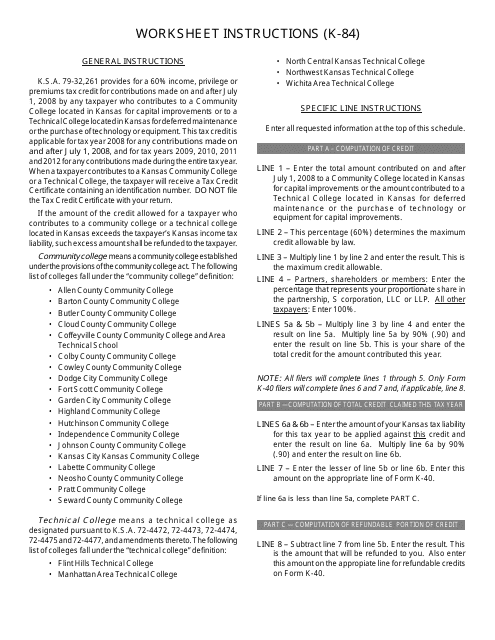

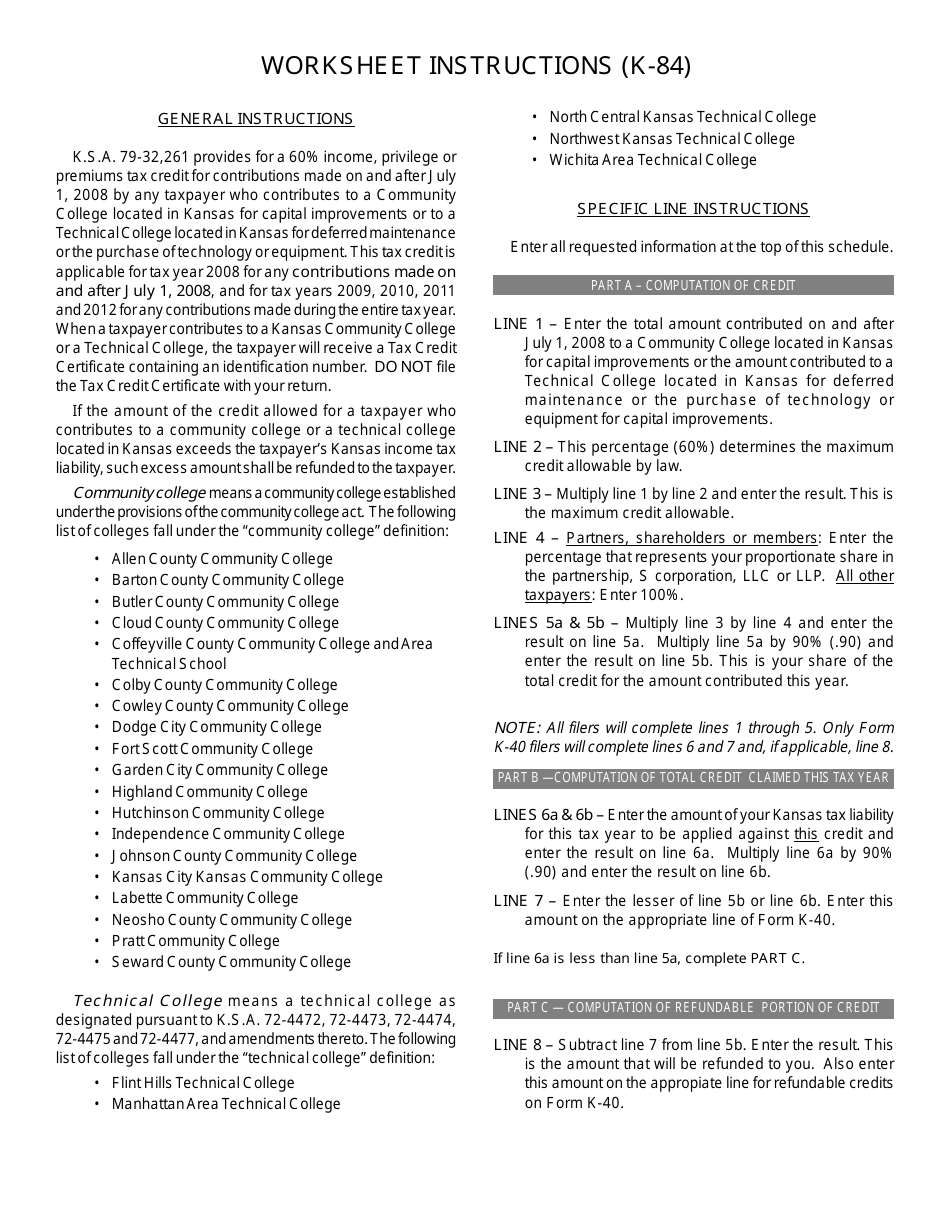

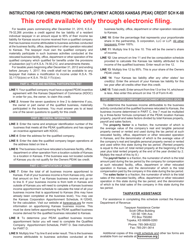

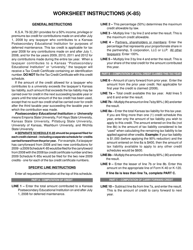

Instructions for Worksheet K-84 Technical and Community College Deferred Maintenance Credit - Kansas

This document contains official instructions for Worksheet K-84 , Technical and Community College Deferred Maintenance Credit - a form released and collected by the Kansas Department of Revenue.

FAQ

Q: What is Worksheet K-84?

A: Worksheet K-84 is a document that provides instructions for claiming the Technical and Community College Deferred Maintenance Credit in Kansas.

Q: What is the purpose of the Deferred Maintenance Credit?

A: The Deferred Maintenance Credit is meant to provide financial assistance to technical and community colleges in Kansas for the purpose of addressing deferred maintenance needs.

Q: Who is eligible to claim the Deferred Maintenance Credit?

A: Technical and community colleges in Kansas are eligible to claim the Deferred Maintenance Credit.

Q: How can colleges claim the Deferred Maintenance Credit?

A: Colleges can claim the Deferred Maintenance Credit by completing Worksheet K-84 and submitting it along with their income tax return.

Q: Are there any specific requirements for claiming the Deferred Maintenance Credit?

A: Yes, colleges must have incurred qualified deferred maintenance expenses and have received approval from the Kansas Board of Regents in order to claim the credit.

Q: What expenses are considered qualified deferred maintenance expenses?

A: Qualified deferred maintenance expenses include costs for the repair, renovation, or replacement of buildings, utilities, or infrastructure.

Q: Is there a limit on the amount of credit that can be claimed?

A: Yes, the maximum credit that can be claimed is $1 million per tax year.

Q: Are there any deadlines for claiming the Deferred Maintenance Credit?

A: Yes, Worksheet K-84 must be filed with the college's income tax return by the original due date of the return.

Q: Are there any additional documents or forms required to claim the Deferred Maintenance Credit?

A: No, Worksheet K-84 is the primary document required to claim the Deferred Maintenance Credit.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Kansas Department of Revenue.