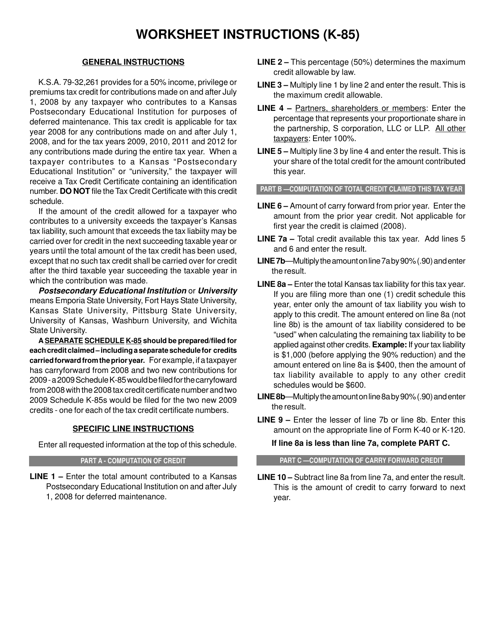

Instructions for Schedule K-85 University Deferred Maintenance Credit - Kansas

This document contains official instructions for Schedule K-85 , University Deferred Maintenance Credit - a form released and collected by the Kansas Department of Revenue.

FAQ

Q: What is Schedule K-85?

A: Schedule K-85 is a Kansas tax form used to claim the University Deferred Maintenance Credit.

Q: What is the University Deferred Maintenance Credit?

A: The University Deferred Maintenance Credit is a tax credit available in Kansas to eligible taxpayers who make qualifying contributions to universities for deferred maintenance.

Q: Who is eligible to claim the University Deferred Maintenance Credit?

A: Individuals, corporations, and fiduciaries that make qualifying contributions to Kansas universities for deferred maintenance are eligible to claim the credit.

Q: What are qualifying contributions?

A: Qualifying contributions are monetary contributions made to Kansas universities for deferred maintenance projects.

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the qualifying contributions made in a taxable year.

Q: Are there any limitations on the tax credit?

A: Yes, the credit is limited to the lesser of the taxpayer's liability or $2 million per taxable year.

Q: How do I claim the University Deferred Maintenance Credit?

A: To claim the credit, complete Schedule K-85 and attach it to your Kansas income tax return.

Q: Is there a deadline to claim the credit?

A: Yes, the credit must be claimed on the taxpayer's original income tax return or within one year from the original due date of the return, whichever is later.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Kansas Department of Revenue.