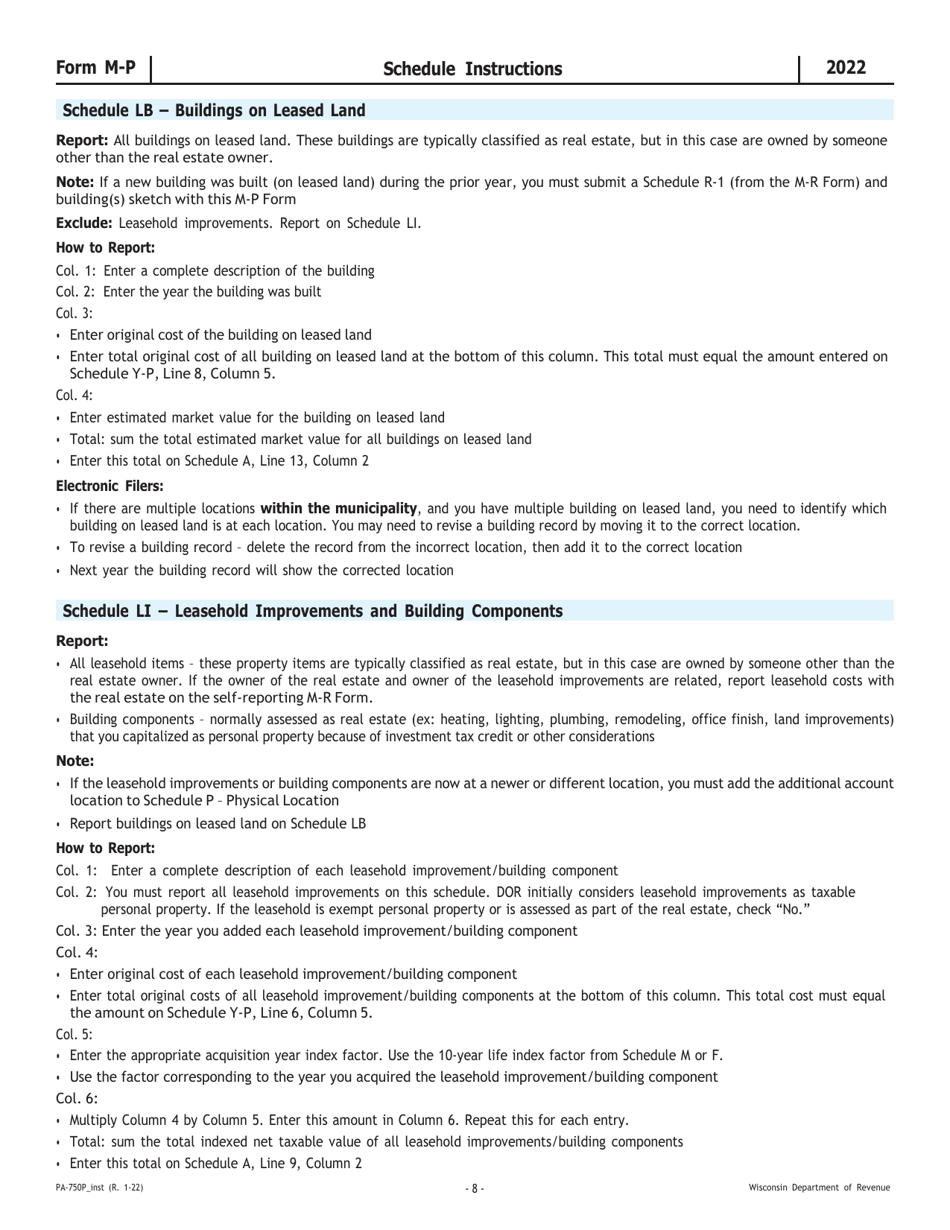

A: Form M-P, PA-750P is used to report personal property used in manufacturing or processing activities for assessment and taxation purposes.

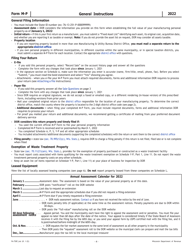

Q: When is Form M-P, PA-750P due?

A: Form M-P, PA-750P is due by March 1st of each year.

Instruction Details:

- This 16-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.