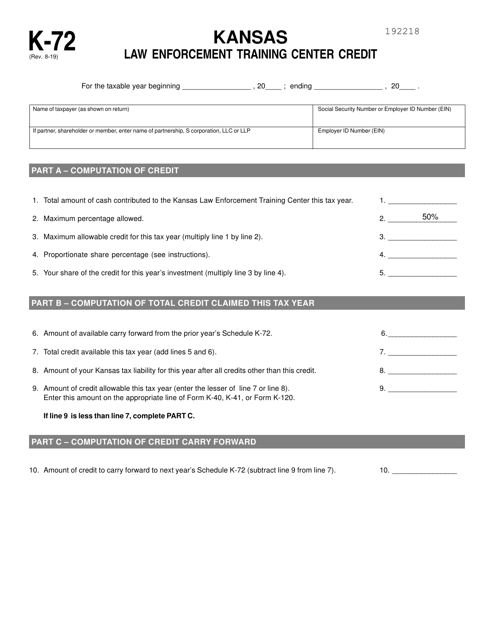

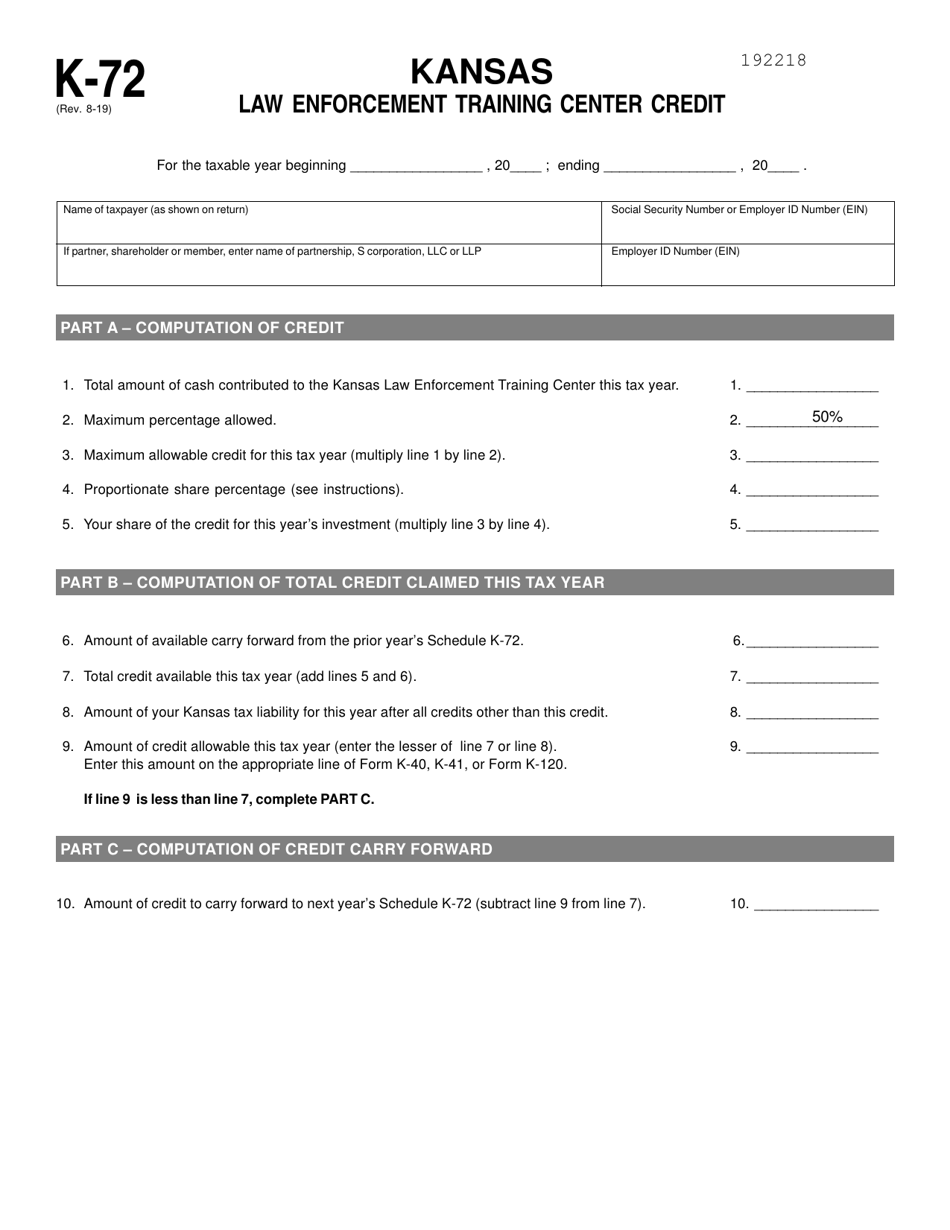

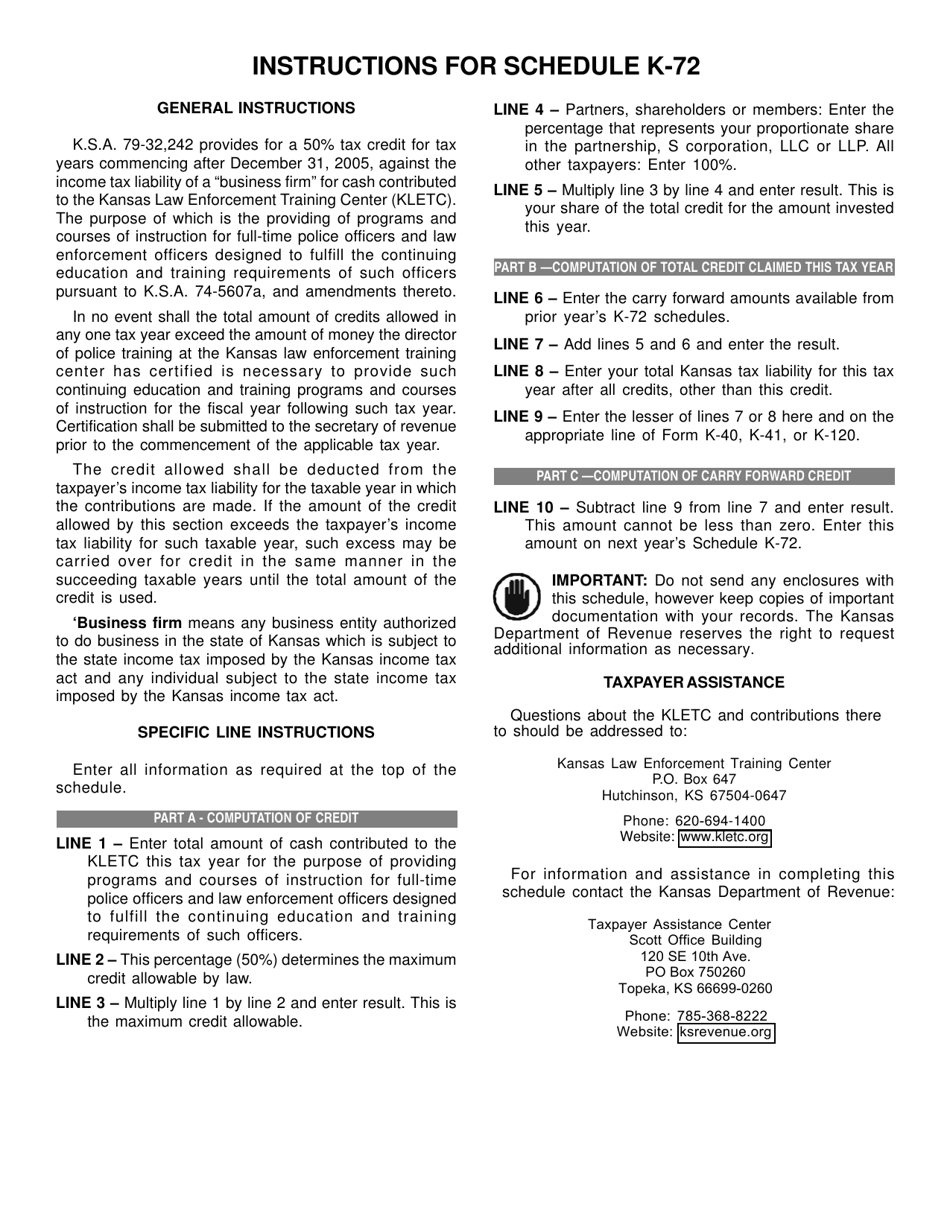

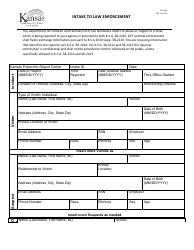

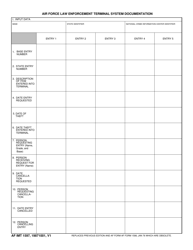

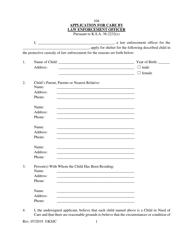

Schedule K-72 Kansas Law Enforcement Training Center Credit - Kansas

What Is Schedule K-72?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-72?

A: Schedule K-72 is a tax form for claiming the Kansas Law Enforcement Training Center Credit.

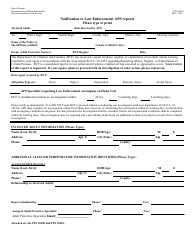

Q: What is the Kansas Law Enforcement Training Center Credit?

A: The Kansas Law Enforcement Training Center Credit is a tax credit available to Kansas residents who have completed training at the Kansas Law Enforcement Training Center.

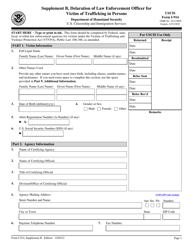

Q: Who is eligible for the Kansas Law Enforcement Training Center Credit?

A: Kansas residents who have completed training at the Kansas Law Enforcement Training Center are eligible for the credit.

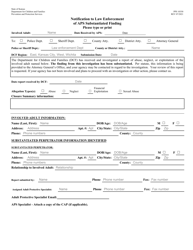

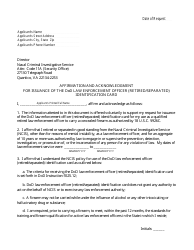

Q: How much is the Kansas Law Enforcement Training Center Credit?

A: The credit amount varies and is based on the number of hours completed at the Kansas Law Enforcement Training Center.

Q: How can I claim the Kansas Law Enforcement Training Center Credit?

A: To claim the credit, you need to complete Schedule K-72 and include it with your Kansas state income tax return.

Q: What documentation do I need to claim the Kansas Law Enforcement Training Center Credit?

A: You will need to provide proof of completion of training at the Kansas Law Enforcement Training Center, such as a certificate or transcript.

Q: Is the Kansas Law Enforcement Training Center Credit refundable?

A: No, the credit is non-refundable, meaning it can only reduce your Kansas state tax liability but cannot result in a refund.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-72 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.