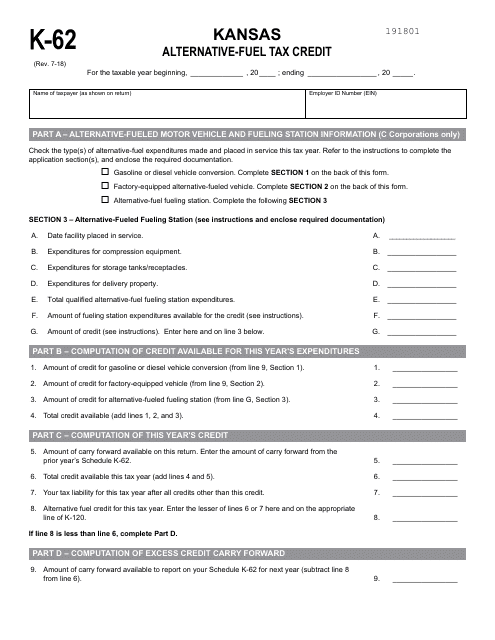

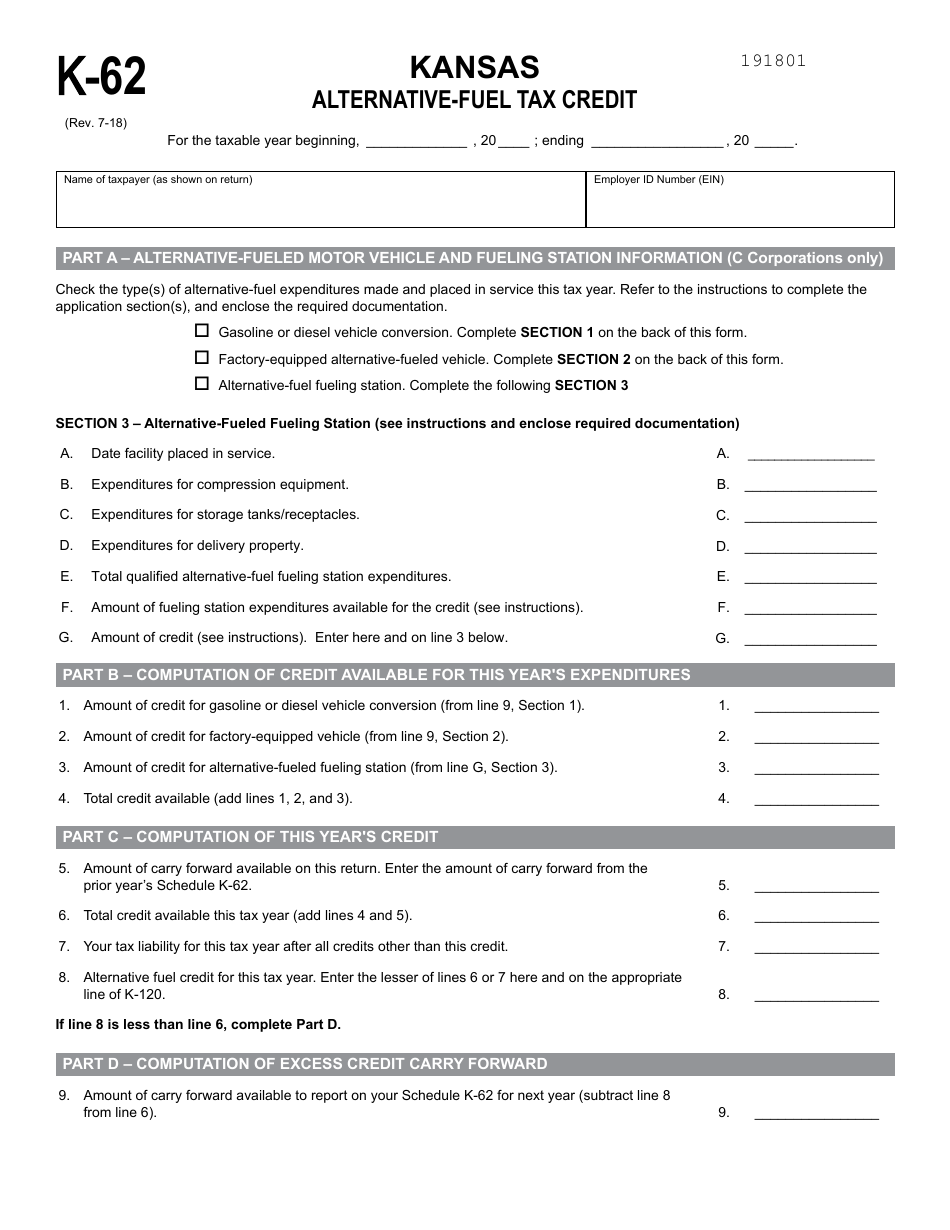

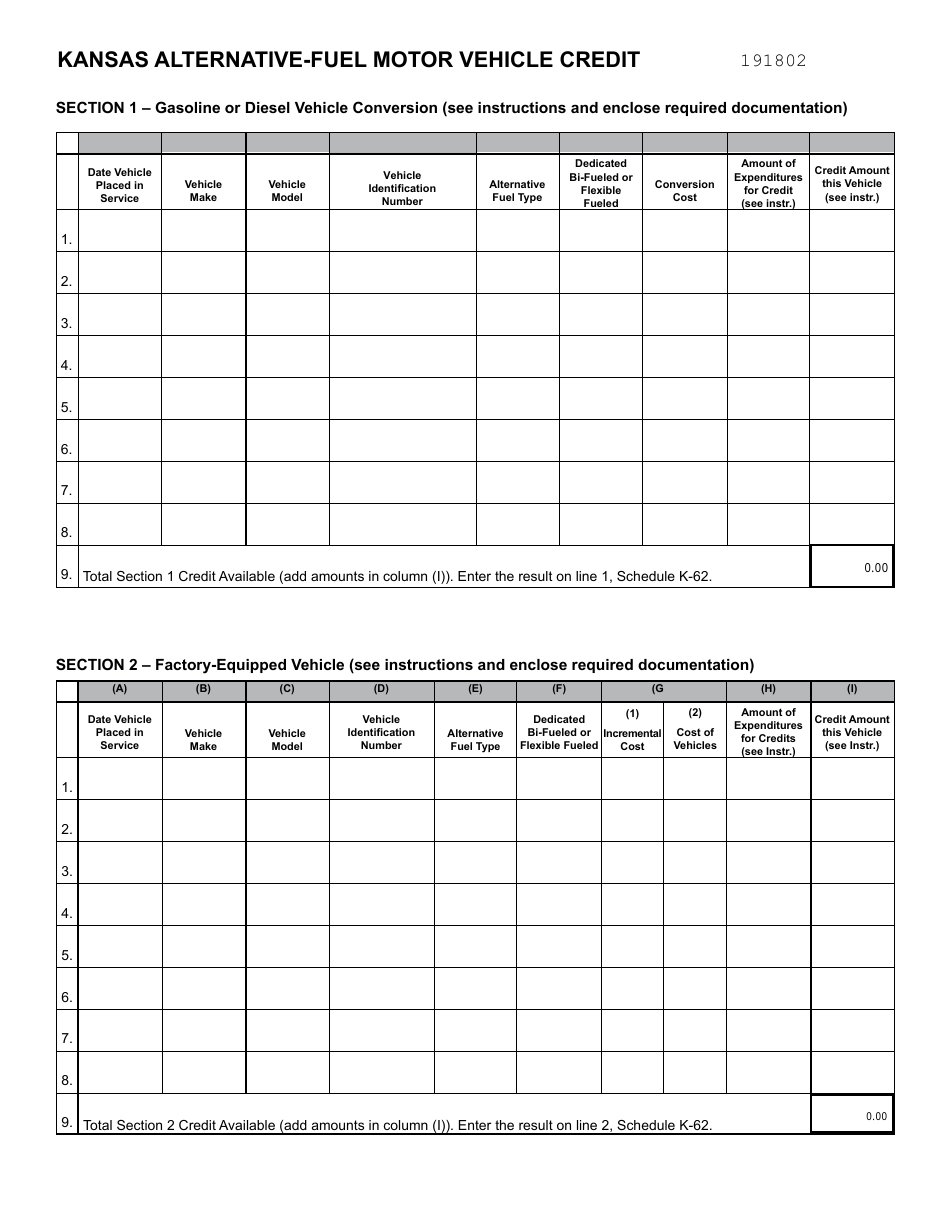

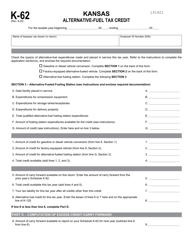

Form K-62 Alternative-Fuel Tax Credit - Kansas

What Is Form K-62?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-62?

A: Form K-62 is a tax form used to claim the Alternative-Fuel Tax Credit in the state of Kansas.

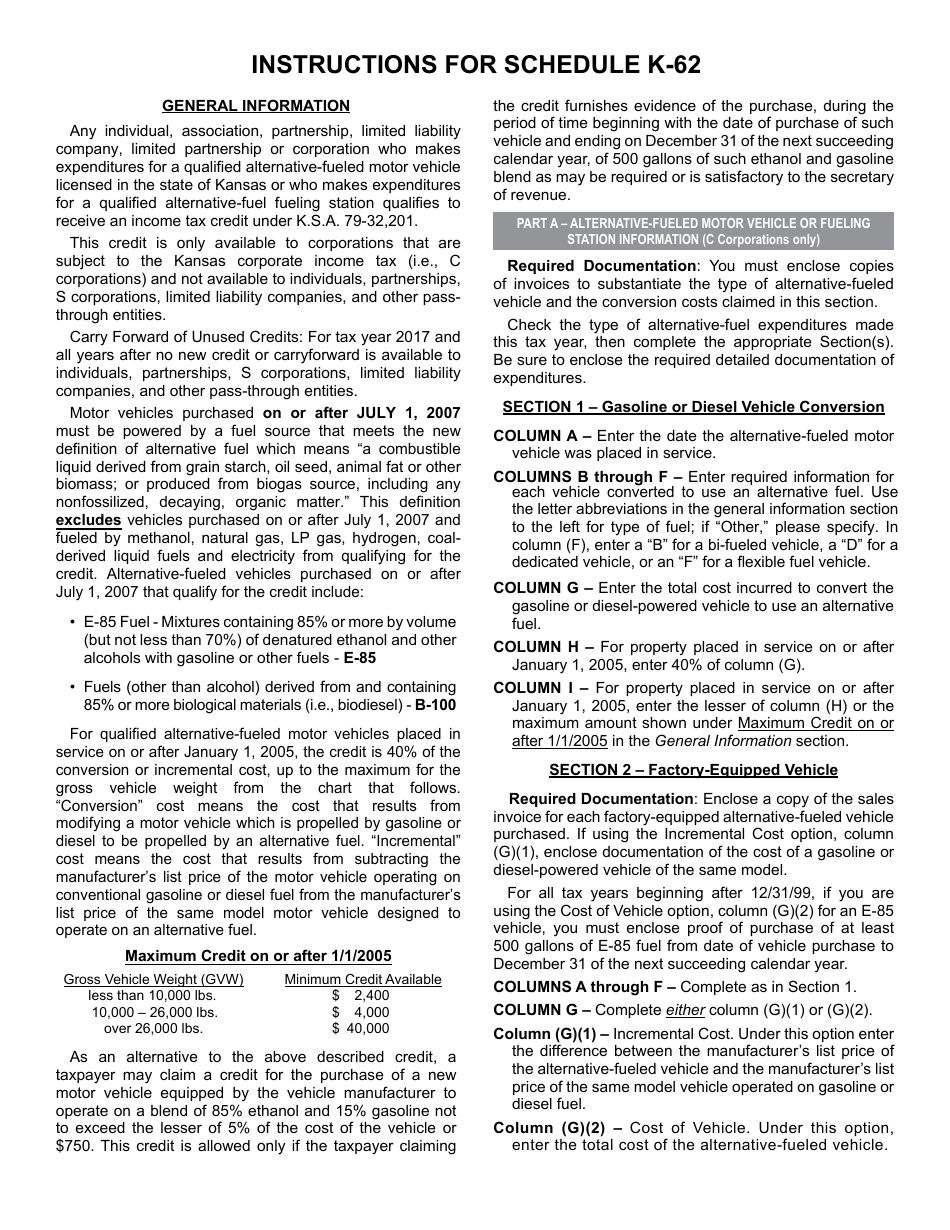

Q: What is the Alternative-Fuel Tax Credit?

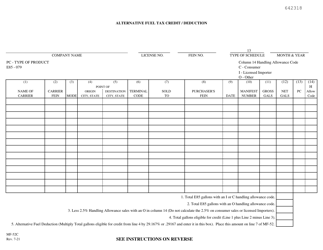

A: The Alternative-Fuel Tax Credit is a tax incentive offered by the state of Kansas for the use of alternative fuels, such as ethanol or biodiesel.

Q: Who can claim the Alternative-Fuel Tax Credit?

A: Any individual or business in Kansas that uses alternative fuels in their vehicles or equipment can claim the Alternative-Fuel Tax Credit.

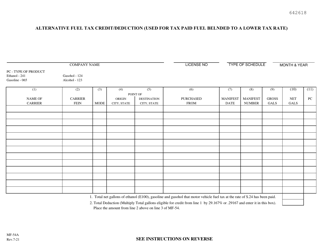

Q: What types of alternative fuels are eligible for the tax credit?

A: Eligible alternative fuels for the tax credit include ethanol, biodiesel, compressed natural gas, propane, electricity, hydrogen, and other fuels approved by the Kansas Department of Revenue.

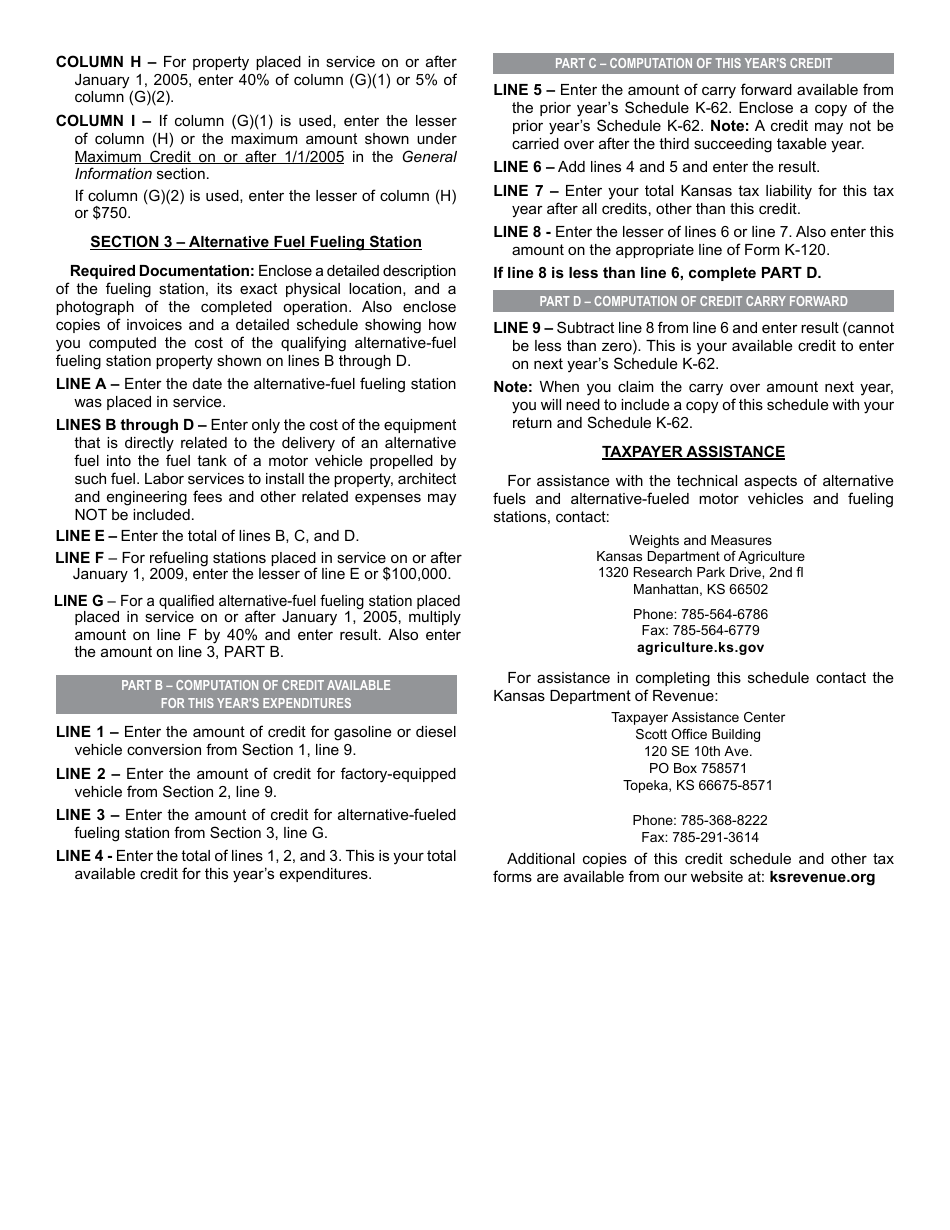

Q: How much is the tax credit?

A: The amount of the tax credit varies depending on the type and amount of alternative fuel used. The credit is generally calculated based on a per-gallon equivalent basis.

Q: How do I claim the Alternative-Fuel Tax Credit?

A: To claim the tax credit, you must complete and submit Form K-62 to the Kansas Department of Revenue. The form requires you to provide information about the type and amount of alternative fuel used, as well as supporting documentation.

Q: Is there a deadline for claiming the tax credit?

A: Yes, the deadline for claiming the Alternative-Fuel Tax Credit is the same as the deadline for filing your state income tax return.

Q: Can the tax credit be carried forward or backward?

A: Yes, any unused portion of the Alternative-Fuel Tax Credit can be carried forward to future tax years or carried back to previous tax years.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are certain limitations and restrictions on the tax credit, including a maximum credit amount, requirements for documentation, and restrictions on claiming the credit for fuel used in certain vehicles or equipment.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-62 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.