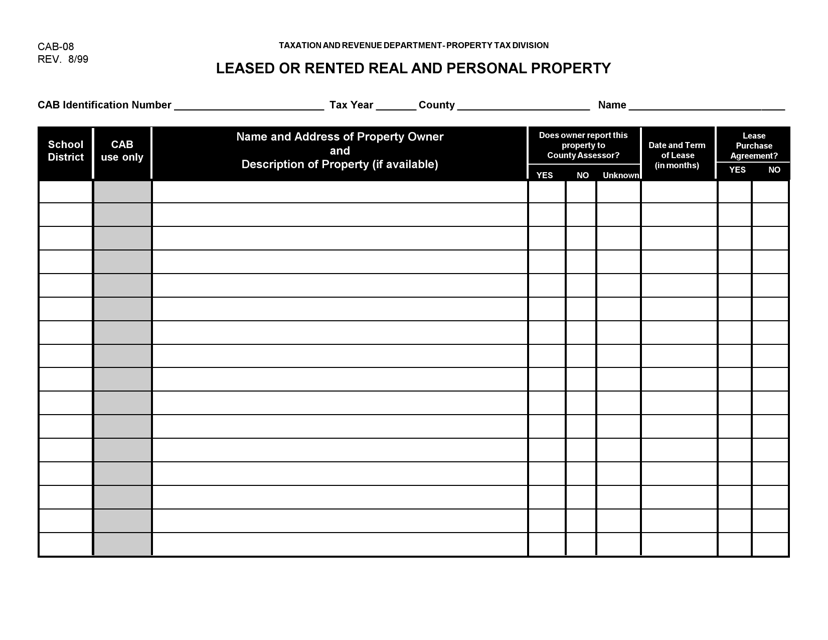

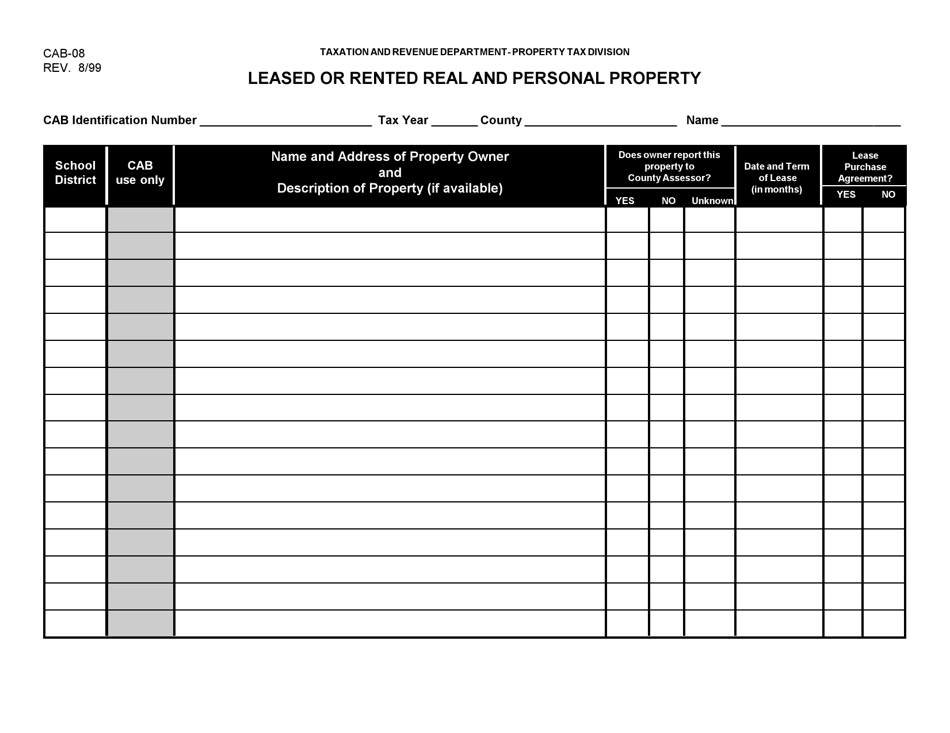

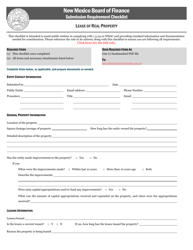

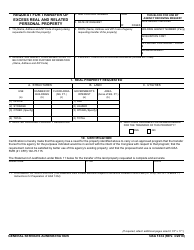

Form CAB-08 Leased or Rented Real and Personal Property - New Mexico

What Is Form CAB-08?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CAB-08?

A: CAB-08 is a form used for reporting leased or rented real and personal property in New Mexico.

Q: Who should use form CAB-08?

A: Anyone who leases or rents real and personal property in New Mexico should use form CAB-08.

Q: What information is required on form CAB-08?

A: Form CAB-08 requires information about the lessor/renter, the property being leased/rented, and the terms of the lease/rental agreement.

Q: Is there a deadline for filing form CAB-08?

A: Yes, form CAB-08 must be filed by April 1st of each year for the previous calendar year.

Q: Are there any penalties for late filing of form CAB-08?

A: Yes, late filing of form CAB-08 may result in penalties and interest.

Q: Is form CAB-08 required for both real and personal property leases/rentals?

A: Yes, form CAB-08 is required for both real and personal property leases/rentals.

Q: What should I do if I am no longer leasing/renting the property reported on form CAB-08?

A: If you are no longer leasing/renting the property, you should notify the New Mexico Taxation and Revenue Department.

Q: Are there any exemptions from filing form CAB-08?

A: Yes, certain types of leases/rentals may be exempt from filing form CAB-08. It is recommended to consult the New Mexico Taxation and Revenue Department for specific details.

Form Details:

- Released on August 1, 1999;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CAB-08 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.