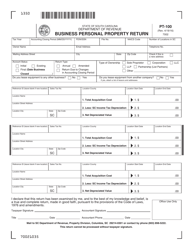

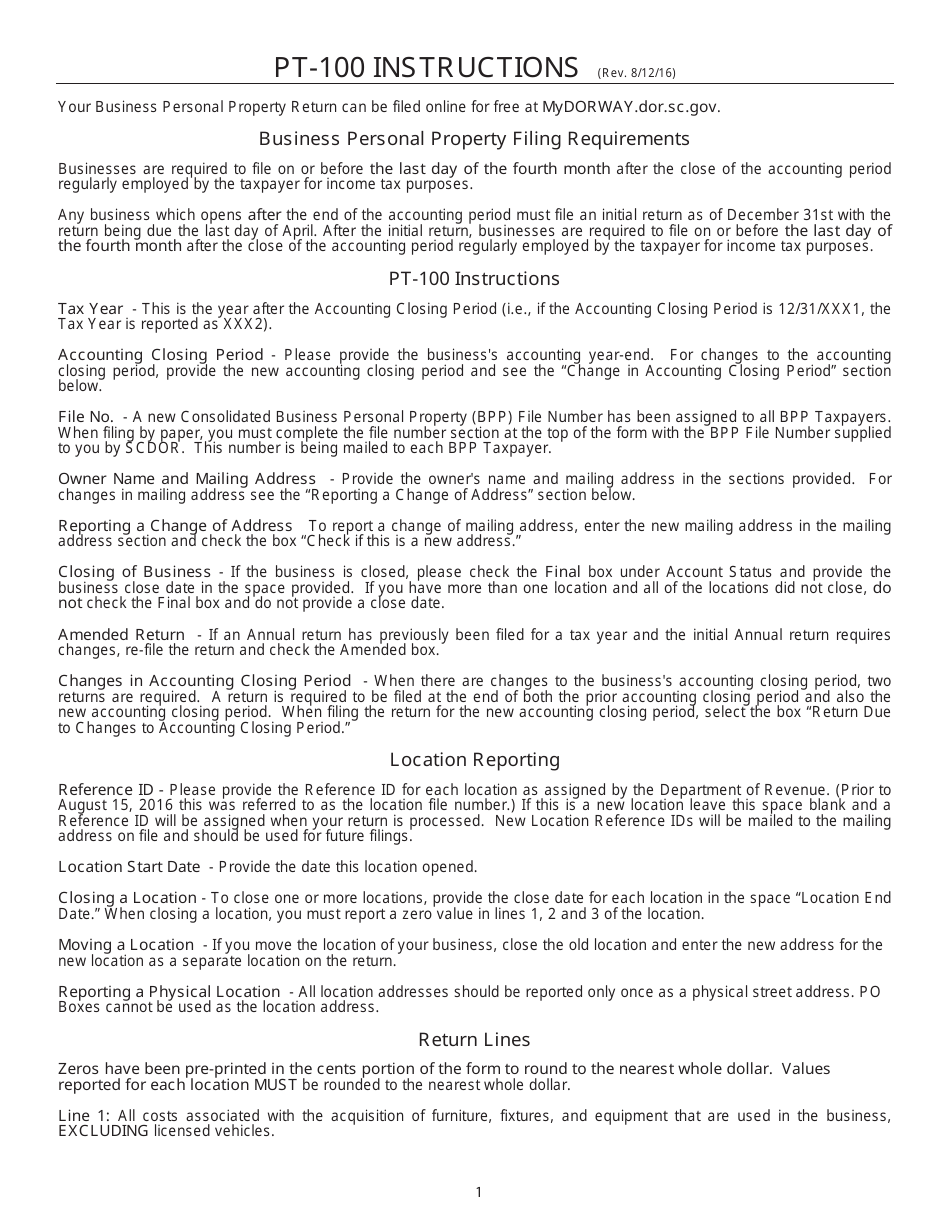

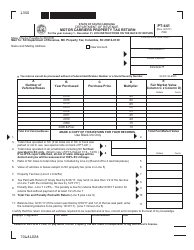

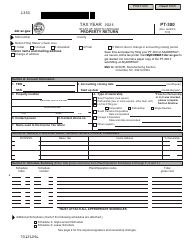

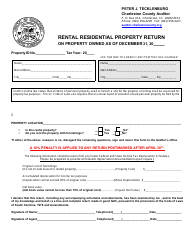

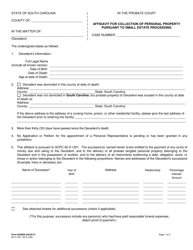

Instructions for Form PT-100 Business Personal Property Return - South Carolina

This document contains official instructions for Form PT-100 , Business Personal Property Return - a form released and collected by the South Carolina Department of Revenue. An up-to-date fillable Form PT-100 is available for download through this link.

FAQ

Q: What is Form PT-100?

A: Form PT-100 is the Business Personal Property Return in South Carolina.

Q: Who needs to file Form PT-100?

A: All businesses operating in South Carolina are required to file Form PT-100.

Q: When is Form PT-100 due?

A: Form PT-100 is due by April 30th each year.

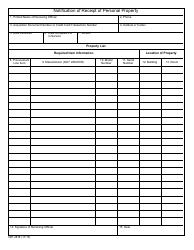

Q: What information do I need to provide on Form PT-100?

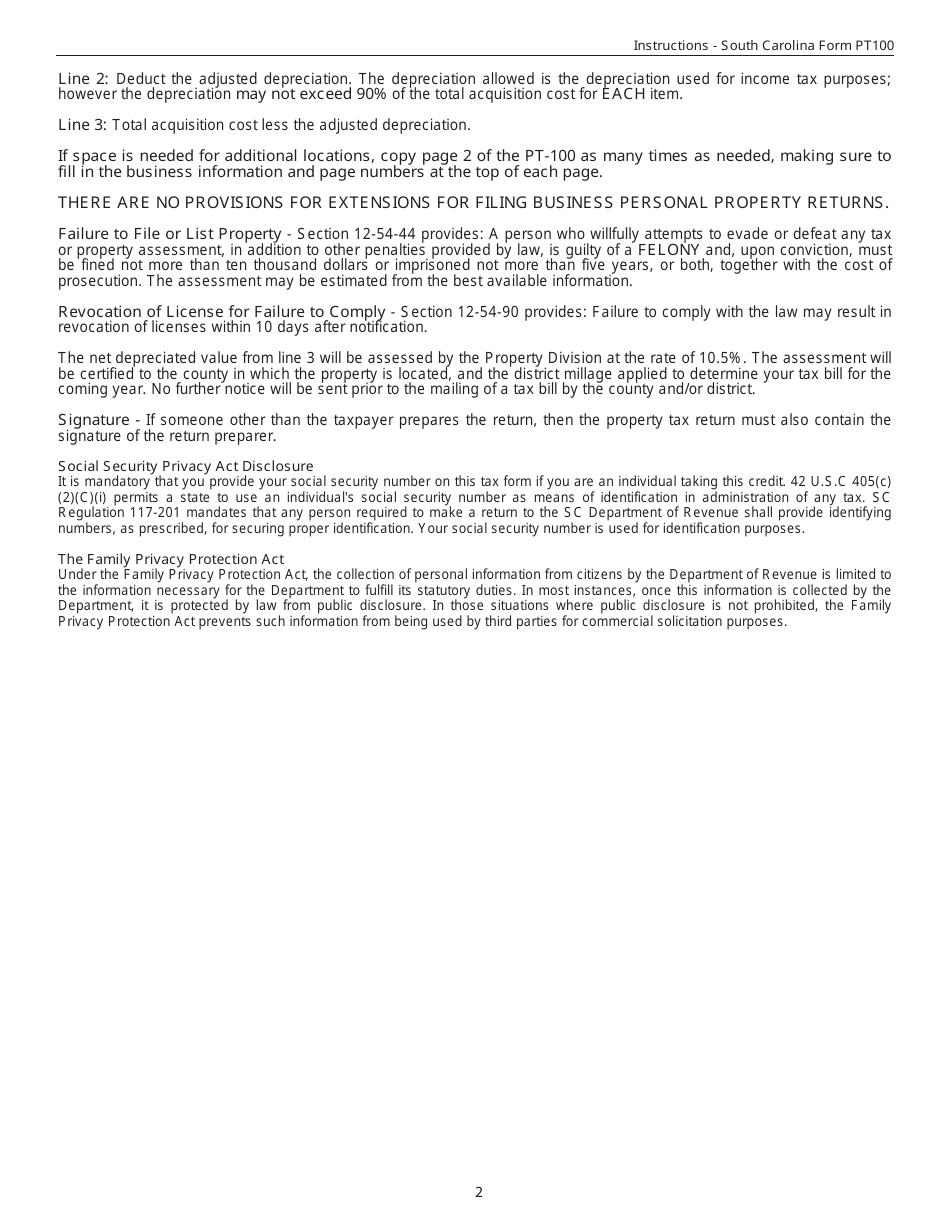

A: You need to provide information about your business personal property, including a description, acquisition date, original cost, and current value.

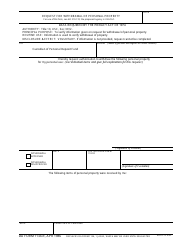

Q: Are there any penalties for not filing Form PT-100?

A: Yes, there are penalties for not filing or late filing of Form PT-100, including possible fines and interest charges.

Q: Can I claim any exemptions on Form PT-100?

A: Yes, there are exemptions available for certain types of property, such as inventory held for sale or personal property used for agricultural purposes.

Q: How often do I need to file Form PT-100?

A: Form PT-100 needs to be filed annually by April 30th.

Q: What if my business has no personal property to report?

A: If your business has no personal property to report, you still need to file a "No Activity" return indicating that no personal property is owned.

Q: Is there a fee to file Form PT-100?

A: There is no fee to file Form PT-100, but penalties may apply for late filing or failure to file.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the South Carolina Department of Revenue.