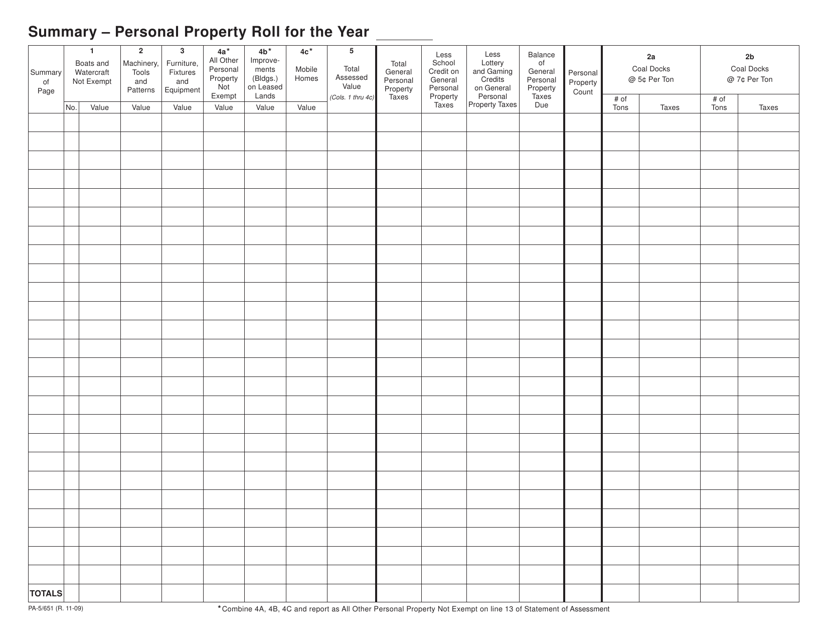

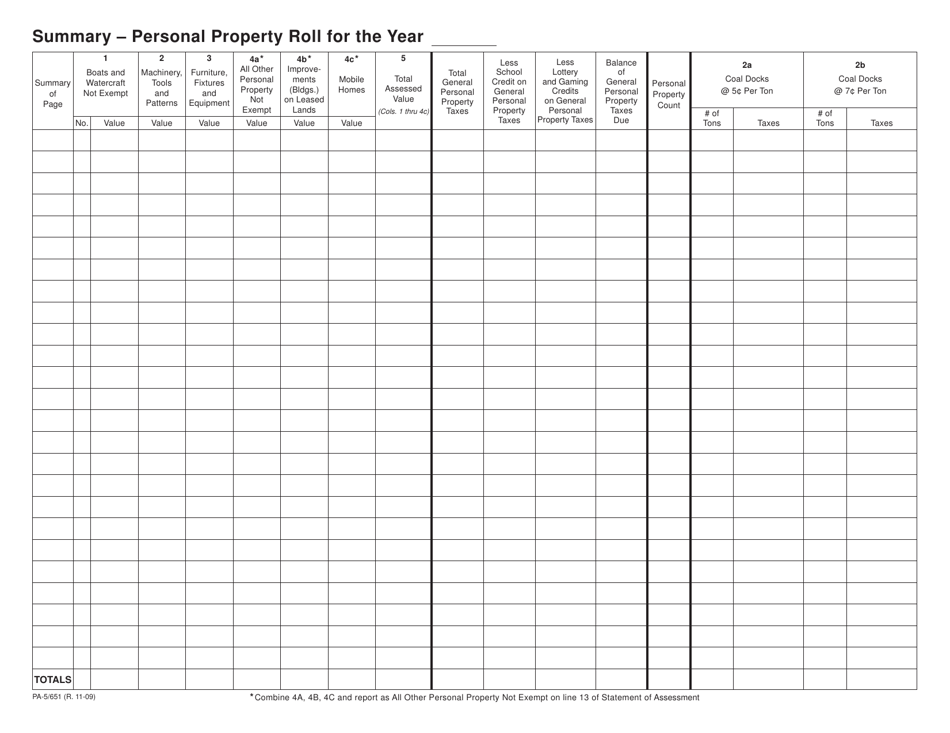

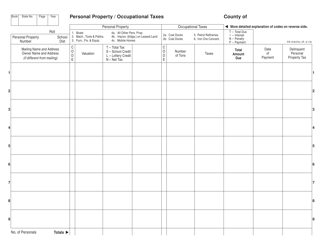

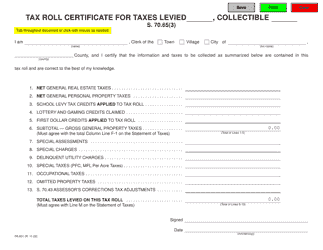

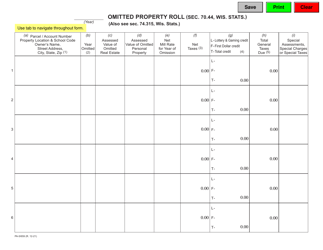

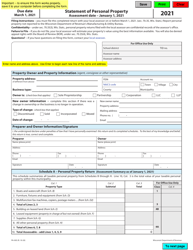

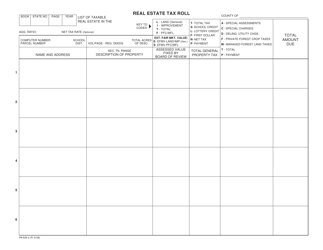

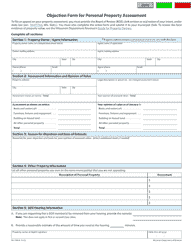

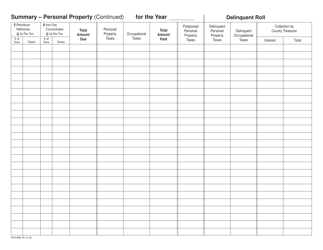

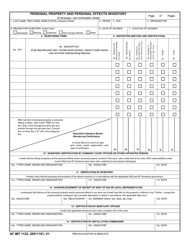

Form PA-5 / 651 Summary - Personal Property Roll - Wisconsin

What Is Form PA-5/651?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-5/651?

A: Form PA-5/651 is a summary of personal property roll in Wisconsin.

Q: What is a personal property roll?

A: A personal property roll is a record of all taxable personal property in a specific jurisdiction.

Q: Who is required to file Form PA-5/651?

A: Individuals and businesses who own taxable personal property in Wisconsin are required to file Form PA-5/651.

Q: When is Form PA-5/651 due?

A: Form PA-5/651 is due by March 1st of each year.

Q: What information is required on Form PA-5/651?

A: Form PA-5/651 requires information such as the name and address of the property owner, a description of the property, and its assessed value.

Q: What happens if I fail to file Form PA-5/651?

A: Failure to file Form PA-5/651 may result in penalties and interest being imposed on the property owner.

Form Details:

- Released on November 1, 2009;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-5/651 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.