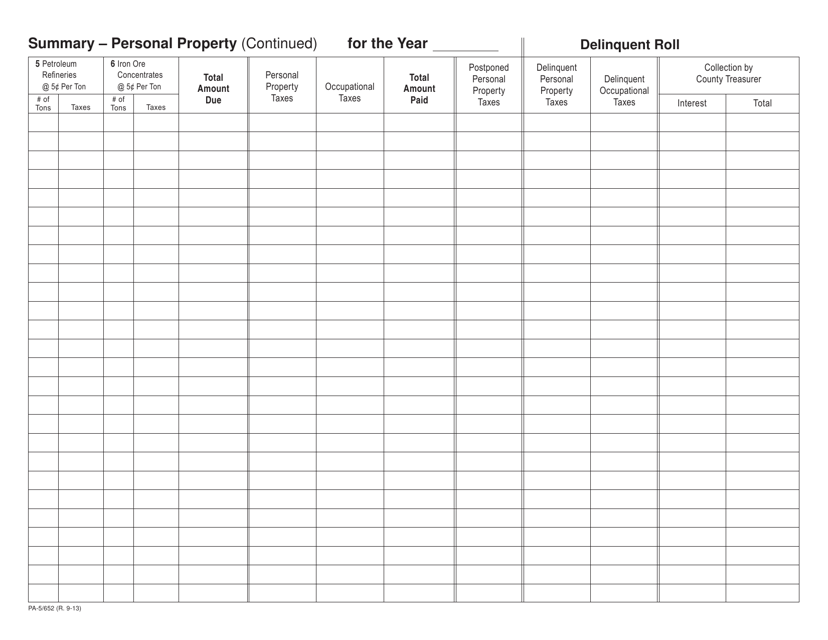

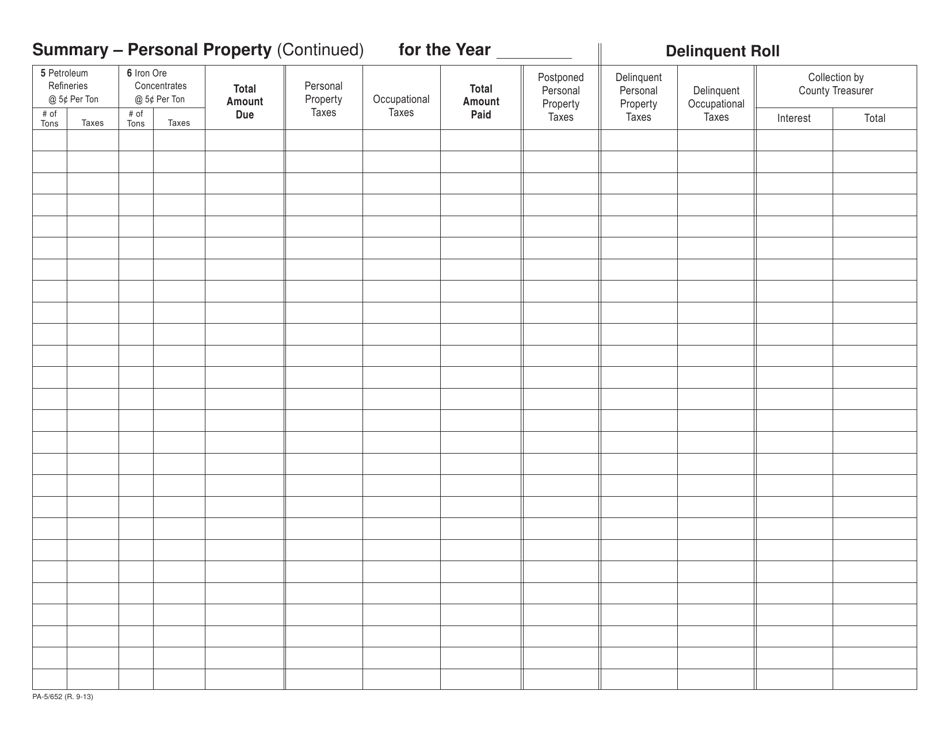

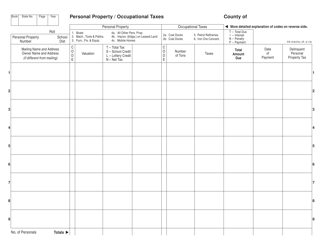

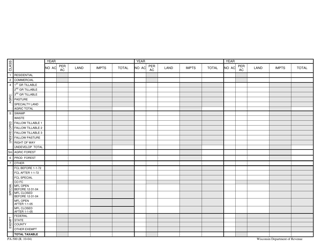

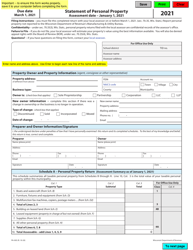

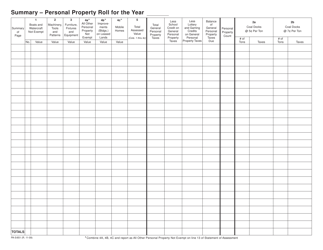

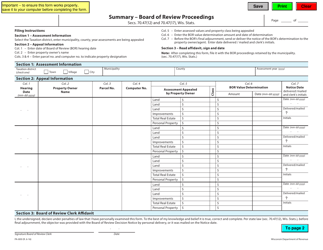

Form PA-5-652 Summary - Personal Property (Continued) - Wisconsin

What Is Form PA-5-652?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-5-652?

A: Form PA-5-652 is a summary for reporting personal property in Wisconsin.

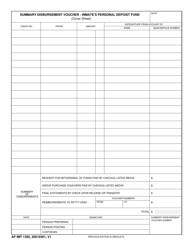

Q: What is personal property?

A: Personal property refers to movable assets such as furniture, vehicles, machinery, and equipment.

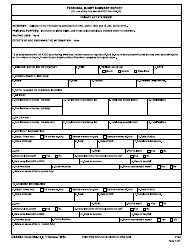

Q: Who needs to file Form PA-5-652?

A: Anyone who owns personal property in Wisconsin is required to file Form PA-5-652.

Q: When is Form PA-5-652 due?

A: Form PA-5-652 is due on or before March 1st of each year.

Q: What happens if Form PA-5-652 is not filed?

A: Failure to file Form PA-5-652 may result in penalties and interest.

Q: Are there any exemptions for filing Form PA-5-652?

A: Yes, there are certain exemptions for individuals who meet specific criteria. Please refer to the instructions on Form PA-5-652 for more information.

Q: What should I do if I no longer own the personal property listed on Form PA-5-652?

A: If you no longer own the personal property listed on Form PA-5-652, you should notify the Wisconsin Department of Revenue to update your records.

Q: Is there a fee to file Form PA-5-652?

A: No, there is no fee to file Form PA-5-652.

Form Details:

- Released on September 1, 2013;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PA-5-652 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.