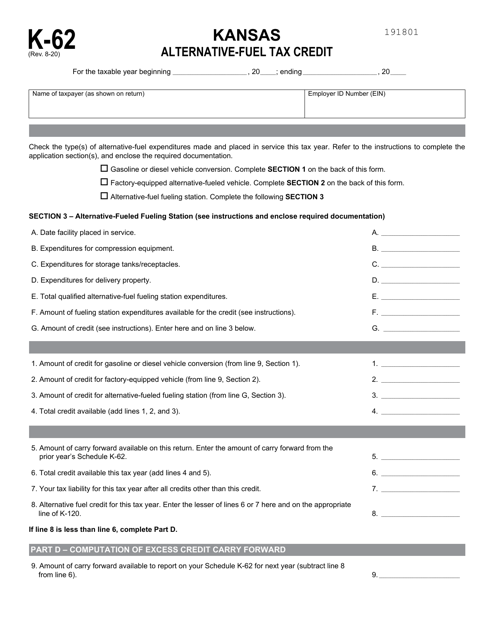

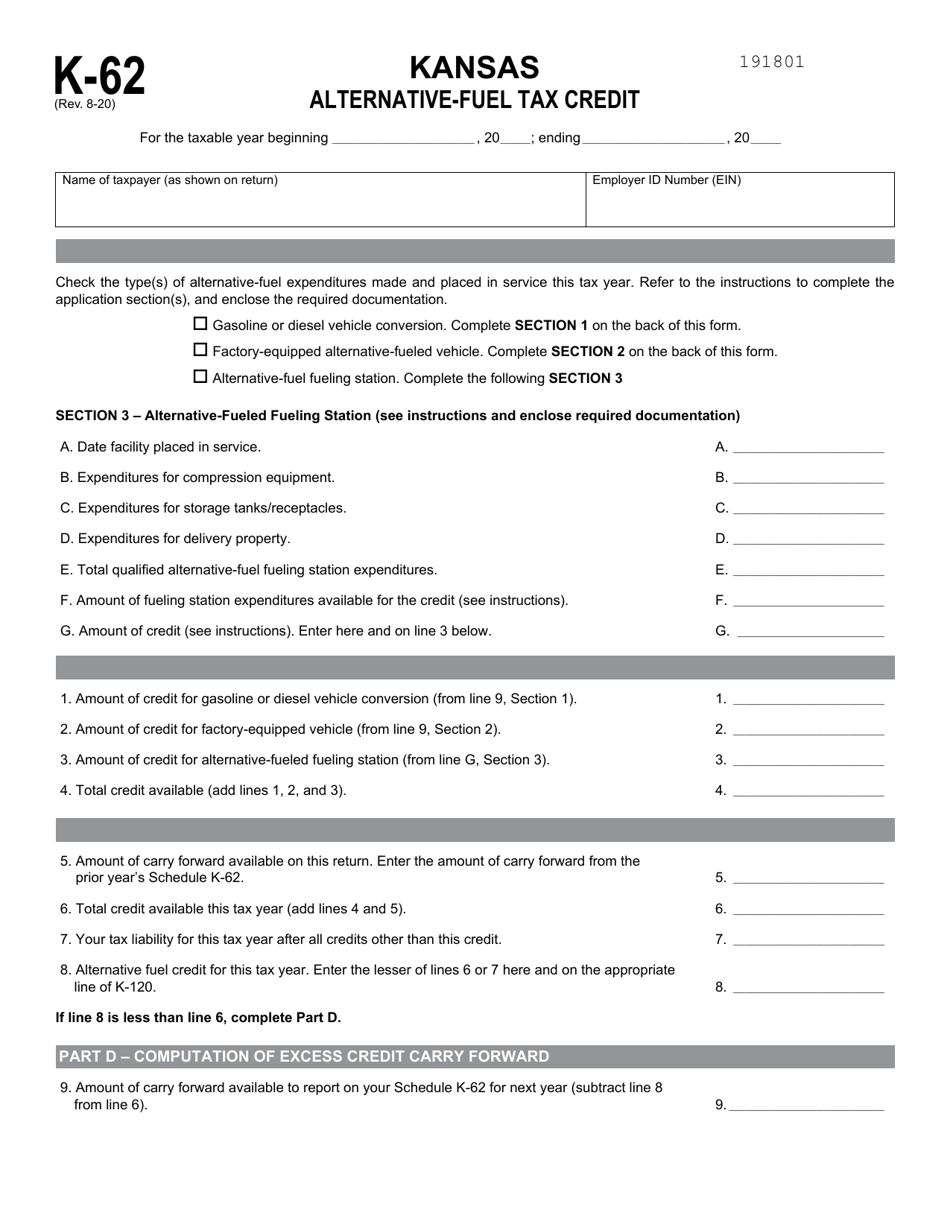

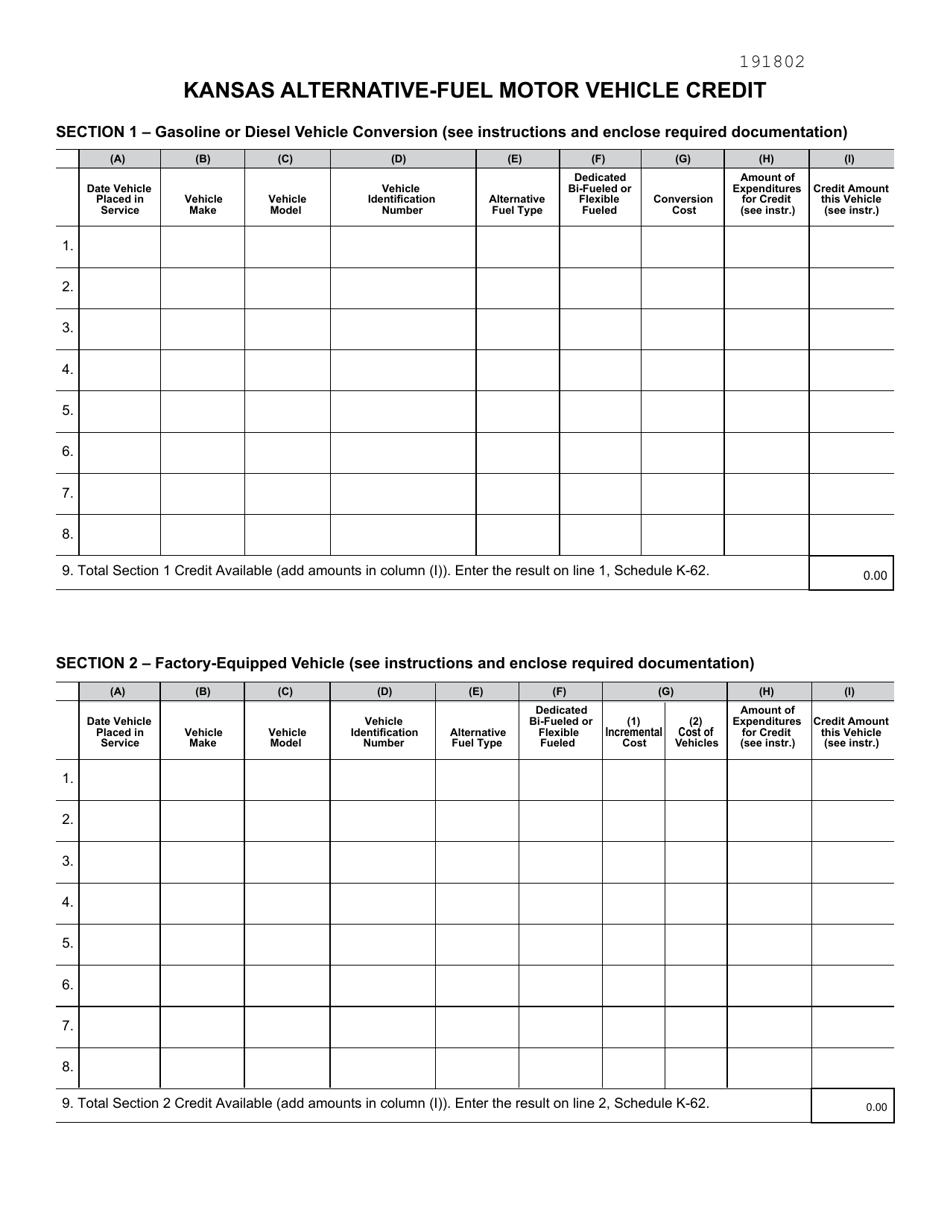

Schedule K-62 Alternative-Fuel Tax Credit - Kansas

What Is Schedule K-62?

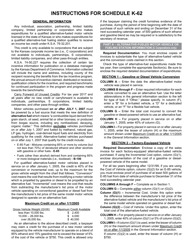

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule K-62?

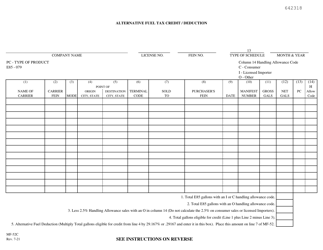

A: Schedule K-62 is a form used to claim the Alternative-Fuel Tax Credit in Kansas.

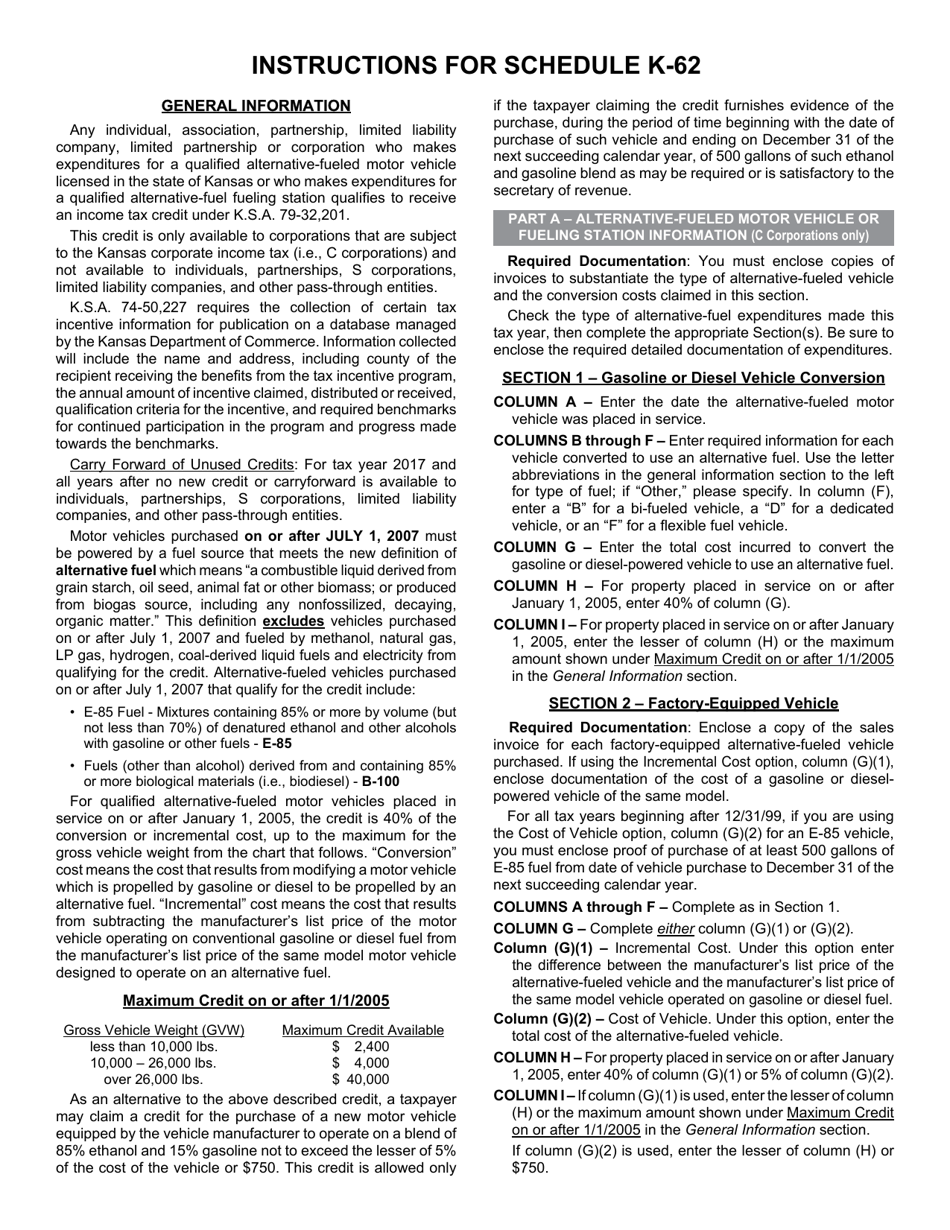

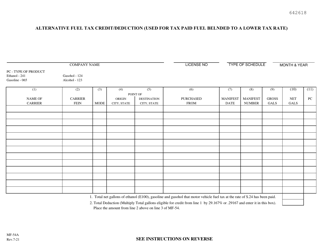

Q: What is the Alternative-Fuel Tax Credit?

A: The Alternative-Fuel Tax Credit is a credit provided by the state of Kansas for individuals or businesses that use alternative fuels.

Q: Who is eligible for the Alternative-Fuel Tax Credit?

A: Any individual or business that uses alternative fuels, such as biodiesel or compressed natural gas, may be eligible for the credit.

Q: What types of fuels are considered alternative fuels?

A: Alternative fuels include biodiesel, ethanol, hydrogen, natural gas, propane, and electricity.

Q: How much is the Alternative-Fuel Tax Credit in Kansas?

A: The credit amount varies depending on the type and quantity of alternative fuel used, as well as the purpose (i.e., personal or commercial use).

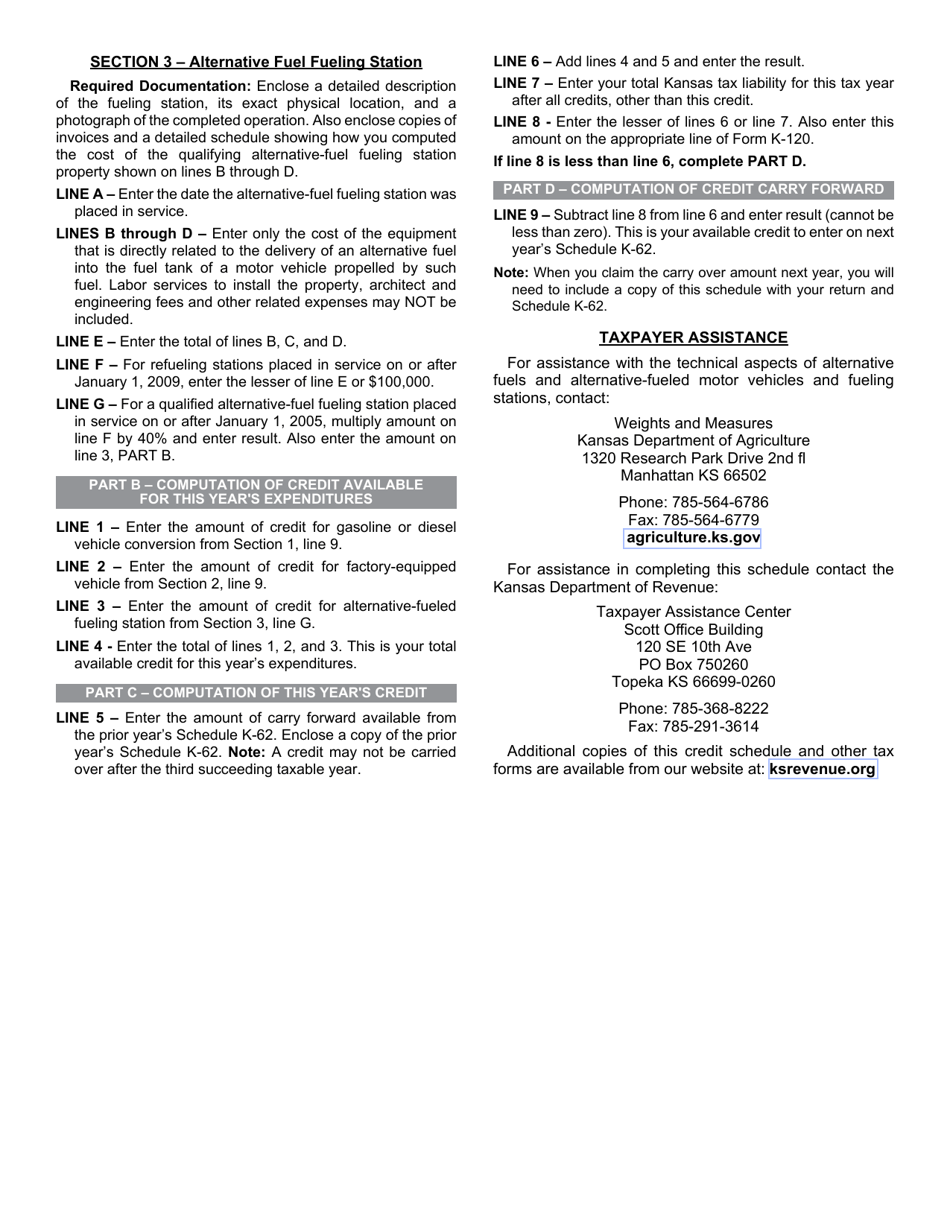

Q: How do I claim the Alternative-Fuel Tax Credit?

A: To claim the credit, you need to complete Schedule K-62 and include it with your Kansas tax return.

Q: Can I carry forward any unused Alternative-Fuel Tax Credit?

A: Yes, any unused portion of the credit can be carried forward for up to two years.

Q: Is there a deadline for claiming the Alternative-Fuel Tax Credit?

A: Yes, the credit must be claimed within three years from the due date of the original tax return.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule K-62 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.