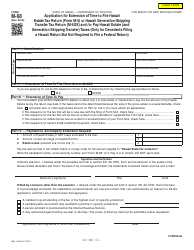

This version of the form is not currently in use and is provided for reference only. Download this version of

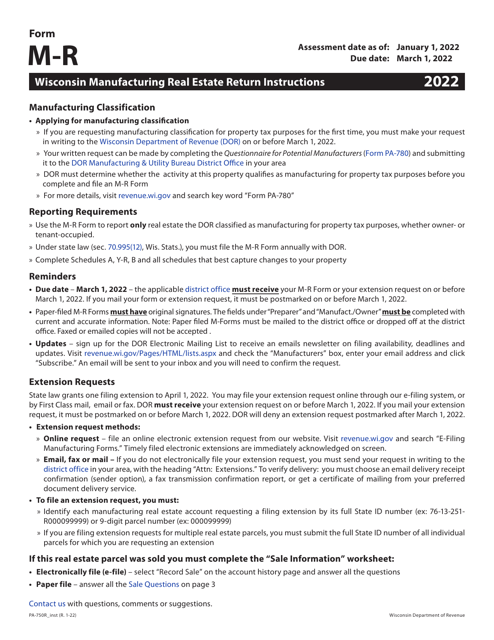

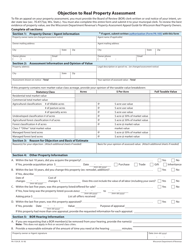

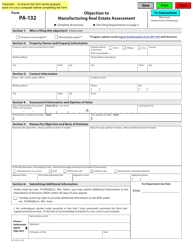

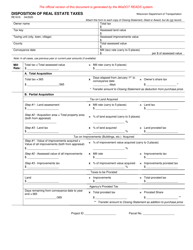

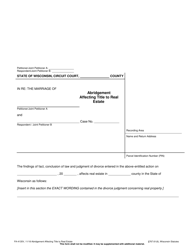

Instructions for Form M-R, PA-750R

for the current year.

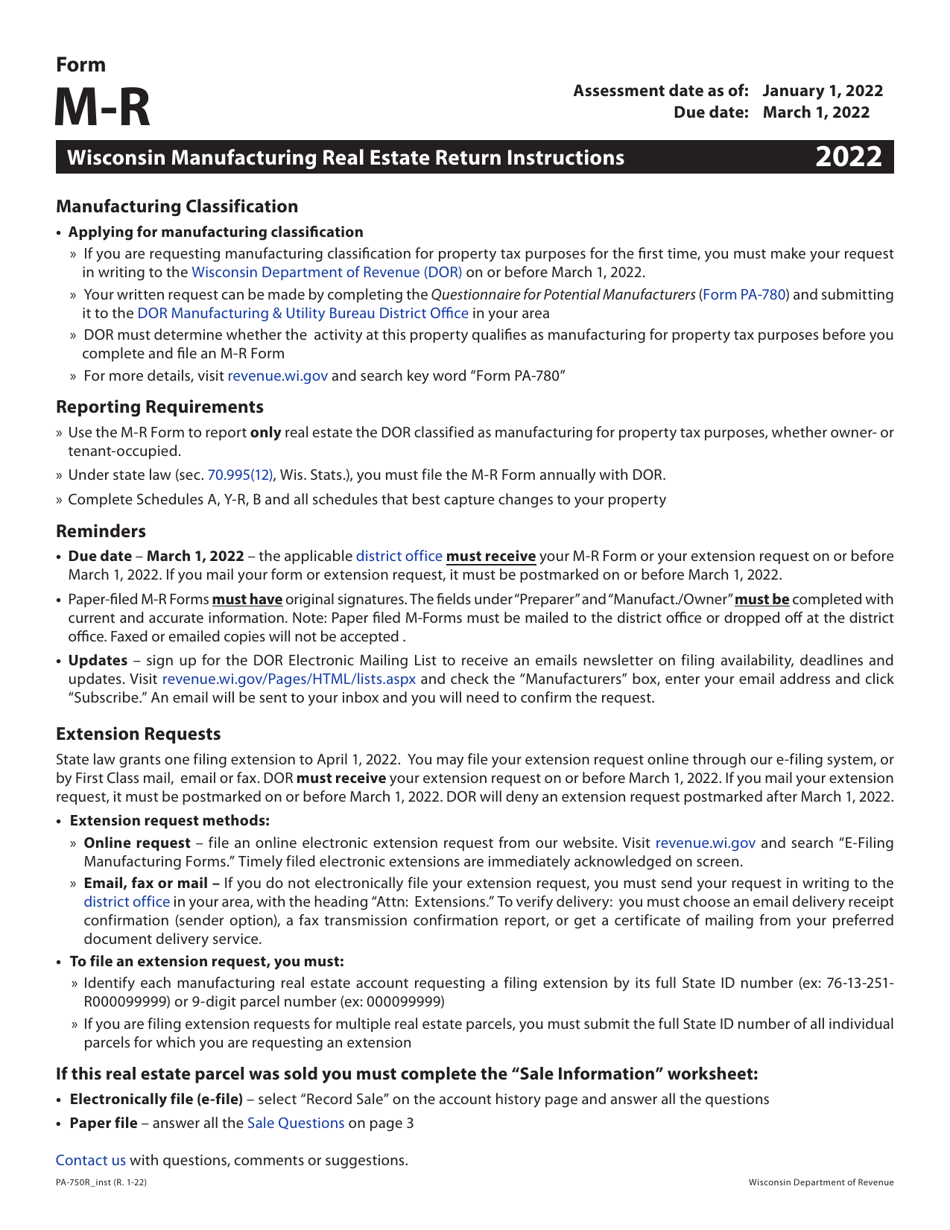

Instructions for Form M-R, PA-750R Wisconsin Manufacturing Real Estate Return - Wisconsin

This document contains official instructions for Form M-R , and Form PA-750R . Both forms are released and collected by the Wisconsin Department of Revenue.

FAQ

Q: What is Form M-R, PA-750R?

A: Form M-R, PA-750R is the Wisconsin Manufacturing Real Estate Return.

Q: Who needs to file Form M-R, PA-750R?

A: Any person or entity owning or leasing qualified manufacturing property in Wisconsin needs to file Form M-R, PA-750R.

Q: What is qualified manufacturing property?

A: Qualified manufacturing property is real estate used for manufacturing activities in Wisconsin.

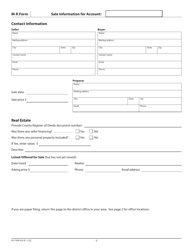

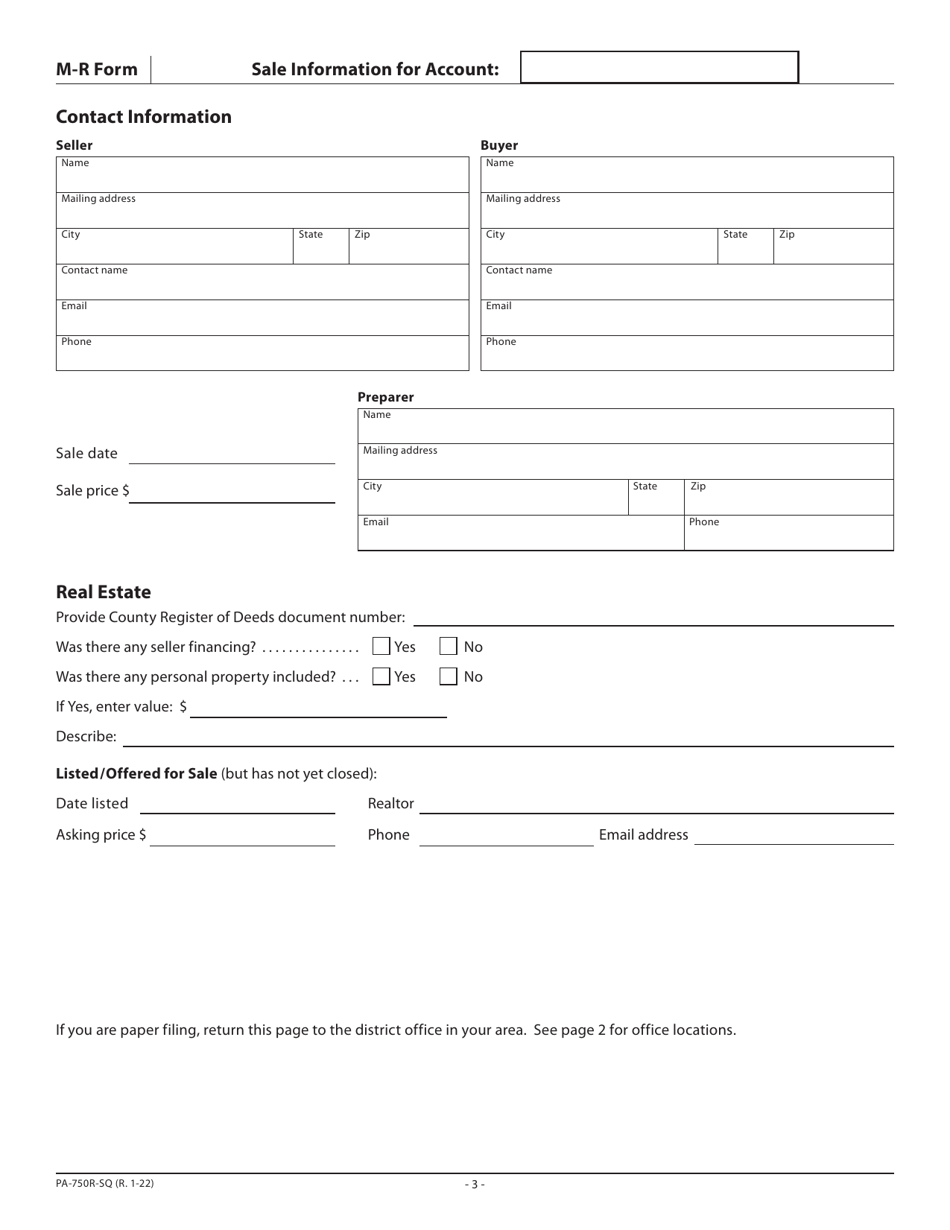

Q: What information do I need to provide on Form M-R, PA-750R?

A: You will need to provide information about the property, such as its location, size, and value, as well as information about any improvements or additions.

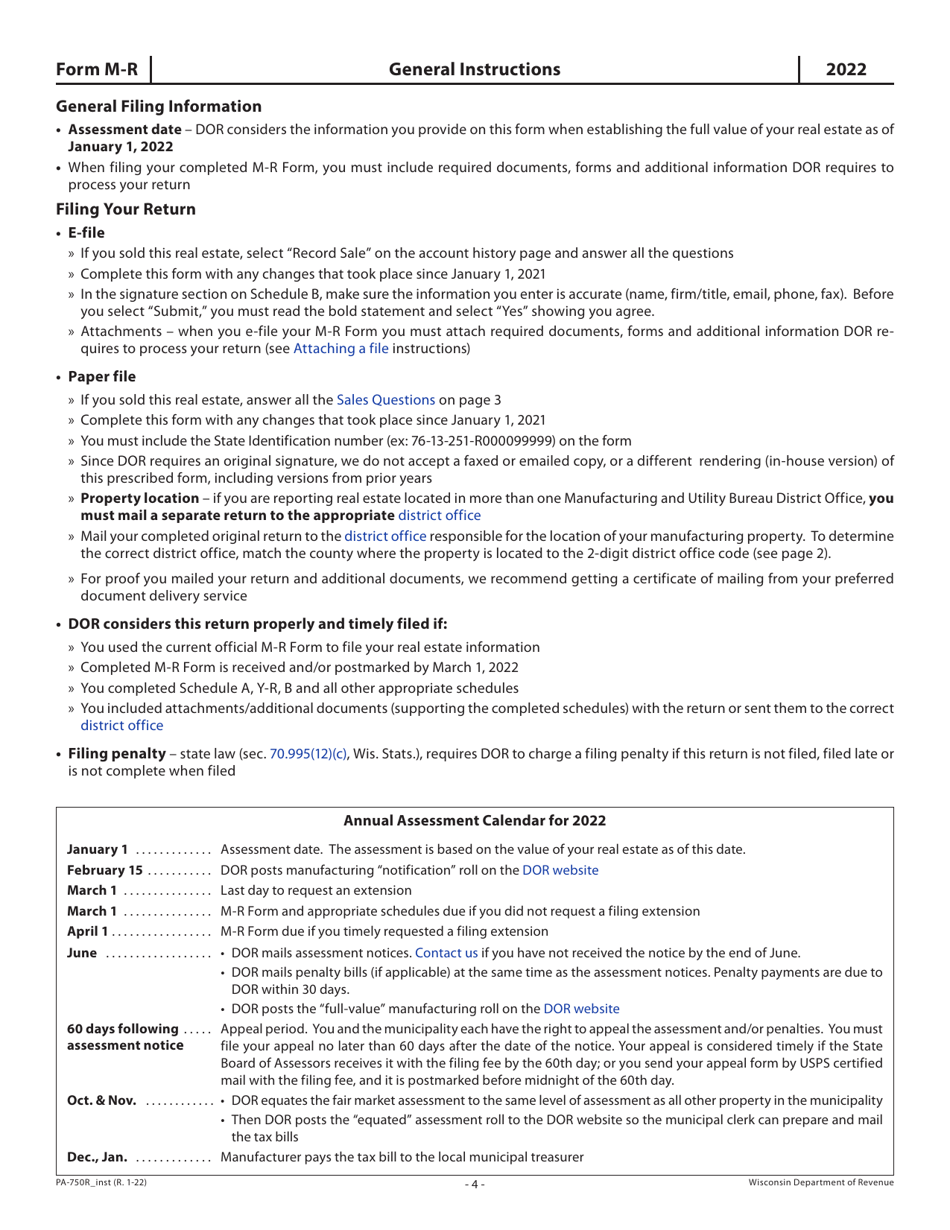

Q: When is the deadline to file Form M-R, PA-750R?

A: Form M-R, PA-750R must be filed on or before March 1st of each year.

Q: Are there any penalties for late filing or non-filing?

A: Yes, there are penalties for late filing or non-filing, including interest charges and potential legal action.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Wisconsin Department of Revenue.