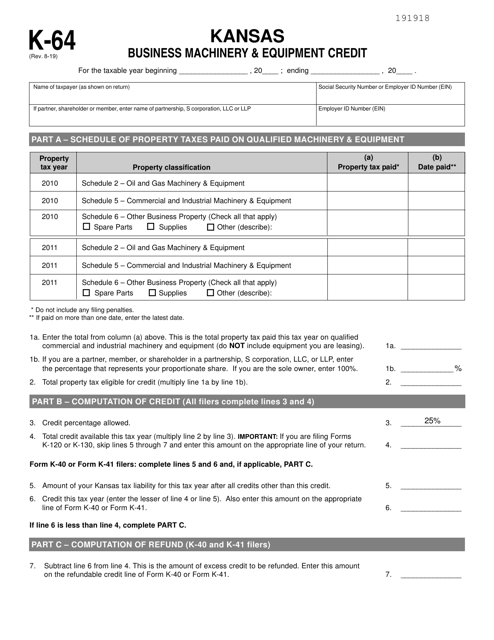

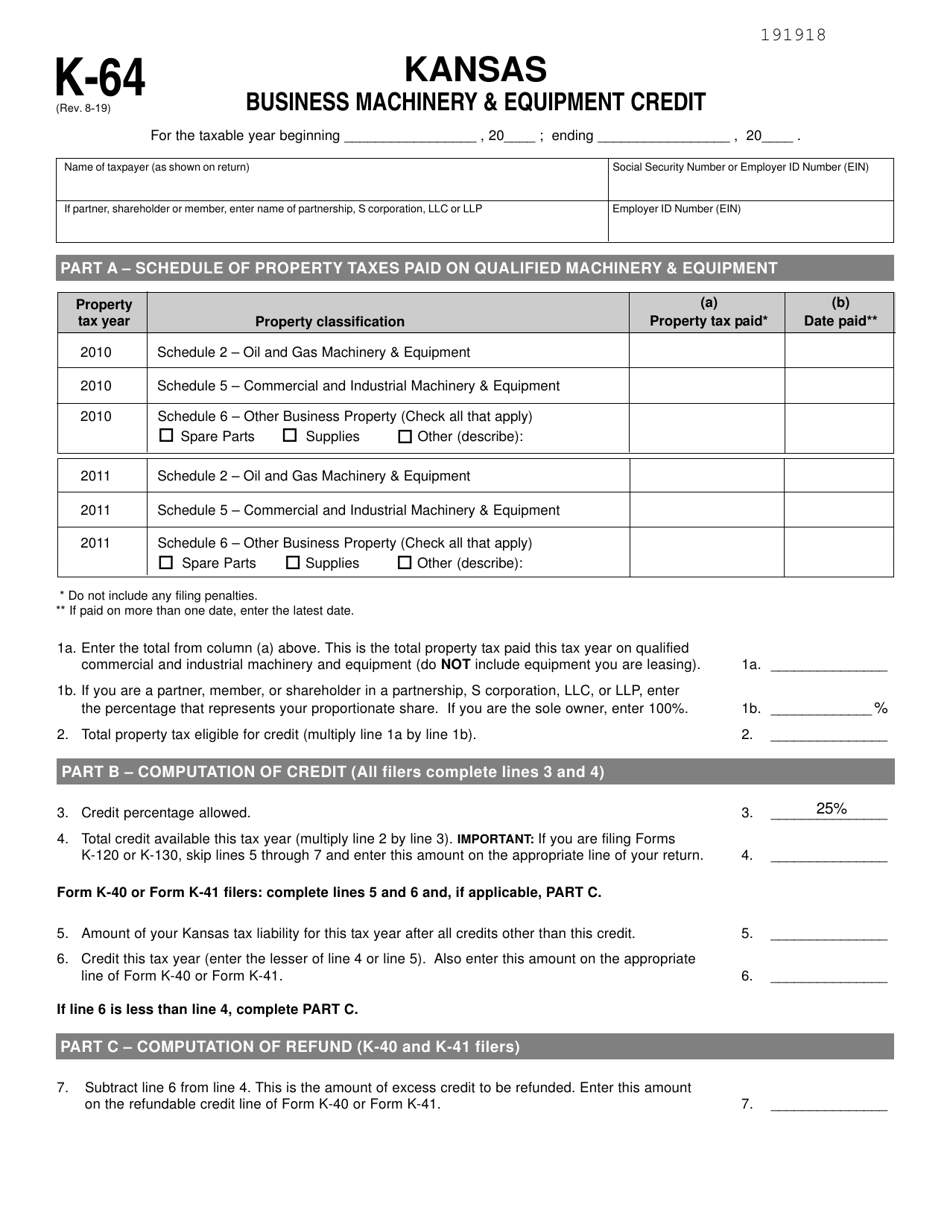

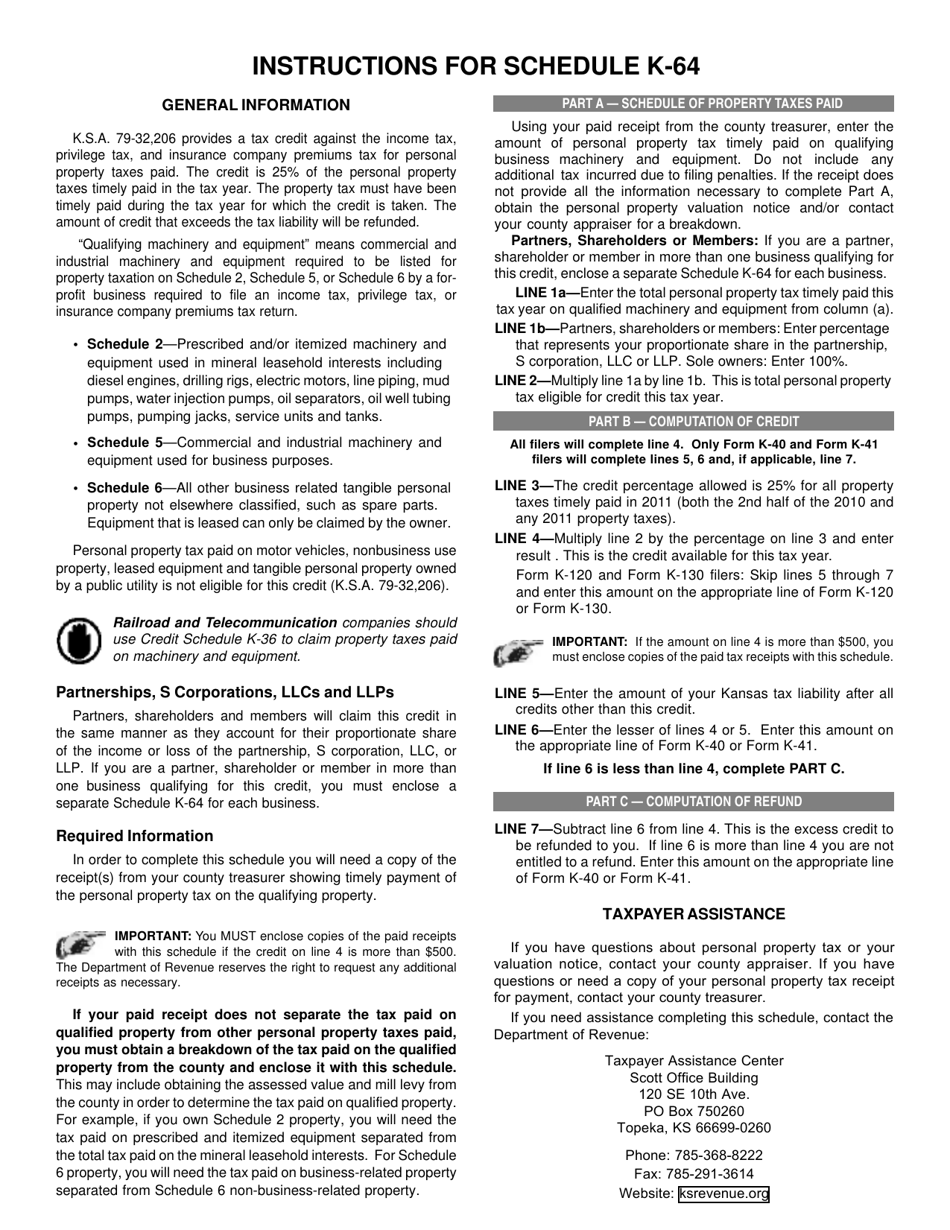

Schedule K-64 Business Machinery & Equipment Credit - Kansas

What Is Schedule K-64?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-64 Business Machinery & Equipment Credit?

A: Schedule K-64 is a tax form in Kansas that allows businesses to claim a credit for purchasing new machinery and equipment.

Q: Who is eligible for the Business Machinery & Equipment Credit?

A: Any business in Kansas that has purchased new machinery and equipment may be eligible for the credit.

Q: How much is the credit?

A: The credit is equal to 10% of the cost of the qualified machinery and equipment.

Q: What is considered qualified machinery and equipment?

A: Qualified machinery and equipment includes items used directly in the manufacturing, production, or processing of tangible personal property.

Q: Is there a maximum credit limit?

A: Yes, the maximum credit that can be claimed is $50,000 per taxable year.

Q: How do I claim the credit?

A: To claim the credit, businesses must complete Schedule K-64 and submit it with their Kansas income tax return.

Q: Can the credit be carried forward?

A: Yes, any unused credit can be carried forward for up to 10 years.

Q: Are there any other requirements to claim the credit?

A: Yes, businesses must meet certain wage and job creation requirements to be eligible for the credit.

Q: Is the Business Machinery & Equipment Credit available in other states?

A: No, the credit is specific to Kansas and is not available in other states.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-64 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.